Buffett Dumps Bank Of America Shares, Buys Into 7,700% Growth Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Dumps Bank of America, Embraces 7,700% Growth Stock: A Strategic Shift?

Warren Buffett's Berkshire Hathaway recently made headlines with a significant portfolio reshuffle. The Oracle of Omaha, renowned for his long-term investment strategy, surprised many by reducing its stake in Bank of America while simultaneously increasing its holdings in a lesser-known company boasting a staggering 7,700% growth. This unexpected move has sent ripples through the financial world, prompting analysts to dissect the implications of this strategic shift.

The sale of Bank of America shares, while significant, isn't entirely surprising. Berkshire Hathaway has been gradually reducing its exposure to the financial sector in recent years, likely reflecting a reassessment of risk and potential returns in a changing economic landscape. While Bank of America remains a strong institution, the current interest rate environment and potential economic headwinds may have influenced Buffett's decision. This isn't the first time Buffett has adjusted his holdings in major financial institutions; his investment philosophy emphasizes adaptability and long-term value creation. [Link to article about previous Berkshire Hathaway adjustments].

However, the purchase of the rapidly growing company – which remains unnamed for now – is what's truly capturing attention. A 7,700% growth trajectory is exceptionally rare, suggesting a high-growth sector with significant disruptive potential. While the specific company remains undisclosed, the move signifies Buffett's continued interest in identifying and capitalizing on emerging market trends. This bold investment underscores his willingness to venture beyond his traditional investment comfort zone, embracing innovative companies with high-growth potential.

<h3>What Does This Mean for Investors?</h3>

Buffett's actions often serve as a significant market indicator, influencing investor sentiment and driving investment flows. While mimicking Buffett's every move is ill-advised – he has decades of experience and a vast team of analysts – his decisions provide valuable insights into potential market shifts. This instance highlights the importance of:

- Diversification: Buffett's portfolio demonstrates the importance of diversifying across sectors and asset classes.

- Long-term perspective: His decisions are rarely influenced by short-term market fluctuations.

- Due diligence: Before making any investment, thorough research and understanding of the company and its potential are crucial.

<h3>The Mystery Stock and Future Implications</h3>

The identity of the 7,700% growth stock remains shrouded in secrecy for now, fueling speculation across financial media outlets. Analysts are scrambling to identify the company, analyzing Berkshire Hathaway's SEC filings and scrutinizing various high-growth sectors for potential candidates. [Link to a reputable financial news source]. The revelation of the company’s identity will undoubtedly be a significant event, likely triggering a surge in its stock price. The longer the mystery remains, the more intense the speculation will become.

This unexpected move by Warren Buffett underscores the dynamic nature of the investment landscape and the importance of staying informed about market trends. While we await the unveiling of the mystery stock, one thing is certain: Buffett's strategic shift highlights the ever-evolving nature of successful long-term investing. Stay tuned for updates as this story unfolds.

What are your thoughts on Buffett's recent investment decisions? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Dumps Bank Of America Shares, Buys Into 7,700% Growth Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

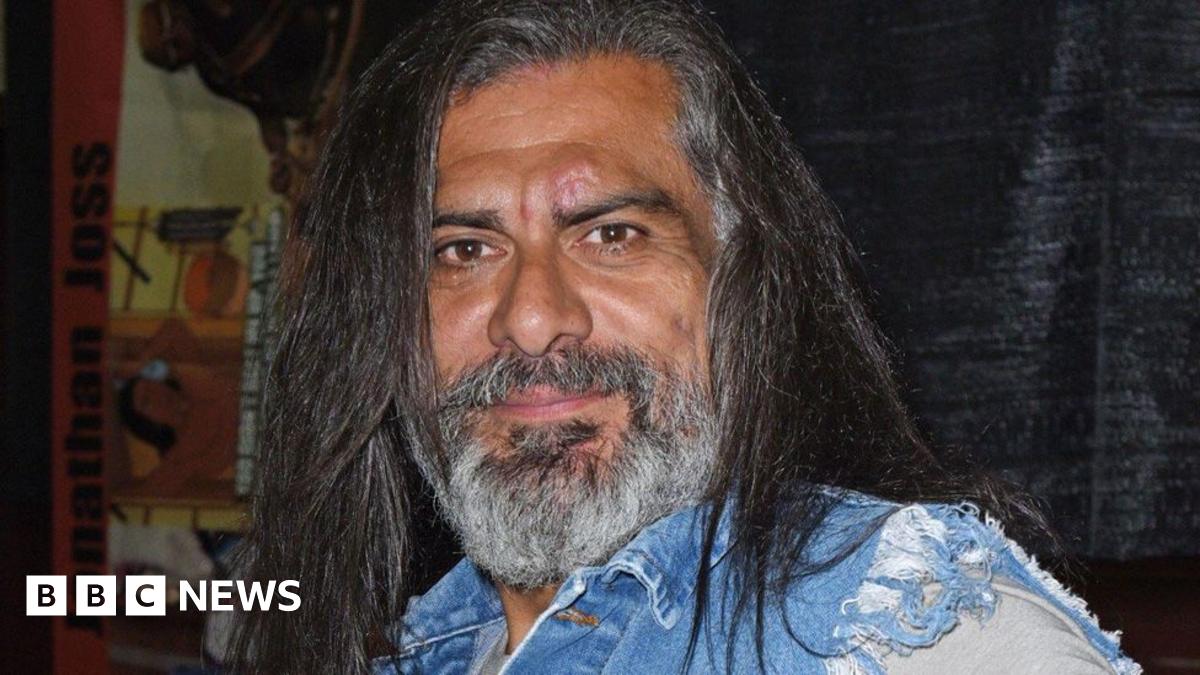

Death Of Jonathan Joss King Of The Hills John Redcorn Actor Confirmed Dead

Jun 05, 2025

Death Of Jonathan Joss King Of The Hills John Redcorn Actor Confirmed Dead

Jun 05, 2025 -

After Ketema Casting Is Ryan Gosling The Next White Black Panther

Jun 05, 2025

After Ketema Casting Is Ryan Gosling The Next White Black Panther

Jun 05, 2025 -

Job Openings Soar In April A Positive Sign For The Us Economy

Jun 05, 2025

Job Openings Soar In April A Positive Sign For The Us Economy

Jun 05, 2025 -

Decoding Clay Why Roland Garros Tests Even The Best Players

Jun 05, 2025

Decoding Clay Why Roland Garros Tests Even The Best Players

Jun 05, 2025 -

Goodbye Summer House Paige De Sorbos Emotional Farewell After Seven Seasons

Jun 05, 2025

Goodbye Summer House Paige De Sorbos Emotional Farewell After Seven Seasons

Jun 05, 2025

Latest Posts

-

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025 -

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025