Buffett Dumps Two Long-Held US Investments: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett Dumps Two Long-Held US Investments: What It Means for Investors

Warren Buffett's Berkshire Hathaway recently revealed it had significantly reduced its holdings in two long-held US companies, sending ripples through the investment world. The moves, shedding significant portions of its stakes in Verizon Communications and Kroger, have left many wondering: what does this mean for investors? This unexpected divestment warrants a closer look at the implications for both individual and institutional investors.

Berkshire Hathaway's Strategic Shift: Verizon and Kroger

Berkshire Hathaway's portfolio adjustments are rarely arbitrary. The significant reduction in holdings of both Verizon and Kroger, companies the conglomerate had held for years, signals a potential shift in Buffett's investment strategy. While the exact reasons remain undisclosed, analysts offer several possible interpretations.

-

Shifting Market Dynamics: The telecommunications sector, where Verizon operates, is experiencing intense competition and technological disruption. The rise of 5G and the increasing demand for high-speed internet are forcing companies to adapt, potentially leading to increased capital expenditure and reduced profit margins. This could have prompted Buffett to re-evaluate Verizon's long-term prospects.

-

Inflationary Pressures: The current inflationary environment poses challenges for many businesses. Kroger, a major grocery chain, faces rising costs for labor, transportation, and supplies. Maintaining profit margins in a high-inflation economy requires significant operational efficiency, a challenge that may have contributed to Berkshire's decision.

-

Portfolio Diversification: Buffett is known for his focus on long-term value investing, but diversification remains crucial. Reducing exposure to specific sectors allows for greater flexibility and reduces overall risk. This move could reflect a strategic realignment of Berkshire's portfolio to better align with anticipated market trends.

What This Means for Investors

Buffett's decisions, while not a direct market predictor, offer valuable insights into the current market sentiment. For individual investors, this news highlights several key considerations:

-

Sector-Specific Risk: The moves underscore the importance of thorough due diligence before investing in any sector. Understanding the specific challenges faced by individual companies and the broader industry is crucial for informed investment decisions.

-

Long-Term vs. Short-Term Perspective: Buffett's moves emphasize the long-term nature of successful investing. While short-term market fluctuations can be tempting, focusing on a company's fundamental value and long-term potential remains crucial.

-

Diversification is Key: The lesson here reinforces the significance of a well-diversified investment portfolio. Don't put all your eggs in one basket, especially in sectors facing significant headwinds.

Looking Ahead: Analyzing Future Investment Strategies

While the exact reasoning behind these divestments remains a subject of ongoing discussion, the moves highlight the dynamic nature of the investment world and the importance of adapting to changing market conditions. Investors should closely monitor Berkshire Hathaway's future moves, paying attention to any shifts in their sector allocation and overall investment strategy. Further analysis of the companies' financial reports and industry trends will provide a more comprehensive understanding of the long-term implications of these divestments. Staying informed through reputable financial news sources like the and is crucial for making informed investment decisions.

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett Dumps Two Long-Held US Investments: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

College Town Backyard Party Shut Down All American Rejects Show Halted

Jun 04, 2025

College Town Backyard Party Shut Down All American Rejects Show Halted

Jun 04, 2025 -

Musetti Triumphs Over Rune Tiafoe Continues Us Open Success

Jun 04, 2025

Musetti Triumphs Over Rune Tiafoe Continues Us Open Success

Jun 04, 2025 -

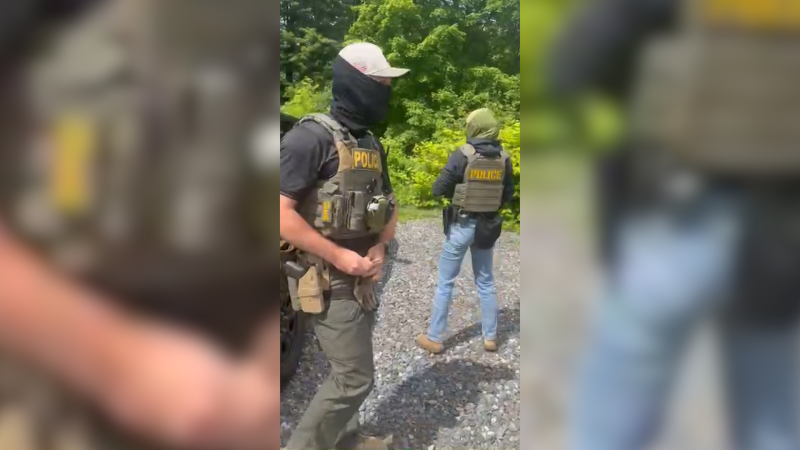

Gardeners Detention Sparks Outrage Business Owners Confront Masked Agents

Jun 04, 2025

Gardeners Detention Sparks Outrage Business Owners Confront Masked Agents

Jun 04, 2025 -

Missing Hiker Aziz Ziriat Found Deceased In The Dolomites

Jun 04, 2025

Missing Hiker Aziz Ziriat Found Deceased In The Dolomites

Jun 04, 2025 -

The Tariff Squeeze How Dollar General Is Winning In A Challenging Economy

Jun 04, 2025

The Tariff Squeeze How Dollar General Is Winning In A Challenging Economy

Jun 04, 2025

Latest Posts

-

First Look Meghan Releases Official Photos Of Lilibet To Mark Her Birthday

Jun 06, 2025

First Look Meghan Releases Official Photos Of Lilibet To Mark Her Birthday

Jun 06, 2025 -

Statement On Villanova Universitys Departure From Colonial Athletic Association Football

Jun 06, 2025

Statement On Villanova Universitys Departure From Colonial Athletic Association Football

Jun 06, 2025 -

Search Concludes Body Recovered In Portugal Missing Scot Confirmed Dead

Jun 06, 2025

Search Concludes Body Recovered In Portugal Missing Scot Confirmed Dead

Jun 06, 2025 -

Landmark Ruling Supreme Court Shifts Landscape Of Reverse Discrimination Claims

Jun 06, 2025

Landmark Ruling Supreme Court Shifts Landscape Of Reverse Discrimination Claims

Jun 06, 2025 -

Robinhood Hood Stock Market Performance 6 46 Uptick June 3rd

Jun 06, 2025

Robinhood Hood Stock Market Performance 6 46 Uptick June 3rd

Jun 06, 2025