Buffett's Portfolio Shakeup: Two US Stocks Removed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Portfolio Shakeup: Two US Stocks Removed – What it Means for Investors

Warren Buffett's Berkshire Hathaway made headlines this week with a significant portfolio adjustment, revealing the removal of two prominent US stocks. This unexpected move has sent ripples through the investment world, prompting questions about the Oracle of Omaha's investment strategy and the future prospects of the affected companies. The decision underscores the dynamic nature of even the most seasoned investor's portfolio and offers valuable insights for both seasoned and novice investors.

The news, revealed in Berkshire Hathaway's latest 13F filing, confirmed the complete divestment of US Bancorp (USB) and Verizon Communications (VZ). This marks a departure from Buffett's typically long-term, buy-and-hold approach, fueling speculation about underlying market shifts and his assessment of these companies' future performance.

Why the Sell-Off? Unpacking Buffett's Decisions

While Berkshire Hathaway doesn't typically provide detailed explanations for individual stock trades, analysts have offered several possible interpretations of this strategic shift. One prevailing theory centers around shifting market conditions. The rise of fintech and increased competition in the banking sector could have influenced the decision regarding US Bancorp. Similarly, the increasing competitiveness in the telecom industry and the ongoing challenges related to 5G network deployment may have contributed to the sale of Verizon shares.

Another perspective suggests a broader portfolio rebalancing strategy. Berkshire Hathaway's portfolio is incredibly diversified, and these divestments might simply reflect a reallocation of capital towards other sectors viewed as more promising for long-term growth. This highlights the importance of regular portfolio review and the adaptability required in dynamic market conditions.

- US Bancorp (USB): The banking sector is facing increasing pressure from fintech disruptors. Buffett's decision might reflect concerns about the long-term profitability of traditional banking models in a rapidly evolving digital landscape. [Link to relevant financial news article about fintech disruption].

- Verizon Communications (VZ): The telecom industry is highly competitive, and the significant investments required for 5G infrastructure upgrades might have influenced Buffett's decision. [Link to relevant article on 5G network deployment challenges].

What This Means for Investors

Buffett's actions, while not necessarily indicative of a market crash, certainly warrant attention. His decisions often serve as a bellwether for the broader market, influencing investor sentiment and potentially impacting the stock prices of the affected companies. However, it's crucial to remember that individual investment decisions should be based on thorough research and personal risk tolerance, rather than solely mimicking the actions of even the most successful investors.

This event underscores the importance of:

- Diversification: A well-diversified portfolio helps mitigate risk and protects against losses in specific sectors.

- Regular Portfolio Review: Market conditions change constantly, requiring periodic reviews and adjustments to align with evolving investment goals.

- Long-Term Perspective: While short-term market fluctuations are inevitable, successful investing often requires a long-term outlook.

Looking Ahead: Implications for Berkshire Hathaway

While the removal of US Bancorp and Verizon is noteworthy, it's important to consider this within the context of Berkshire Hathaway's vast portfolio. These divestments represent a relatively small portion of their overall holdings. The company’s continued success is likely to be driven by its diverse investments across various sectors and its strong leadership.

The sell-off does, however, prompt speculation about where Buffett might allocate his capital next. His future investment choices will undoubtedly be closely followed by the market. This shakeup serves as a reminder that even the most experienced investors adapt their strategies to navigate the ever-changing economic landscape. Stay tuned for further updates and analysis as the story unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Portfolio Shakeup: Two US Stocks Removed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Villanova Joins Patriot League For Football Starting In 2026

Jun 05, 2025

Villanova Joins Patriot League For Football Starting In 2026

Jun 05, 2025 -

Inside The Mind Of Alexander Bublik A Tennis Pros Perspective On Elite Sports Culture

Jun 05, 2025

Inside The Mind Of Alexander Bublik A Tennis Pros Perspective On Elite Sports Culture

Jun 05, 2025 -

Robinhood Hood Stock Performance 6 46 Gain On June 3rd And Future Outlook

Jun 05, 2025

Robinhood Hood Stock Performance 6 46 Gain On June 3rd And Future Outlook

Jun 05, 2025 -

No More Summer House For Paige De Sorbo Star Confirms Exit

Jun 05, 2025

No More Summer House For Paige De Sorbo Star Confirms Exit

Jun 05, 2025 -

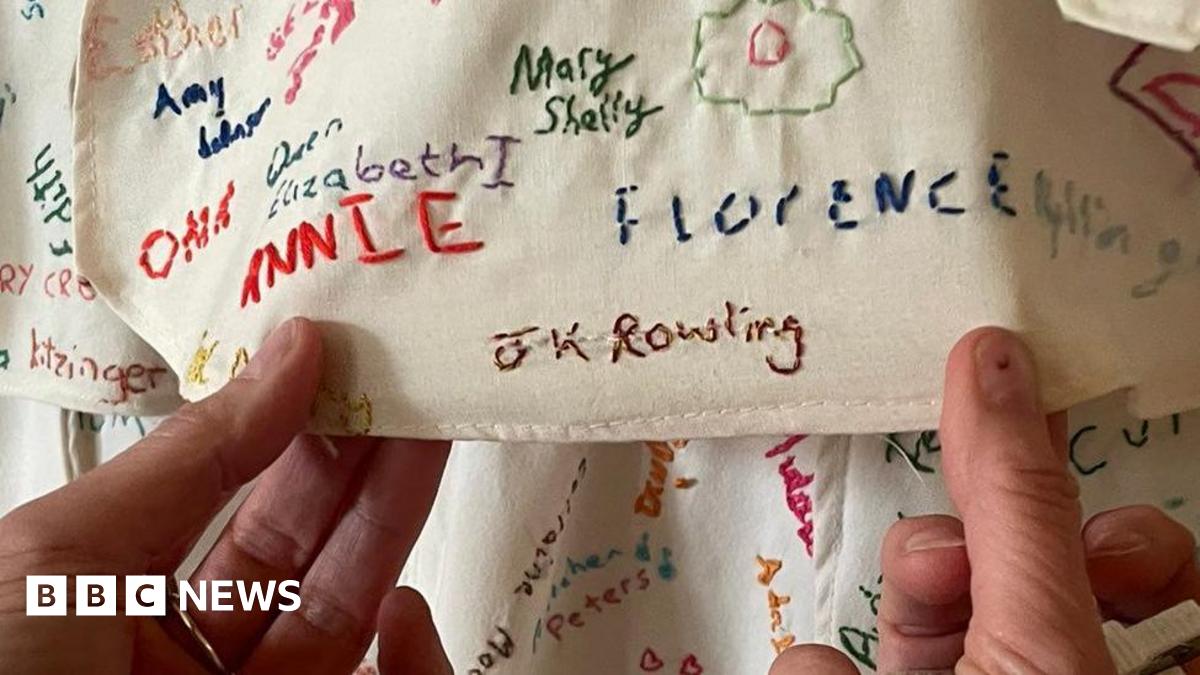

National Trust Addresses Tampered J K Rowling Artwork In Derbyshire Estate

Jun 05, 2025

National Trust Addresses Tampered J K Rowling Artwork In Derbyshire Estate

Jun 05, 2025

Latest Posts

-

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025 -

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025 -

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025