Broadcom (AVGO) Earnings: Analyst Predictions And Stock Price Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom (AVGO) Earnings: Analyst Predictions and Stock Price Outlook

Broadcom (AVGO), a leading designer, developer, and global supplier of a broad range of semiconductor and infrastructure software solutions, is set to release its latest earnings report. This announcement is keenly anticipated by investors and analysts alike, given the company's significant influence on the tech sector and its recent performance. This article delves into the analyst predictions surrounding the report and explores the potential impact on AVGO's stock price.

Analyst Expectations: A Mixed Bag

Leading up to the earnings release, analyst predictions have been somewhat varied. While overall sentiment remains cautiously optimistic, several factors contribute to this nuanced outlook. Some analysts predict strong revenue growth driven by robust demand for Broadcom's networking and infrastructure solutions, particularly in the data center and 5G sectors. These analysts point to the ongoing digital transformation and the increasing need for high-bandwidth connectivity as key drivers.

However, other analysts express concerns about potential headwinds. The global chip shortage, while easing, still poses a challenge. Furthermore, macroeconomic uncertainty and concerns about a potential recession could impact spending in the technology sector, potentially affecting Broadcom's sales.

Several key metrics will be under intense scrutiny, including:

- Revenue Growth: Analysts are closely monitoring the year-over-year and quarter-over-quarter revenue growth to gauge the strength of demand for Broadcom's products.

- Earnings Per Share (EPS): EPS is a critical indicator of profitability, and any significant deviation from analyst consensus could significantly impact the stock price.

- Guidance: Broadcom's guidance for the next quarter will be closely analyzed for clues about future performance and potential risks.

- Market Share: Maintaining and expanding market share in key segments is crucial for Broadcom's continued success.

Stock Price Outlook: Navigating Uncertainty

The impact of the earnings report on AVGO's stock price is difficult to predict with certainty. A beat on earnings and revenue expectations, coupled with positive guidance, could trigger a significant price increase. Investors are likely to reward strong performance, especially given Broadcom's position in high-growth sectors.

Conversely, a miss on expectations, or even worse, disappointing guidance, could lead to a sell-off. The current macroeconomic climate adds another layer of complexity, as investors remain sensitive to potential economic downturns.

Factors to Consider:

- Competition: Intense competition from other semiconductor companies could impact Broadcom's market share and profitability.

- Supply Chain Issues: While easing, persistent supply chain disruptions could still affect production and delivery timelines.

- Geopolitical Factors: Global political instability and trade tensions could pose challenges for Broadcom's operations.

Investing in AVGO: A Long-Term Perspective

Investing in any stock, including Broadcom, involves inherent risks. While the company has a strong track record of innovation and growth, it's crucial to conduct thorough due diligence before making any investment decisions. Considering diversification as part of a broader investment strategy is also advisable. For specific financial advice, consult a qualified financial advisor.

Conclusion:

Broadcom's upcoming earnings report holds significant implications for the company's stock price. While analyst predictions are varied, the overall outlook is cautiously optimistic. Investors should carefully consider the various factors impacting Broadcom's performance and the broader macroeconomic environment before making any investment decisions. Keep an eye on the news following the release for in-depth analysis and market reaction. Stay informed and make smart investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom (AVGO) Earnings: Analyst Predictions And Stock Price Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Landmark Ruling Supreme Court Decision On Reverse Discrimination And Heterosexual Plaintiffs

Jun 06, 2025

Landmark Ruling Supreme Court Decision On Reverse Discrimination And Heterosexual Plaintiffs

Jun 06, 2025 -

Patriot League Expands Villanova Football Accepted For 2026 Season

Jun 06, 2025

Patriot League Expands Villanova Football Accepted For 2026 Season

Jun 06, 2025 -

First Look Meghan Shares Intimate Photos Of Lilibet On Her Birthday

Jun 06, 2025

First Look Meghan Shares Intimate Photos Of Lilibet On Her Birthday

Jun 06, 2025 -

Madeleine Mc Cann Disappearance A Look Back At 18 Years Of Investigation

Jun 06, 2025

Madeleine Mc Cann Disappearance A Look Back At 18 Years Of Investigation

Jun 06, 2025 -

Controversy Erupts Navy Ships Name Change After Harvey Milk Honor

Jun 06, 2025

Controversy Erupts Navy Ships Name Change After Harvey Milk Honor

Jun 06, 2025

Latest Posts

-

From Police Academy To Kidnapping Steve Guttenbergs Latest Role Explored

Jun 06, 2025

From Police Academy To Kidnapping Steve Guttenbergs Latest Role Explored

Jun 06, 2025 -

Ghost Hurricanes A New Tool For More Accurate Hurricane Forecasts

Jun 06, 2025

Ghost Hurricanes A New Tool For More Accurate Hurricane Forecasts

Jun 06, 2025 -

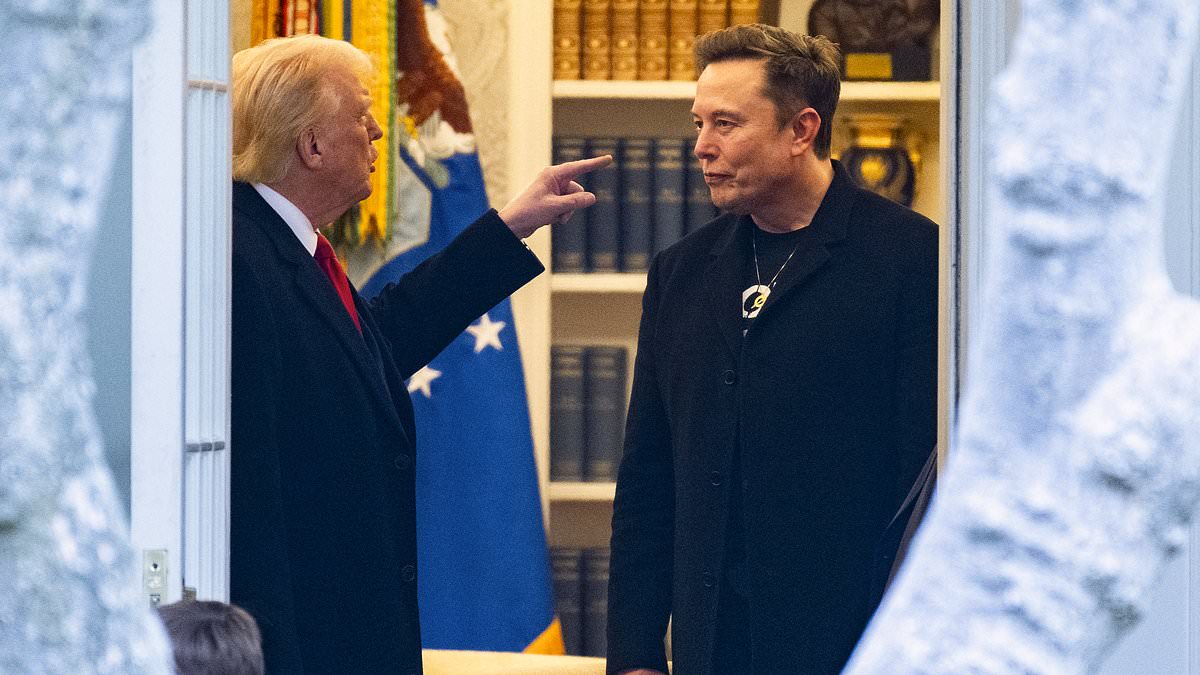

Behind Trump And Musks Feud Uncovering The Influence Of A Key Aide

Jun 06, 2025

Behind Trump And Musks Feud Uncovering The Influence Of A Key Aide

Jun 06, 2025 -

Concerning New Ai Trends Insights From An Ai Ceo

Jun 06, 2025

Concerning New Ai Trends Insights From An Ai Ceo

Jun 06, 2025 -

The First Bacteria How Gut Microbiome Impacts Health Outcomes

Jun 06, 2025

The First Bacteria How Gut Microbiome Impacts Health Outcomes

Jun 06, 2025