Broadcom Earnings Impact: Analyzing Trader Predictions For AVGO Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Earnings Impact: Analyzing Trader Predictions for AVGO Stock Price

Broadcom (AVGO), a leading semiconductor company, recently released its earnings report, sending ripples through the financial markets. The results, a complex mix of strong revenue growth and cautious guidance, have left investors and traders scrambling to predict the future trajectory of AVGO stock price. This article delves into the key takeaways from Broadcom's earnings announcement and analyzes the diverse predictions swirling among traders.

Key Highlights from Broadcom's Earnings Report:

Broadcom's Q2 2024 earnings report showcased a strong performance in several key areas. Revenue exceeded expectations, driven primarily by robust demand in its networking and software segments. However, the company's outlook for the next quarter was more conservative, citing potential macroeconomic headwinds and softening demand in certain sectors. This cautious guidance has been the primary driver of the mixed reactions in the market.

- Positive Aspects: Strong revenue growth, exceeding analyst expectations; continued dominance in key market segments; successful integration of acquisitions.

- Negative Aspects: Cautious guidance for the upcoming quarter; potential impact of macroeconomic uncertainty; concerns about future demand in specific sectors.

Trader Sentiment and Predictions for AVGO Stock Price:

The market reaction to Broadcom's earnings has been far from uniform. While some analysts remain bullish on AVGO's long-term prospects, others are taking a more cautious approach, citing the uncertainties highlighted in the company's guidance. This divergence in opinion is reflected in the wide range of price predictions circulating among traders.

Bullish Predictions: Many analysts point to Broadcom's strong market position, diversified revenue streams, and history of innovation as reasons to remain optimistic about the stock's future. They anticipate a recovery in the coming quarters, leading to a potential increase in AVGO's stock price. These predictions often cite the long-term growth potential of the semiconductor industry and Broadcom's strategic positioning within it.

Bearish Predictions: Conversely, some traders express concerns about the macroeconomic environment and the potential for a prolonged slowdown in demand for semiconductors. They highlight the cautious guidance provided by Broadcom as a sign of potential near-term challenges. This group anticipates a period of consolidation or even a slight decline in AVGO's stock price before a potential recovery.

Analyzing the Disparity: The disparity in predictions underscores the inherent uncertainty in the stock market. While Broadcom's fundamentals remain strong, external factors like global economic conditions and industry-specific trends play a significant role in shaping investor sentiment and influencing the stock's price.

What to Watch for:

Investors should closely monitor several key factors in the coming weeks and months to gain a clearer picture of AVGO's future performance:

- Macroeconomic indicators: Global economic growth, inflation rates, and interest rate decisions will all impact demand for semiconductors.

- Industry trends: Changes in demand for specific semiconductor applications will influence Broadcom's revenue streams.

- Competitive landscape: The actions of competitors will impact Broadcom's market share and profitability.

- Future guidance: Broadcom's next earnings report will be crucial in confirming or revising current predictions.

Conclusion:

The impact of Broadcom's earnings report on AVGO stock price remains uncertain. While the strong revenue growth is encouraging, the cautious guidance introduces an element of risk. Traders are divided in their predictions, reflecting the complexity of the current economic climate and the challenges faced by the semiconductor industry. Careful monitoring of key economic indicators and industry trends is essential for investors seeking to navigate this uncertainty. Ultimately, long-term investors may view the current situation as a potential buying opportunity, while short-term traders may prefer a more cautious approach. Remember to consult with a financial advisor before making any investment decisions.

Keywords: Broadcom, AVGO, stock price, earnings report, semiconductor, trader predictions, investment, stock market, macroeconomic, Q2 2024, financial news, analysis, revenue, guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Earnings Impact: Analyzing Trader Predictions For AVGO Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baltimore Waterfront Contaminated Investigation Launched After Diesel Spill

Jun 06, 2025

Baltimore Waterfront Contaminated Investigation Launched After Diesel Spill

Jun 06, 2025 -

Walton Goggins Tearfully Details Instagram Decision Regarding Aimee Lou Wood

Jun 06, 2025

Walton Goggins Tearfully Details Instagram Decision Regarding Aimee Lou Wood

Jun 06, 2025 -

Joe Sacco Departs Bruins New Nhl Coaching Staff Role Confirmed

Jun 06, 2025

Joe Sacco Departs Bruins New Nhl Coaching Staff Role Confirmed

Jun 06, 2025 -

May Jobs Report Shows Significant Slowdown Private Sector Hiring At 2 Year Low

Jun 06, 2025

May Jobs Report Shows Significant Slowdown Private Sector Hiring At 2 Year Low

Jun 06, 2025 -

Political Shift Karine Jean Pierre Leaves Democratic Party

Jun 06, 2025

Political Shift Karine Jean Pierre Leaves Democratic Party

Jun 06, 2025

Latest Posts

-

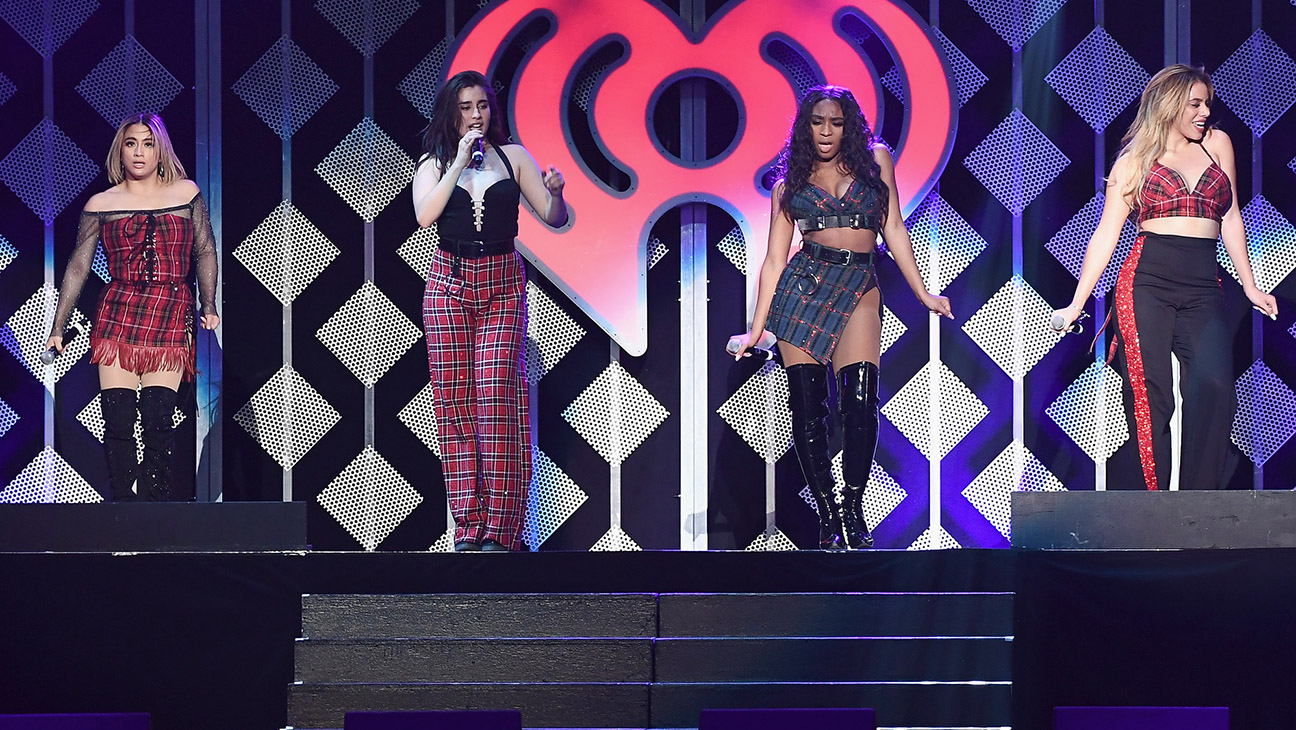

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025 -

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025

Relationship Update Matthew Hussey Ex Of Camila Cabello Announces Pregnancy

Jun 06, 2025 -

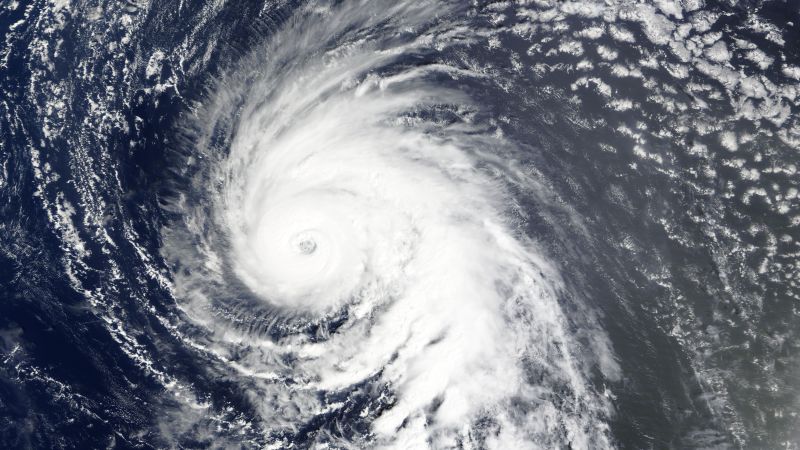

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025

The Potential Of Ghost Hurricanes For Enhanced Hurricane Prediction Models

Jun 06, 2025 -

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025

Ais Unforeseen Evolution A Ceo Sounds The Alarm

Jun 06, 2025