Buffett's Big Move: Reducing Bank Of America Stake, Investing In A Skyrocketing Consumer Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Big Move: Reducing Bank of America Stake, Investing in a Skyrocketing Consumer Stock

Warren Buffett's Berkshire Hathaway has made significant portfolio adjustments, sending ripples through the financial world. The Oracle of Omaha's recent moves, detailed in the company's 13F filing, reveal a decrease in its Bank of America stake and a surprising surge in investment in a rapidly growing consumer goods company. This strategic shift signals a potential recalibration of Berkshire's investment strategy, prompting analysts to reassess the market's direction.

The reduction in Bank of America (BAC) shares, while significant, doesn't necessarily represent a loss of confidence in the financial giant. Instead, it could be attributed to several factors, including portfolio diversification and the need to rebalance holdings in a dynamic market environment. Berkshire Hathaway has historically maintained a significant stake in BAC, viewing it as a stable, long-term investment. This recent reduction, therefore, warrants closer examination rather than immediate alarm. [Link to Bank of America's Investor Relations page]

<h3>The Mystery of the Consumer Stock</h3>

The real intrigue lies in Berkshire Hathaway's substantial increase in its holdings of [Name of Consumer Stock - replace with actual company name]. This lesser-known company (at least relative to Bank of America) has experienced explosive growth in recent months, driven by [mention key reasons for growth, e.g., innovative product launches, strong marketing campaigns, expansion into new markets]. The sharp rise in the stock price has captivated investors, making it a subject of considerable speculation.

This strategic investment in a burgeoning consumer stock contrasts with Berkshire's traditional preference for established, blue-chip companies. This bold move suggests Buffett may be adapting his investment approach to capitalize on the opportunities presented by the rapidly changing consumer landscape. The company’s [mention key metrics, e.g., revenue growth, market share] paint a picture of impressive performance, attracting the attention of the legendary investor. [Link to the company's investor relations page, if available].

<h3>What Does This Mean for Investors?</h3>

Buffett's actions often serve as a powerful indicator of market sentiment. The decision to reduce Bank of America's holdings while simultaneously increasing investment in a rapidly growing consumer stock may reflect a shift in his outlook on the financial sector versus the burgeoning potential of certain consumer brands.

- Diversification: The move highlights the importance of portfolio diversification. Even seasoned investors like Buffett adjust their holdings to manage risk and capitalize on emerging opportunities.

- Market Signals: This action could be interpreted as a vote of confidence in the long-term prospects of the consumer goods sector, potentially signaling further growth in this area.

- Long-Term Strategy: It reinforces the idea that even the most successful investors continually adapt their strategies based on market dynamics and emerging trends.

While it's impossible to predict the future with certainty, Buffett's decisions certainly warrant careful consideration for investors seeking to navigate the complexities of the current market. Understanding the reasons behind these moves, including the potential for growth in the consumer sector, offers valuable insights for building a robust investment portfolio. This latest move emphasizes the importance of staying informed and adapting one's investment strategy to market trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Big Move: Reducing Bank Of America Stake, Investing In A Skyrocketing Consumer Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Third England West Indies Odi Traffic Delays Cause Match Postponement

Jun 04, 2025

Third England West Indies Odi Traffic Delays Cause Match Postponement

Jun 04, 2025 -

Ronny Mauricio Called Up Analyzing The Mets Decision And Expectations

Jun 04, 2025

Ronny Mauricio Called Up Analyzing The Mets Decision And Expectations

Jun 04, 2025 -

Tiafoe And Musetti Shine American Makes History Italian Takes Down Rune

Jun 04, 2025

Tiafoe And Musetti Shine American Makes History Italian Takes Down Rune

Jun 04, 2025 -

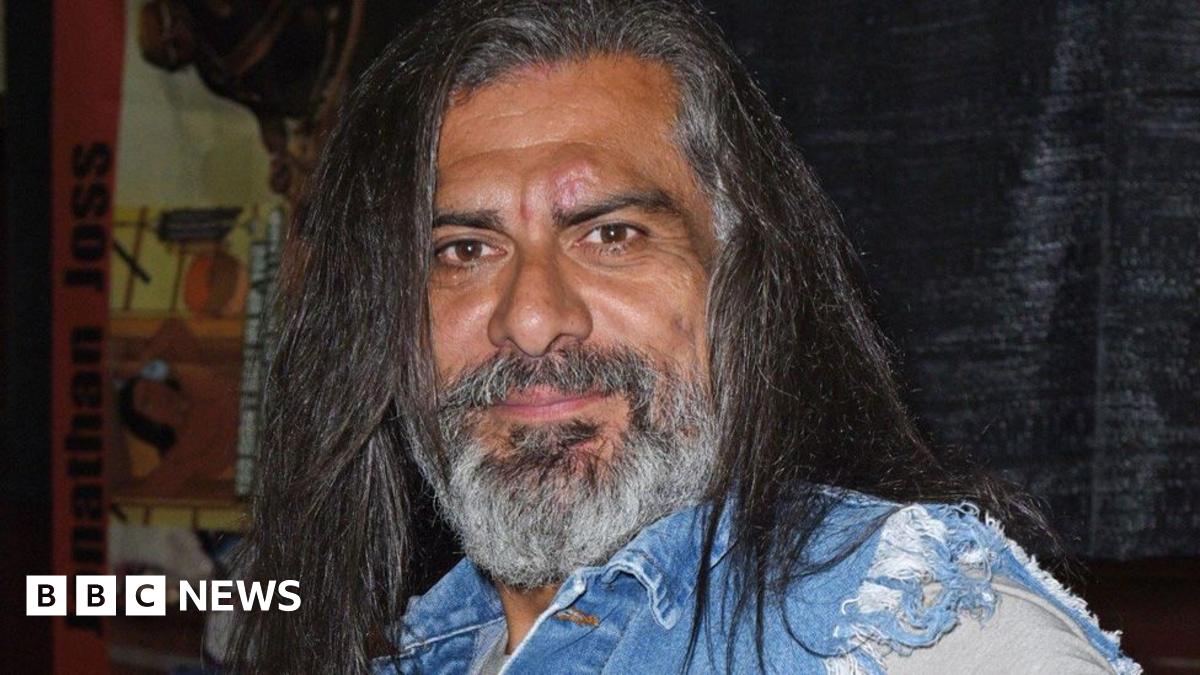

Confirmed Jonathan Joss King Of The Hills John Redcorn Is Dead

Jun 04, 2025

Confirmed Jonathan Joss King Of The Hills John Redcorn Is Dead

Jun 04, 2025 -

Reveal Your Youthful Neck Halle Berrys Choice

Jun 04, 2025

Reveal Your Youthful Neck Halle Berrys Choice

Jun 04, 2025

Latest Posts

-

Major Rescue Operation 22 Crew Members Saved From Burning Car Carrier

Jun 06, 2025

Major Rescue Operation 22 Crew Members Saved From Burning Car Carrier

Jun 06, 2025 -

Car Carrier Fire In North Pacific 22 Crew Members Rescued

Jun 06, 2025

Car Carrier Fire In North Pacific 22 Crew Members Rescued

Jun 06, 2025 -

Karen Reads Retrial Strategy Defense Files Indicate No Testimony

Jun 06, 2025

Karen Reads Retrial Strategy Defense Files Indicate No Testimony

Jun 06, 2025 -

Landmark Supreme Court Ruling Victory For Ohio Woman In Discrimination Lawsuit

Jun 06, 2025

Landmark Supreme Court Ruling Victory For Ohio Woman In Discrimination Lawsuit

Jun 06, 2025 -

Official David Quinn And Joe Sacco Named Rangers Assistant Coaches

Jun 06, 2025

Official David Quinn And Joe Sacco Named Rangers Assistant Coaches

Jun 06, 2025