Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock

![Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock](https://vtrandafir.com/image/broadcoms-q-quarter-earnings-impact-traders-outlook-on-avgo-stock.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Broadcom's Q3 Earnings Impact: Traders Eye AVGO Stock's Future

Broadcom (AVGO) recently released its third-quarter earnings report, sending ripples through the tech sector and leaving traders assessing the impact on AVGO stock. The results, a mixed bag of successes and challenges, have sparked considerable debate about the future trajectory of this semiconductor giant. This article delves into the key takeaways from the report, analyzes the market's reaction, and offers insights into what traders should anticipate moving forward.

Q3 Earnings: A Closer Look

Broadcom exceeded analysts' expectations on revenue, reporting a strong performance driven primarily by its robust infrastructure software segment. This segment, increasingly crucial to Broadcom's diversification strategy, showcased impressive growth, fueled by strong demand for networking and cloud solutions. However, the company's semiconductor solutions segment, while still performing well, showed slightly softer growth than anticipated, possibly reflecting broader macroeconomic uncertainties and a potential slowdown in certain sectors.

- Key Highlights:

- Revenue exceeded expectations, driven by strong infrastructure software performance.

- Semiconductor solutions segment growth slightly below projections.

- Guidance for Q4 was cautiously optimistic, reflecting ongoing market uncertainties.

- Management reiterated long-term confidence in the company's growth prospects.

Market Reaction and Trader Sentiment

The initial market reaction to Broadcom's Q3 earnings was somewhat muted. While the revenue beat was positive, the slightly softer-than-expected growth in the semiconductor segment and cautious Q4 guidance tempered enthusiasm. This led to a period of consolidation for AVGO stock, with traders carefully weighing the positive and negative aspects of the report.

Several analysts have expressed differing viewpoints. Some maintain a bullish outlook, citing Broadcom's strong position in key growth markets and its ongoing efforts to diversify its revenue streams. They highlight the long-term potential of the infrastructure software segment as a major driver of future growth. Others are more cautious, pointing to potential headwinds from macroeconomic factors and the cyclical nature of the semiconductor industry.

Looking Ahead: What to Expect from AVGO Stock

The outlook for AVGO stock remains complex. While the company's fundamentals appear strong, macroeconomic uncertainty and potential sector-specific slowdowns introduce an element of risk. Traders should carefully consider the following factors:

- Global Economic Conditions: The global economic landscape plays a significant role in the semiconductor industry. Any further deterioration could negatively impact demand for Broadcom's products.

- Competition: Intense competition within the semiconductor sector remains a key factor influencing AVGO's performance.

- Innovation and R&D: Broadcom's continued investment in research and development is crucial for maintaining its competitive edge and driving future growth.

Strategic Considerations for Traders

For traders considering AVGO stock, a long-term perspective is likely warranted. While short-term volatility is expected, the company's strong position in key growth markets and its efforts toward diversification offer a potentially attractive investment opportunity for those with a higher risk tolerance and a longer-term investment horizon. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. Staying informed about industry trends and Broadcom's ongoing developments is crucial for informed trading.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

![Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock](https://vtrandafir.com/image/broadcoms-q-quarter-earnings-impact-traders-outlook-on-avgo-stock.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Broadcom's Q[Quarter] Earnings Impact: Traders' Outlook On AVGO Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

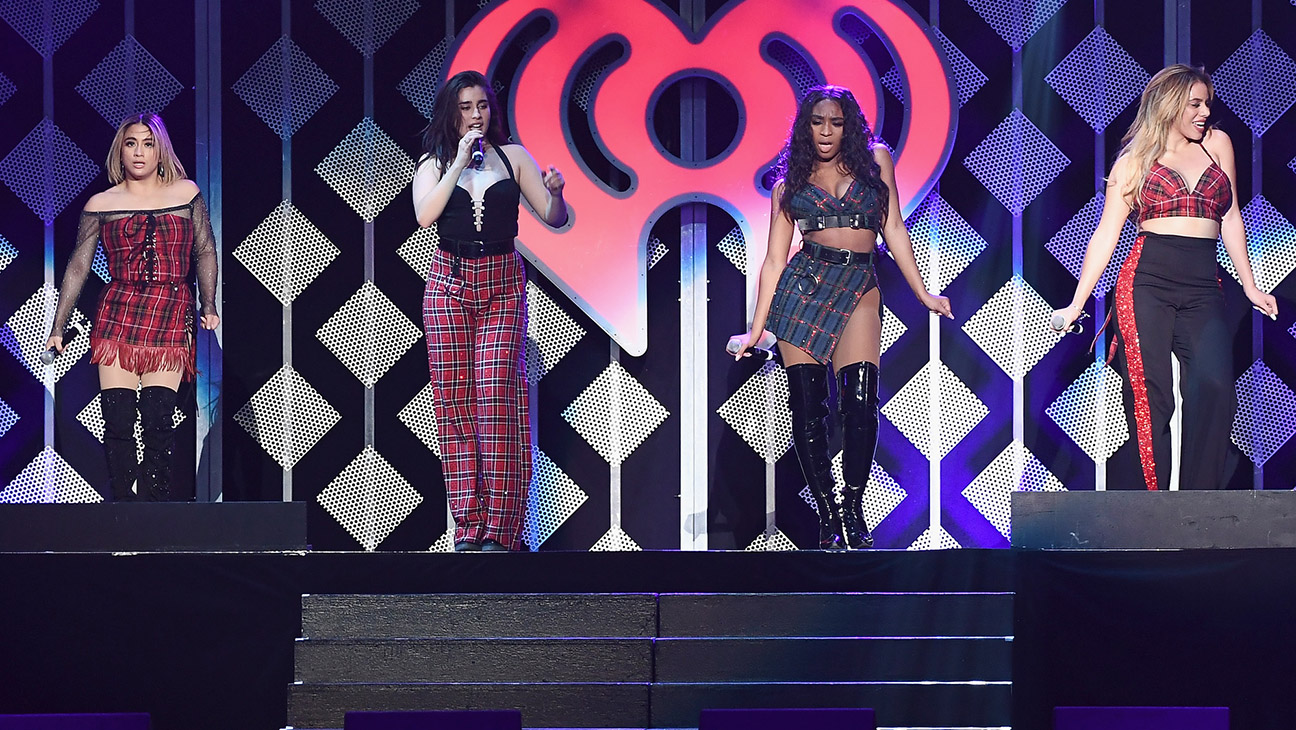

Exclusive Fifth Harmony Minus Camila Cabello Explore Reunion Possibilities

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Cabello Explore Reunion Possibilities

Jun 06, 2025 -

Madeleine Mc Cann Disappearance A Look Back At 18 Years Of Investigation

Jun 06, 2025

Madeleine Mc Cann Disappearance A Look Back At 18 Years Of Investigation

Jun 06, 2025 -

Israeli Forces Hold Bbc Film Crew At Gunpoint In Syria

Jun 06, 2025

Israeli Forces Hold Bbc Film Crew At Gunpoint In Syria

Jun 06, 2025 -

Tragic Update Body Recovered In Search For Missing Scotsman In Portugal

Jun 06, 2025

Tragic Update Body Recovered In Search For Missing Scotsman In Portugal

Jun 06, 2025 -

Karen Reads Retrial Key Development In Defense Strategy Revealed

Jun 06, 2025

Karen Reads Retrial Key Development In Defense Strategy Revealed

Jun 06, 2025

Latest Posts

-

Trump Investigates Biden Autopen Use And Alleged Cognitive Decline Under Scrutiny

Jun 06, 2025

Trump Investigates Biden Autopen Use And Alleged Cognitive Decline Under Scrutiny

Jun 06, 2025 -

Core Weaves 7 Billion Lease Fuels 48 Spike In Applied Digital Stock

Jun 06, 2025

Core Weaves 7 Billion Lease Fuels 48 Spike In Applied Digital Stock

Jun 06, 2025 -

Combs Trial Update Key Witness Cassie Venturas Friend To Testify

Jun 06, 2025

Combs Trial Update Key Witness Cassie Venturas Friend To Testify

Jun 06, 2025 -

White Lotus Stars Address Instagram Unfollow Goggins And Wood Clarify Their Connection

Jun 06, 2025

White Lotus Stars Address Instagram Unfollow Goggins And Wood Clarify Their Connection

Jun 06, 2025 -

Israeli Military Confirms Recovery Of Two Hostage Bodies In Southern Gaza

Jun 06, 2025

Israeli Military Confirms Recovery Of Two Hostage Bodies In Southern Gaza

Jun 06, 2025