Buffett Dumps Long-Held US Stocks: A Deep Dive Into His Recent Moves

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Dumps Long-Held US Stocks: A Deep Dive into His Recent Moves

Warren Buffett's Berkshire Hathaway has made headlines recently with significant divestments from long-held US stocks. This unexpected shift in strategy has sent ripples through the financial world, leaving investors questioning the Oracle of Omaha's next move. What prompted this change, and what does it mean for the market? Let's delve into the details.

The Sell-Off: Key Stocks and Significant Changes

Berkshire Hathaway's recent 13F filing revealed substantial reductions in holdings across several major US companies. While Buffett has always been known for his long-term investment approach, these moves represent a notable departure from his typical strategy. Key divestments include:

-

Reduced Stake in Bank of America: A significant decrease in Berkshire's Bank of America (BAC) shares signals a potential shift in Buffett's outlook on the financial sector. This is particularly noteworthy given his long-standing confidence in the bank's prospects. [Link to relevant Bank of America news article]

-

Decreased Holdings in Chevron: Similarly, the reduction in Chevron (CVX) shares raises eyebrows. While energy stocks have performed well recently, this move suggests a reassessment of Berkshire's energy sector investments. [Link to relevant Chevron news article]

-

Other Notable Reductions: Beyond these prominent examples, smaller but still significant reductions have been observed across other holdings, indicating a more widespread adjustment in Berkshire's portfolio.

Why the Change? Analyzing Buffett's Rationale

Pinpointing the exact reasons behind these divestments is challenging, as Buffett rarely offers explicit explanations for his investment decisions. However, several factors might be at play:

-

Market Valuation: High stock valuations across various sectors could be prompting Buffett to take profits, especially considering the potential for a market correction. This aligns with his long-held principle of buying low and selling high.

-

Shifting Economic Landscape: The current economic climate, characterized by inflation, rising interest rates, and geopolitical uncertainty, might be influencing his decision-making. A more conservative approach in the face of uncertainty is not unexpected.

-

Strategic Portfolio Rebalancing: Buffett might be reallocating capital towards other sectors he deems more promising or undervalued. This could involve bolstering existing holdings or investing in new opportunities.

-

Succession Planning: While speculation, some analysts suggest these moves are part of a broader succession plan, gradually adjusting the portfolio for the future leadership of Berkshire Hathaway.

Implications for Investors: What Does It Mean for You?

Buffett's actions send a powerful message to the market. While it doesn't necessarily signal an impending market crash, it does suggest a cautious approach is warranted. For individual investors, this could mean:

-

Review your portfolio: Assess your own risk tolerance and investment strategy in light of these developments. Consider diversifying your holdings across different sectors.

-

Monitor market trends: Pay close attention to market fluctuations and economic indicators. Being informed will help you make more strategic investment decisions.

-

Seek professional advice: If you're unsure how to navigate the current market, consider consulting with a financial advisor.

Conclusion: A Watchful Wait

Buffett's recent moves are a significant development in the financial world. While the precise reasons remain somewhat opaque, they underscore the ever-evolving nature of the investment landscape. Investors should maintain a watchful eye on market trends and adjust their strategies accordingly, remembering that even the Oracle of Omaha adapts to changing circumstances. The coming months will be crucial in understanding the full implications of these divestments and the direction of Berkshire Hathaway's future investment strategies. Stay informed, and remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Dumps Long-Held US Stocks: A Deep Dive Into His Recent Moves. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harry Enten On Cnn Analyzes The My Pillow Ceos Trajectory

Jun 05, 2025

Harry Enten On Cnn Analyzes The My Pillow Ceos Trajectory

Jun 05, 2025 -

Paige De Sorbo Announces Summer House Departure After Seven Years

Jun 05, 2025

Paige De Sorbo Announces Summer House Departure After Seven Years

Jun 05, 2025 -

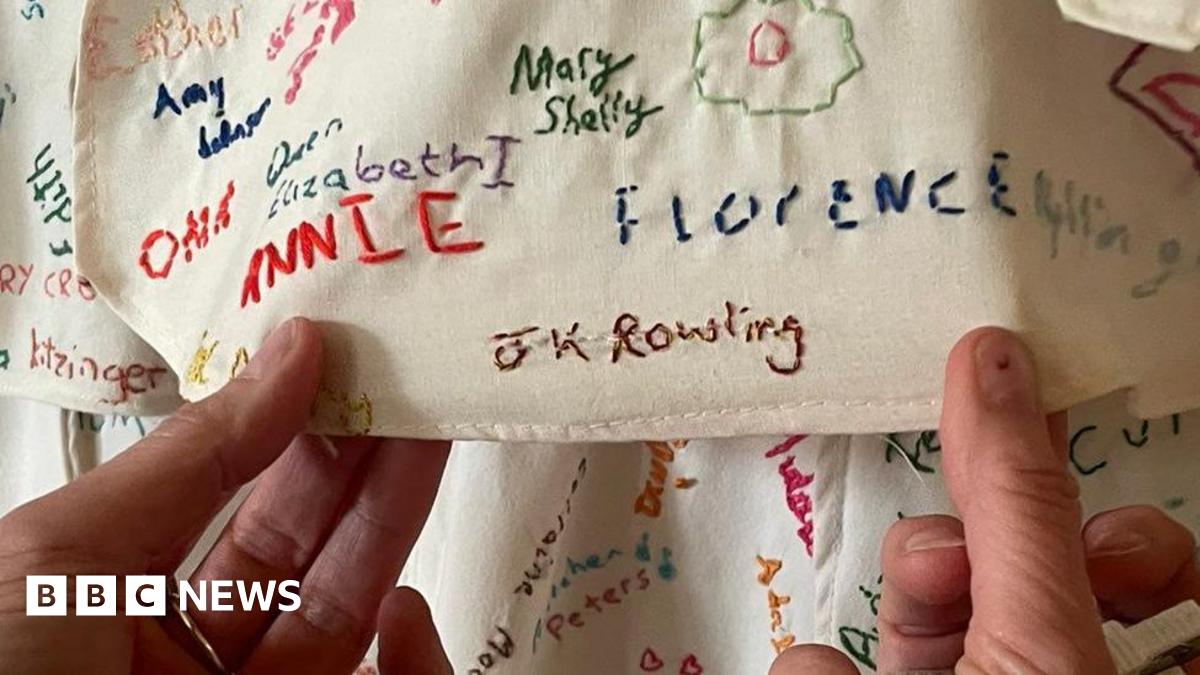

Investigation Launched Vandalized Artwork Featuring J K Rowling At National Trust Site In Derbyshire

Jun 05, 2025

Investigation Launched Vandalized Artwork Featuring J K Rowling At National Trust Site In Derbyshire

Jun 05, 2025 -

New Black Panther Revealed By Marvel Comics A Controversial Choice

Jun 05, 2025

New Black Panther Revealed By Marvel Comics A Controversial Choice

Jun 05, 2025 -

Court Hears Crucial Forensic Video Evidence In Sean Combs Case

Jun 05, 2025

Court Hears Crucial Forensic Video Evidence In Sean Combs Case

Jun 05, 2025

Latest Posts

-

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025 -

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025 -

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025