Broadcom Earnings Impact: Trader Expectations And AVGO Stock Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Earnings Impact: Trader Expectations and AVGO Stock Outlook

Broadcom (AVGO) recently released its quarterly earnings report, sending ripples through the tech sector and leaving investors wondering about the future trajectory of its stock. This report delves into the impact of those earnings, examining trader expectations beforehand, the actual results, and the resulting outlook for AVGO stock. Understanding this analysis is crucial for anyone holding or considering investing in this semiconductor giant.

Pre-Earnings Expectations: A Cautious Optimism

Before the release, analysts held a cautiously optimistic outlook for Broadcom. While the semiconductor industry faced headwinds from softening demand in certain sectors, Broadcom's diversification across infrastructure software, wireless communications, and broadband had fostered a degree of resilience. Many analysts projected modest growth, focusing on the strength of its infrastructure software segment and its continued dominance in the networking equipment market. However, concerns remained about potential inventory adjustments within the supply chain and the overall macroeconomic climate. This cautious optimism translated into a relatively stable AVGO stock price in the weeks leading up to the earnings announcement.

Earnings Report: Beating Expectations, But With Nuances

Broadcom's actual earnings report surprised many by exceeding expectations. Revenue and earnings per share (EPS) surpassed analyst estimates, indicating strong performance despite the challenging economic backdrop. The company highlighted the success of its infrastructure software division, which continues to be a significant driver of growth. However, the company's outlook for the next quarter offered a more conservative forecast than some analysts had hoped for, fueling some immediate sell-offs. This seemingly contradictory situation highlights the complexity of interpreting financial results. While beating expectations is positive, forward-looking guidance often carries more weight in shaping investor sentiment.

Key Factors Affecting AVGO Stock:

Several key factors are shaping the current outlook for AVGO stock:

- Macroeconomic Uncertainty: The global economic slowdown continues to pose a significant risk to the semiconductor industry. Reduced consumer spending and corporate investment can directly impact demand for Broadcom's products.

- Supply Chain Dynamics: While Broadcom has navigated supply chain challenges relatively well, ongoing disruptions could still affect its production and delivery timelines.

- Competition: Broadcom faces intense competition in various market segments. The ability to maintain its technological edge and market share will be crucial for its future growth.

- Regulatory Scrutiny: Mergers and acquisitions in the tech sector often face regulatory scrutiny. Broadcom's past and future acquisition strategies could face hurdles, impacting its growth prospects.

AVGO Stock Outlook: A Long-Term Perspective

Despite the short-term volatility following the earnings release, the long-term outlook for AVGO stock remains relatively positive for many analysts. Broadcom’s diversification across multiple high-growth sectors, combined with its strong financial position and consistent track record of innovation, suggests resilience in the face of market fluctuations. However, investors should maintain a balanced perspective, acknowledging the persistent risks associated with the broader economic climate and competitive pressures.

What to Watch For:

Investors should closely monitor the following in the coming quarters:

- Guidance Updates: Pay close attention to any revisions in the company's future revenue and earnings projections.

- Market Share Trends: Track Broadcom's performance against key competitors in its various market segments.

- Macroeconomic Indicators: Monitor overall economic trends to assess their potential impact on semiconductor demand.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Consider diversifying your portfolio to mitigate risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Earnings Impact: Trader Expectations And AVGO Stock Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controversy Erupts Navy Ships Name Changed Following Hegseths Directive

Jun 06, 2025

Controversy Erupts Navy Ships Name Changed Following Hegseths Directive

Jun 06, 2025 -

Fact Check White House Vs Bbc On Gaza Reporting

Jun 06, 2025

Fact Check White House Vs Bbc On Gaza Reporting

Jun 06, 2025 -

Ryan Goslings Mcu Future Exploring The Possibility Of A White Black Panther Role Following Ketema Reveal

Jun 06, 2025

Ryan Goslings Mcu Future Exploring The Possibility Of A White Black Panther Role Following Ketema Reveal

Jun 06, 2025 -

Decoding The Difficulty Why Clay Dominates At Roland Garros

Jun 06, 2025

Decoding The Difficulty Why Clay Dominates At Roland Garros

Jun 06, 2025 -

Matthew Hussey Welcomes New Chapter Expecting First Baby

Jun 06, 2025

Matthew Hussey Welcomes New Chapter Expecting First Baby

Jun 06, 2025

Latest Posts

-

Western Conference Finals Loss Costs Stars Coach Peter De Boer His Job

Jun 06, 2025

Western Conference Finals Loss Costs Stars Coach Peter De Boer His Job

Jun 06, 2025 -

Dallas Stars Fire Coach Peter De Boer After Western Conference Finals Loss

Jun 06, 2025

Dallas Stars Fire Coach Peter De Boer After Western Conference Finals Loss

Jun 06, 2025 -

Camila Cabellos Ex Matthew Hussey And Wife Expecting First Child

Jun 06, 2025

Camila Cabellos Ex Matthew Hussey And Wife Expecting First Child

Jun 06, 2025 -

Relationship Update Matthew Hussey To Become A Father

Jun 06, 2025

Relationship Update Matthew Hussey To Become A Father

Jun 06, 2025 -

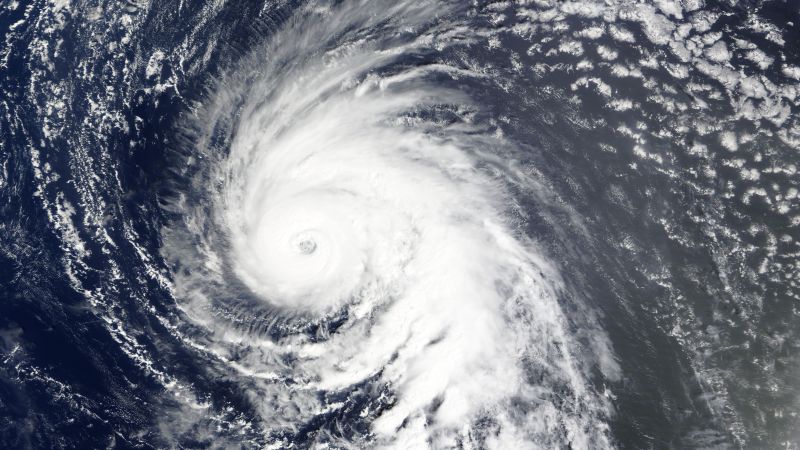

Atmospheric Disturbances How Ghost Hurricanes Aid Hurricane Forecasting

Jun 06, 2025

Atmospheric Disturbances How Ghost Hurricanes Aid Hurricane Forecasting

Jun 06, 2025