Britons Struggle With Savings: One In Ten Have No Emergency Fund

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Britons Struggle with Savings: One in Ten Have No Emergency Fund

A worrying new report reveals the precarious financial position of many Britons, with a significant portion lacking even a basic emergency fund. The cost of living crisis continues to bite, leaving millions struggling to make ends meet and highlighting a growing vulnerability to unexpected financial shocks. This isn't just about splurges; it's about fundamental financial security.

The stark reality is this: one in ten Britons have absolutely no savings set aside for emergencies, according to a recent survey by [insert reputable source here, e.g., the Office for National Statistics, a major financial institution]. This equates to millions of people facing potential hardship from unexpected events like job loss, illness, or car repairs. The impact extends far beyond individual households, impacting the broader economy and social stability.

<br>

The Crushing Weight of the Cost of Living Crisis

The ongoing cost of living crisis is the primary driver behind this concerning trend. Soaring inflation, rising energy prices, and increased food costs are leaving many families with little or nothing left over at the end of the month. Many are forced to prioritize essential spending, leaving savings as a luxury they simply cannot afford.

- Rising energy bills: A major contributor to financial strain, forcing many to choose between heating and eating.

- Food inflation: The cost of groceries has increased dramatically, impacting even basic food budgets.

- Stagnant wages: Wages haven't kept pace with inflation, leaving many people with less disposable income.

<br>

The Consequences of No Emergency Fund

The lack of an emergency fund exposes individuals and families to significant risks:

- Debt spiral: Unexpected expenses often lead to borrowing, potentially trapping individuals in a cycle of debt.

- Mental health strain: Financial worries contribute significantly to stress and anxiety, impacting overall well-being.

- Reduced financial stability: The inability to cope with unexpected events increases the risk of financial instability and potential homelessness.

<br>

What Can Be Done?

While the situation is challenging, there are steps individuals can take to improve their financial resilience:

- Budgeting: Creating a realistic budget is crucial to understanding spending habits and identifying areas for potential savings. Many free budgeting apps and resources are available online. (Link to a reputable budgeting resource here)

- Small savings: Even small, regular savings can accumulate over time. Consider setting up a direct debit to a savings account, even if it's a small amount.

- Seeking professional advice: Financial advisors can provide personalized guidance and support to help individuals create a plan to manage their finances effectively. (Link to a reputable financial advice website here).

- Government support: Explore available government benefits and support schemes. Check the government website for details relevant to your situation. (Link to the relevant government website here).

<br>

Looking Ahead

The lack of emergency savings among a significant portion of the British population highlights a serious issue requiring urgent attention. A multi-pronged approach, involving government support, financial education initiatives, and responsible lending practices, is needed to address this growing problem and build a more financially secure future for all. The time to act is now, before the consequences become even more devastating. What steps are you taking to improve your financial security? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Britons Struggle With Savings: One In Ten Have No Emergency Fund. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Made In America Test A Business Owner Shares His Results

May 17, 2025

The Made In America Test A Business Owner Shares His Results

May 17, 2025 -

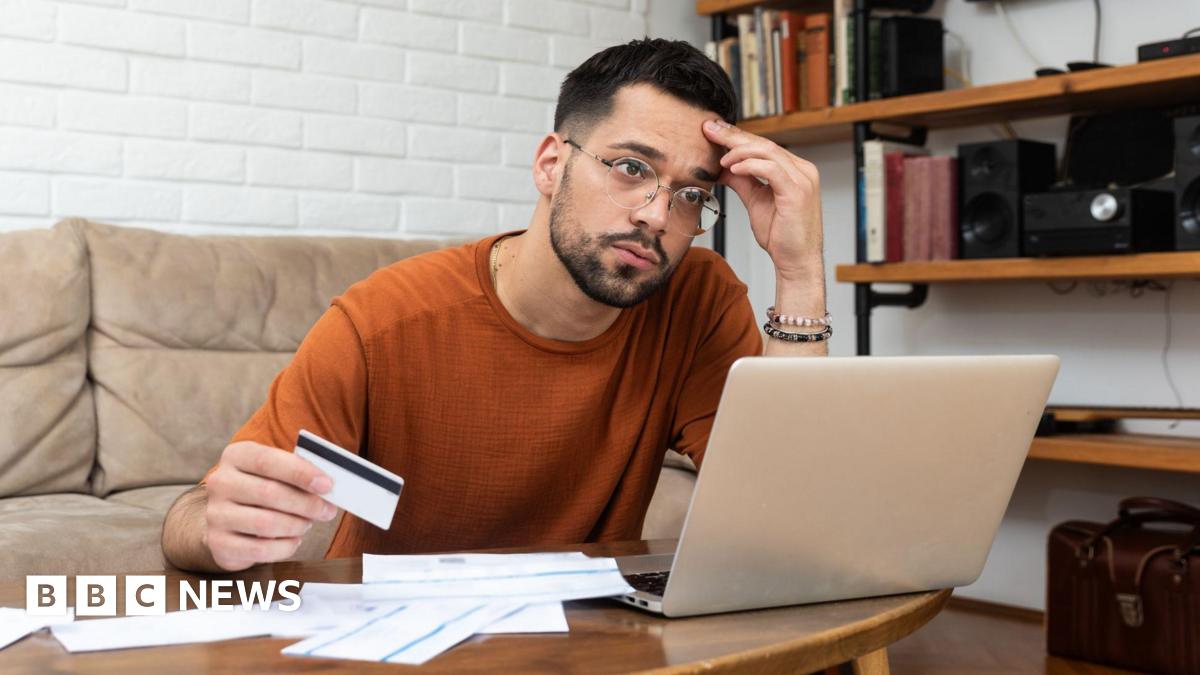

Stanley Tucci Explores Italys Regional Cuisine In New Nat Geo Show

May 17, 2025

Stanley Tucci Explores Italys Regional Cuisine In New Nat Geo Show

May 17, 2025 -

The Phoenician Scheme Cannes And Why You Need To See Wes Anderson Films Twice

May 17, 2025

The Phoenician Scheme Cannes And Why You Need To See Wes Anderson Films Twice

May 17, 2025 -

Harvards Magna Carta Acquisition From Bargain To Historical Treasure

May 17, 2025

Harvards Magna Carta Acquisition From Bargain To Historical Treasure

May 17, 2025 -

1000 Us Babies Named King Exploring The Contrast With New Zealands Naming Restrictions

May 17, 2025

1000 Us Babies Named King Exploring The Contrast With New Zealands Naming Restrictions

May 17, 2025

Latest Posts

-

The Underlying Sadness In Wes Andersons Visually Stunning Films

May 17, 2025

The Underlying Sadness In Wes Andersons Visually Stunning Films

May 17, 2025 -

The Scheme For Benicio Del Toro A Unique And Generous Gesture

May 17, 2025

The Scheme For Benicio Del Toro A Unique And Generous Gesture

May 17, 2025 -

Indie Hit Friendship Celebrates Detroit Success Sister Midnight And The Old Woman With The Knife Preview

May 17, 2025

Indie Hit Friendship Celebrates Detroit Success Sister Midnight And The Old Woman With The Knife Preview

May 17, 2025 -

Corporate Ties Exposed Regulators Rome Trip Raises Ethical Questions

May 17, 2025

Corporate Ties Exposed Regulators Rome Trip Raises Ethical Questions

May 17, 2025 -

Condo Lawsuit Exposes Widespread Structural Issues In New York City Skyscraper

May 17, 2025

Condo Lawsuit Exposes Widespread Structural Issues In New York City Skyscraper

May 17, 2025