Broadcom Stock Outlook: Expert Analysis Following Latest Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom Stock Outlook: Expert Analysis Following Latest Earnings

Broadcom (AVGO), a leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions, recently released its latest earnings report, sending ripples through the tech sector. Investors are now scrambling to understand what this means for the future of AVGO stock. This analysis dives deep into the expert opinions and market predictions following the announcement, helping you navigate the complexities and make informed investment decisions.

Strong Q2 Earnings, But a Cautious Outlook

Broadcom reported strong second-quarter earnings, exceeding analysts' expectations on both revenue and earnings per share (EPS). The company's performance was fueled by robust demand for its semiconductor solutions in key markets like data centers, wireless communications, and broadband infrastructure. However, the company offered a slightly cautious outlook for the upcoming quarters, citing macroeconomic uncertainties and potential softening in demand for certain product segments. This cautious tone, despite the strong Q2 results, is a key factor influencing the current AVGO stock outlook.

Key Factors Shaping Broadcom's Future:

Several key factors are shaping the ongoing narrative surrounding Broadcom stock. These include:

-

Macroeconomic Headwinds: Global economic uncertainty, including inflation and potential recessionary pressures, is casting a shadow over the tech sector. This uncertainty is impacting investor sentiment and contributing to the cautious outlook expressed by Broadcom's management.

-

Supply Chain Dynamics: While the global chip shortage seems to be easing, supply chain disruptions remain a potential risk. Broadcom's ability to navigate these complexities and maintain its production efficiency will be crucial for its future performance.

-

Competition: The semiconductor industry is highly competitive, with several major players vying for market share. Broadcom's ability to innovate and maintain its technological edge will be essential for sustaining its growth trajectory.

-

Strategic Acquisitions: Broadcom has a history of strategic acquisitions, expanding its product portfolio and market reach. Future acquisitions could significantly impact its stock performance, but also introduce inherent risk.

Expert Opinions Diverge:

Analyst opinions on Broadcom's stock outlook are currently divided. Some analysts remain bullish, highlighting the company's strong fundamentals, diverse product portfolio, and significant market position. They point to the long-term growth potential driven by increasing demand for semiconductors in various applications. Others are more cautious, citing macroeconomic risks and potential competition as factors that could negatively impact the stock price in the short term.

What to Watch For:

Investors should closely monitor the following in the coming months:

-

Upcoming Earnings Reports: Future earnings reports will provide further insights into Broadcom's performance and offer a clearer picture of the company's trajectory.

-

Guidance Updates: Pay close attention to any guidance updates from Broadcom management, which could offer clues about future growth prospects.

-

Market Sentiment: Keep a close eye on overall market sentiment and investor confidence in the tech sector. This can significantly impact the price of Broadcom stock.

-

Industry News: Stay updated on industry developments, competitive dynamics, and any technological advancements that could affect Broadcom's position.

Conclusion:

The current Broadcom stock outlook presents a mixed picture. While the company's recent earnings were strong, macroeconomic uncertainties and a cautious outlook have introduced some level of uncertainty. Investors should conduct thorough research and consider their own risk tolerance before making any investment decisions. Seeking professional financial advice is always recommended. This analysis aims to provide a comprehensive overview; it's crucial to remember that this is not financial advice. Always conduct your own due diligence before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom Stock Outlook: Expert Analysis Following Latest Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Living A Double Life The Unexpected Challenges Of Two Homes

Jun 06, 2025

Living A Double Life The Unexpected Challenges Of Two Homes

Jun 06, 2025 -

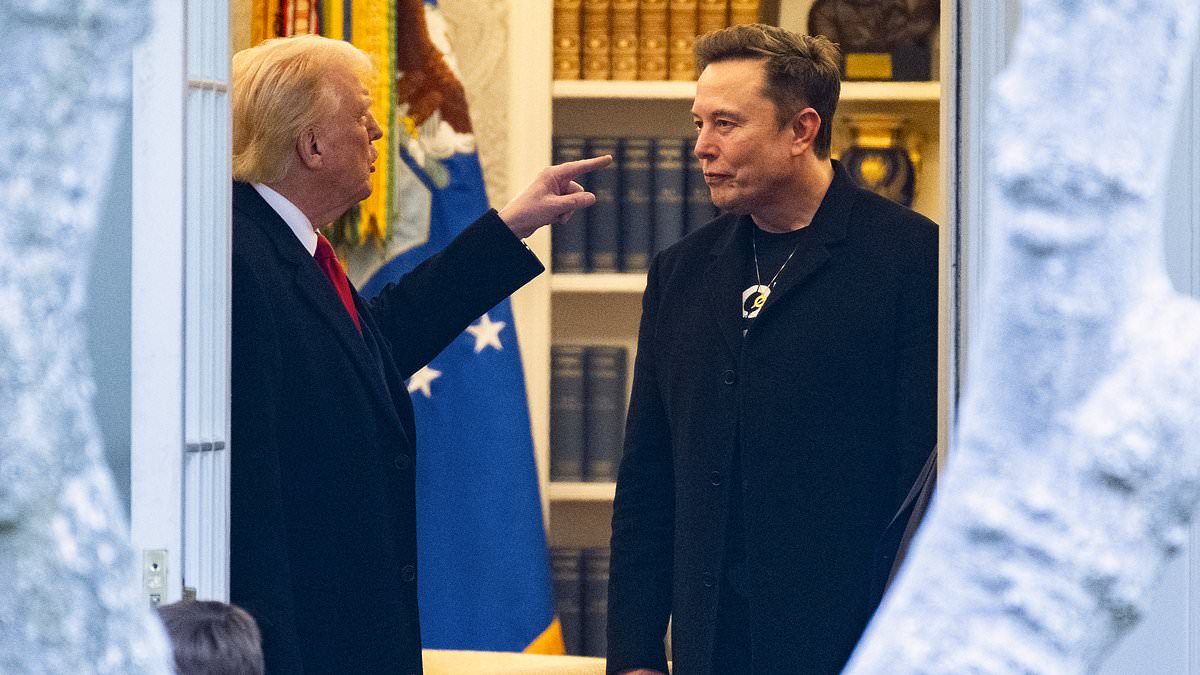

The Untold Story How A Trump Advisor Caused The Trump Musk Rift

Jun 06, 2025

The Untold Story How A Trump Advisor Caused The Trump Musk Rift

Jun 06, 2025 -

Traders Expectations Broadcom Stocks Trajectory Following Earnings Release

Jun 06, 2025

Traders Expectations Broadcom Stocks Trajectory Following Earnings Release

Jun 06, 2025 -

Maxwell Anderson Found Guilty Milwaukee Jury Reaches Verdict

Jun 06, 2025

Maxwell Anderson Found Guilty Milwaukee Jury Reaches Verdict

Jun 06, 2025 -

2026 Villanova Wildcats Football Heads To The Patriot League As Associate Member

Jun 06, 2025

2026 Villanova Wildcats Football Heads To The Patriot League As Associate Member

Jun 06, 2025

Latest Posts

-

Key Witness Returns To Stand Day Two Of Combs Trial Featuring Cassie Venturas Friend

Jun 07, 2025

Key Witness Returns To Stand Day Two Of Combs Trial Featuring Cassie Venturas Friend

Jun 07, 2025 -

Atmospheric Rivers And Ghost Hurricanes Unraveling The Link To Improved Hurricane Prediction

Jun 07, 2025

Atmospheric Rivers And Ghost Hurricanes Unraveling The Link To Improved Hurricane Prediction

Jun 07, 2025 -

Sade Robinson Death Maxwell Anderson Trial Opens This Friday

Jun 07, 2025

Sade Robinson Death Maxwell Anderson Trial Opens This Friday

Jun 07, 2025 -

Friday June 6th Maxwell Anderson Faces Court In Sade Robinson Killing

Jun 07, 2025

Friday June 6th Maxwell Anderson Faces Court In Sade Robinson Killing

Jun 07, 2025 -

Reform Mp Faces Backlash Over Dumb Burka Ban Call

Jun 07, 2025

Reform Mp Faces Backlash Over Dumb Burka Ban Call

Jun 07, 2025