Brown Shipley & Co Ltd's $NVDA Transaction: 3,351 Shares Sold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Brown Shipley & Co Ltd Offloads Nvidia Stake: 3,351 Shares Sold – What Does This Mean?

Brown Shipley & Co Ltd, a prominent wealth management firm, recently reduced its holdings in Nvidia Corporation (NVDA), selling 3,351 shares according to the latest SEC filings. This move has sparked interest amongst investors, prompting questions about the firm's outlook on the tech giant and the broader market sentiment surrounding NVDA. The transaction, while seemingly small in the grand scheme of NVDA's overall trading volume, highlights the dynamic nature of institutional investment and offers a glimpse into potential market shifts.

Understanding the Transaction:

The sale of 3,351 shares represents a relatively small portion of Brown Shipley & Co Ltd's previous NVDA holdings. However, any change in position by a significant institutional investor like Brown Shipley can influence market perception and trading activity. This particular transaction occurred amidst a period of [insert relevant market conditions, e.g., fluctuating stock prices, increased volatility, specific market news impacting tech stocks]. The exact reasons behind the sale remain undisclosed, but several factors could be at play.

Possible Interpretations:

-

Profit-Taking: Given NVDA's impressive run in recent months, Brown Shipley may have decided to secure profits by partially liquidating its position. This is a common strategy employed by institutional investors to manage risk and ensure returns.

-

Portfolio Rebalancing: The firm might be adjusting its portfolio allocation, shifting funds into other sectors deemed more promising or less risky at this time. This is a standard practice to optimize overall portfolio performance.

-

Market Sentiment: The sale could reflect a cautious outlook on NVDA's future performance, potentially due to concerns about [insert relevant concerns, e.g., competition, economic slowdown, regulatory changes]. However, this is speculative without further information from Brown Shipley.

Analyzing the Broader Context:

It's crucial to consider this transaction within the larger context of NVDA's performance and the overall tech sector. [Insert relevant data points here, e.g., NVDA's recent earnings report, analyst ratings, competitor activity]. Understanding these broader trends helps contextualize Brown Shipley's decision and offers a more comprehensive picture.

What This Means for Investors:

While a single transaction by one institutional investor shouldn't trigger drastic changes in investment strategies, it does serve as a data point to consider. Investors should always conduct their own thorough research before making any investment decisions. This includes analyzing financial statements, understanding industry trends, and assessing risk tolerance. Consulting with a qualified financial advisor is highly recommended.

Keywords: Brown Shipley, NVDA, Nvidia, stock sale, SEC filings, institutional investors, wealth management, portfolio rebalancing, profit-taking, market sentiment, tech stocks, investment strategy, financial news.

Call to Action (subtle): Stay informed about market trends and important financial news by [linking to a relevant financial news source or your own platform, if applicable].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Brown Shipley & Co Ltd's $NVDA Transaction: 3,351 Shares Sold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dominic Casciani Assessing The Deliverability Of Reforms Migration Plan

Aug 28, 2025

Dominic Casciani Assessing The Deliverability Of Reforms Migration Plan

Aug 28, 2025 -

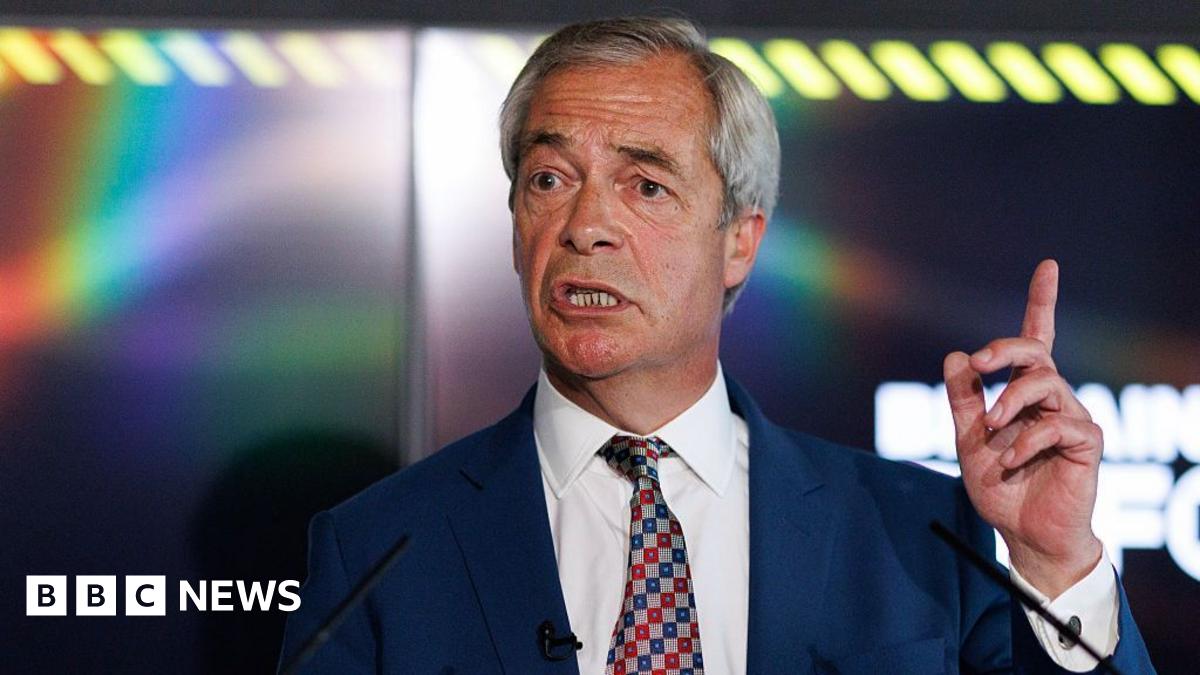

Illegal Immigration Farage Calls For Stricter Border Controls

Aug 28, 2025

Illegal Immigration Farage Calls For Stricter Border Controls

Aug 28, 2025 -

Brown Shipley And Co Ltd Offloads Nvidia Nvda Stock 3 351 Shares

Aug 28, 2025

Brown Shipley And Co Ltd Offloads Nvidia Nvda Stock 3 351 Shares

Aug 28, 2025 -

Bill Financial Report Fourth Quarter 2025 And Fiscal Year Highlights

Aug 28, 2025

Bill Financial Report Fourth Quarter 2025 And Fiscal Year Highlights

Aug 28, 2025 -

Bryan Woos Approach To Metronomic Composition And Performance

Aug 28, 2025

Bryan Woos Approach To Metronomic Composition And Performance

Aug 28, 2025

Latest Posts

-

Toxic Workplace Claims Prompts Devon Walkers Snl Departure

Aug 28, 2025

Toxic Workplace Claims Prompts Devon Walkers Snl Departure

Aug 28, 2025 -

Court Hears Mans Have A Baby Remark To Girls In Epping

Aug 28, 2025

Court Hears Mans Have A Baby Remark To Girls In Epping

Aug 28, 2025 -

Dominic Casciani Assessing The Deliverability Of Reforms Migration Plan

Aug 28, 2025

Dominic Casciani Assessing The Deliverability Of Reforms Migration Plan

Aug 28, 2025 -

Martin Damms Career Retrospective Egypt Play Station And A Defining Victory

Aug 28, 2025

Martin Damms Career Retrospective Egypt Play Station And A Defining Victory

Aug 28, 2025 -

Former Snl Cast Member Devon Walker Alleges Toxic Work Environment

Aug 28, 2025

Former Snl Cast Member Devon Walker Alleges Toxic Work Environment

Aug 28, 2025