Buffett's Billions: A Massive Bank Of America Sell-Off And A Surprising Consumer Brand Buy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Billions: A Massive Bank of America Sell-Off and a Surprising Consumer Brand Buy

Warren Buffett's Berkshire Hathaway has sent shockwaves through the financial world with a double-whammy announcement: a significant reduction in its Bank of America stake and a surprising investment in a major consumer brand. The moves, revealed in the company's latest SEC filings, have sparked intense speculation about Buffett's investment strategy and the future direction of the market.

This unexpected shift highlights the Oracle of Omaha's ongoing adaptability in the face of evolving economic conditions. While the sell-off of Bank of America shares is significant, it doesn't necessarily signal a lack of confidence in the banking sector. Instead, it might reflect Berkshire Hathaway's ongoing portfolio diversification and a shrewd reallocation of capital towards potentially higher-growth opportunities.

The Bank of America Sell-Off: A Strategic Retreat or Something More?

Berkshire Hathaway dramatically reduced its holdings in Bank of America (BAC), shedding millions of shares. This represents a substantial decrease in their overall stake, prompting analysts to dissect the motivations behind this move. Several theories abound, ranging from simple profit-taking after a period of significant growth in BAC stock price to a more strategic repositioning of the portfolio in anticipation of economic headwinds. The timing, coinciding with rising interest rates and concerns about a potential recession, has only fueled the speculation. [Link to Bank of America's investor relations page]

While the exact reasoning remains unclear, the move underscores the dynamic nature of Buffett's investment philosophy. He's famously known for his long-term "buy and hold" strategy, but this sell-off proves that even the most seasoned investors adapt their strategies based on market conditions and perceived opportunities.

A Surprising New Acquisition: Which Consumer Brand Won Buffett's Favor?

The second, equally intriguing piece of news centers around Berkshire Hathaway's investment in [Insert Name of Consumer Brand Here – This needs to be replaced with the actual brand name once it's publicly known]. This acquisition comes as a surprise to many, given Berkshire's typically conservative investment approach. The specifics of this investment, including the size of the stake and the reasons behind it, are still emerging. However, the move signals Buffett's belief in the brand’s long-term potential and its ability to navigate the current consumer landscape. [Link to the consumer brand's website – replace with actual link]

Analyzing the Implications

- Market Volatility: These announcements highlight the inherent volatility of the market and the need for even the most experienced investors to adjust their strategies accordingly.

- Diversification: Buffett's moves underscore the importance of portfolio diversification, ensuring that a portfolio isn't overly reliant on any single sector or company.

- Long-Term Vision: Despite the significant changes, Buffett’s actions continue to reflect a long-term investment strategy focused on identifying fundamentally strong companies with sustainable growth potential.

What's Next for Berkshire Hathaway?

The coming months will be crucial in understanding the full implications of these significant shifts in Berkshire Hathaway's portfolio. Analysts are closely watching for further announcements and any indications of broader strategic shifts. The Oracle of Omaha's moves always command attention, and these recent decisions are no exception. They serve as a potent reminder of the unpredictable nature of the market and the ever-evolving strategies employed by even the most successful investors. Stay tuned for further updates as this story unfolds.

Call to Action: What are your thoughts on Buffett’s recent investment decisions? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Billions: A Massive Bank Of America Sell-Off And A Surprising Consumer Brand Buy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uncertainty Mounts For Thames Water Following Bidder Withdrawal

Jun 05, 2025

Uncertainty Mounts For Thames Water Following Bidder Withdrawal

Jun 05, 2025 -

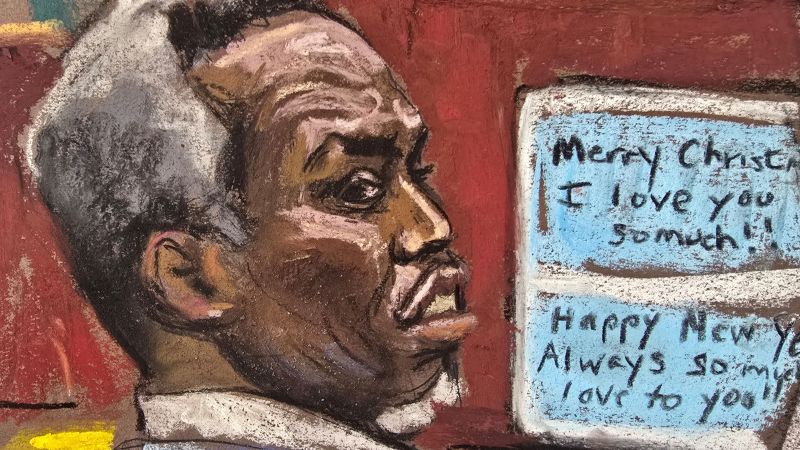

The Sean Diddy Combs Trial A Timeline Of Recent Events

Jun 05, 2025

The Sean Diddy Combs Trial A Timeline Of Recent Events

Jun 05, 2025 -

Djokovic And Bublik Triumph At French Open Match Results And Highlights

Jun 05, 2025

Djokovic And Bublik Triumph At French Open Match Results And Highlights

Jun 05, 2025 -

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025 -

Ryan Goslings White Black Panther Rumor Could He Join The Mcu After Ketemas Casting

Jun 05, 2025

Ryan Goslings White Black Panther Rumor Could He Join The Mcu After Ketemas Casting

Jun 05, 2025

Latest Posts

-

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025 -

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025