Buffett's Portfolio Shakeup: Two Major US Investments Sold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Portfolio Shakeup: Berkshire Hathaway Dumps Two Major US Holdings

Warren Buffett's Berkshire Hathaway has sent shockwaves through the investment world with the announcement of significant divestments from two major US companies. The move, revealed in the company's latest quarterly filing, marks a notable shift in the legendary investor's long-term strategy and has sparked considerable speculation about the future direction of his portfolio. This article delves into the details of these surprising sales and analyzes their potential implications.

The Sold Holdings: A Look at the Divestments

Berkshire Hathaway's 13F filing, which details its equity holdings, revealed the complete or near-complete sale of its stakes in two significant US companies:

-

US Bancorp (USB): Berkshire Hathaway had held a substantial position in US Bancorp, a major regional bank, for several years. The sale represents a significant departure from Buffett's traditionally conservative approach to banking investments. The exact reasons behind this divestment remain unclear, but analysts are speculating on a range of possibilities, from concerns about rising interest rates to a reassessment of the bank's long-term growth prospects.

-

Verizon Communications (VZ): The sale of Berkshire Hathaway's stake in telecom giant Verizon is equally surprising. Buffett has historically favored stable, dividend-paying stocks, and Verizon has fit that profile. However, the recent divestment suggests a reevaluation of the company’s future performance in a rapidly evolving telecommunications landscape. The sale could indicate a shift in Berkshire Hathaway's outlook on the sector's growth potential.

Implications and Market Reactions

The news of these significant divestments has naturally caused ripples in the market. Shares of both US Bancorp and Verizon experienced [insert percentage change and direction - up or down] following the announcement. Analysts are divided on the long-term implications. Some interpret the sales as a sign of a more cautious approach by Buffett in the face of potential economic headwinds, while others see it as a strategic repositioning of the portfolio to capitalize on emerging opportunities in other sectors.

Buffett's Shifting Investment Philosophy?

This portfolio shakeup raises questions about the evolution of Buffett's investment philosophy. While he remains committed to long-term value investing, the recent sales suggest a willingness to adapt to changing market conditions and reassess even long-held positions. This move highlights the dynamic nature of even the most successful investment strategies and underscores the importance of continuous reevaluation and adaptation in the ever-changing world of finance.

What's Next for Berkshire Hathaway?

The future direction of Berkshire Hathaway's investment strategy remains to be seen. However, the recent sales suggest a potential shift in focus towards [mention potential sectors based on news and speculation, e.g., technology, renewable energy]. Investors are eagerly awaiting further updates from Berkshire Hathaway to gain a clearer understanding of its long-term investment plans.

Conclusion:

The sale of US Bancorp and Verizon represents a significant turning point for Berkshire Hathaway. The reasons behind these decisions remain somewhat opaque, fueling speculation and analysis within the financial community. This event serves as a powerful reminder of the ever-changing landscape of the investment world and the importance of adaptability, even for the most seasoned investors. Further developments and the company's future moves will be closely monitored by investors globally. Stay tuned for updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Portfolio Shakeup: Two Major US Investments Sold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

50 000 Theft Pontardawe Mothers Sentencing And Repayment

Jun 05, 2025

50 000 Theft Pontardawe Mothers Sentencing And Repayment

Jun 05, 2025 -

Missing Scot From Stag Do Found Dead In Portugal Investigation Underway

Jun 05, 2025

Missing Scot From Stag Do Found Dead In Portugal Investigation Underway

Jun 05, 2025 -

Reverse Discrimination Suits Supreme Court Sides With Plaintiff In Landmark Case

Jun 05, 2025

Reverse Discrimination Suits Supreme Court Sides With Plaintiff In Landmark Case

Jun 05, 2025 -

Coca Cola Company Ko Investor Interest And Key Considerations

Jun 05, 2025

Coca Cola Company Ko Investor Interest And Key Considerations

Jun 05, 2025 -

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025

Wilders Departure Shakes Dutch Politics Coalition Government Collapses

Jun 05, 2025

Latest Posts

-

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025 -

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025

Understanding The Trump Putin Alaska Summit Five Crucial Points

Aug 17, 2025 -

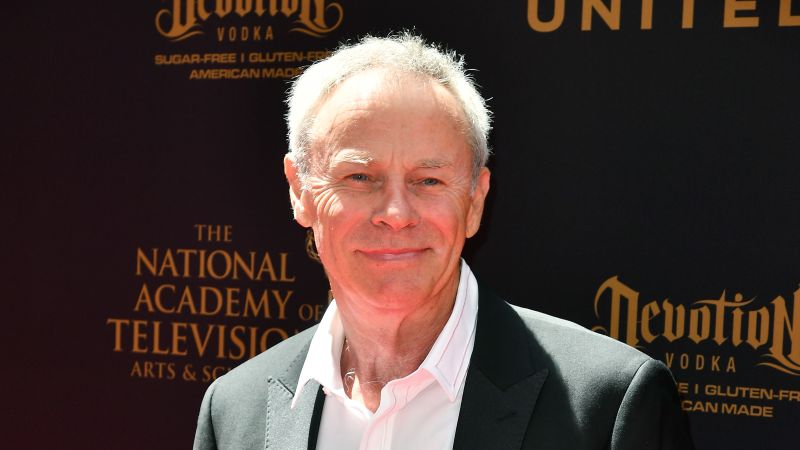

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025