Bull Of The Day: Deep Dive Into Limbach Holdings (LMB) Stock Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bull of the Day: Deep Dive into Limbach Holdings (LMB) Stock Performance

Limbach Holdings (LMB) has caught the eye of many investors recently, sparking significant interest in its stock performance. This detailed analysis explores the factors contributing to LMB's bullish momentum, examining its financial health, market position, and future prospects. Is Limbach Holdings a worthwhile investment, or is the current bullish sentiment overblown? Let's delve into the details.

Understanding Limbach Holdings (LMB)

Limbach Holdings, Inc. is a leading provider of mechanical, electrical, and plumbing (MEP) building systems. They primarily serve the healthcare, commercial, and industrial sectors, offering design-build, construction management, and commissioning services. Their focus on sustainable and energy-efficient solutions positions them well within the current market trends. Understanding their core business is crucial to analyzing their stock performance.

Recent Stock Performance and Key Catalysts

LMB's stock has demonstrated impressive growth in the past [Insert Time Period, e.g., quarter, year]. Several key factors have contributed to this positive trend:

- Strong Financial Results: [Insert specific data points, e.g., Revenue growth percentage, EPS growth, improved profit margins]. These figures indicate a healthy and growing company. (Link to official LMB financial reports here).

- Strategic Acquisitions: [Mention any recent acquisitions and their impact on the company's growth and market share]. Successful integration of acquired companies can significantly boost revenue and expand market reach.

- Increased Demand in Key Sectors: The healthcare and commercial construction sectors are experiencing [Describe current market conditions, e.g., a period of robust growth, increased demand for sustainable building practices]. This favorable market environment benefits LMB's core business.

- Positive Industry Outlook: The overall outlook for the MEP industry remains [Describe the outlook – positive, neutral, or negative, and support with relevant data or industry reports]. This provides a supportive backdrop for LMB's continued success.

Analyzing LMB's Valuation and Risks

While the current bullish sentiment surrounding LMB is encouraging, it's crucial to consider potential risks:

- Competition: The MEP industry is competitive. LMB faces pressure from established players and emerging competitors. Understanding their competitive advantages is crucial.

- Economic Downturn: A significant economic downturn could negatively impact construction spending, affecting LMB's revenue.

- Supply Chain Disruptions: Fluctuations in material costs and supply chain disruptions can affect profitability.

Investment Considerations:

Investors interested in LMB should carefully consider their risk tolerance and investment goals. While the company shows strong potential, it's essential to conduct thorough due diligence before making any investment decisions. Consulting with a financial advisor is always recommended.

Conclusion: Is LMB a Buy?

Based on its recent performance, strategic initiatives, and the positive industry outlook, LMB presents an intriguing opportunity for investors. However, potential risks associated with the industry and broader economic factors should be carefully considered. The ultimate decision of whether to invest in LMB rests on an individual's risk appetite and investment strategy. Further research into LMB's financial statements and market analysis is strongly advised before taking any action.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Keywords: Limbach Holdings, LMB, LMB stock, stock performance, bull of the day, MEP, mechanical electrical plumbing, construction, investment, stock analysis, financial analysis, market outlook, risk assessment, company profile.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bull Of The Day: Deep Dive Into Limbach Holdings (LMB) Stock Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Hidden World Of Ticket Scalping Bulk Buying And Exploited Labor

Jun 27, 2025

The Hidden World Of Ticket Scalping Bulk Buying And Exploited Labor

Jun 27, 2025 -

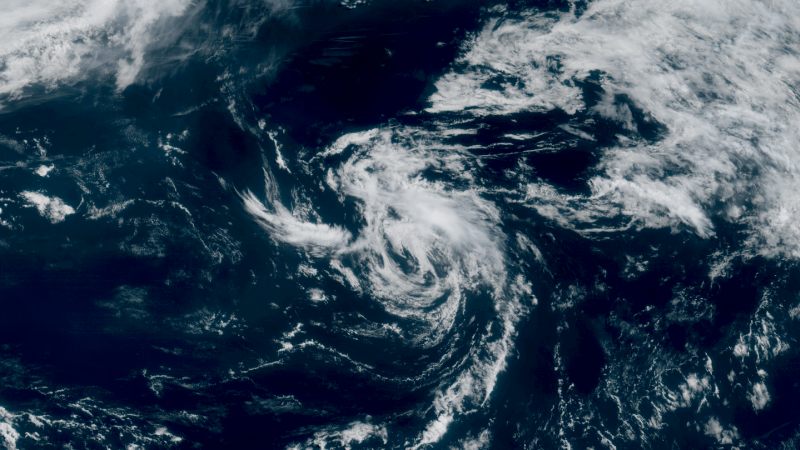

Tropical Storm Andrea Early Start To The Atlantic Hurricane Season

Jun 27, 2025

Tropical Storm Andrea Early Start To The Atlantic Hurricane Season

Jun 27, 2025 -

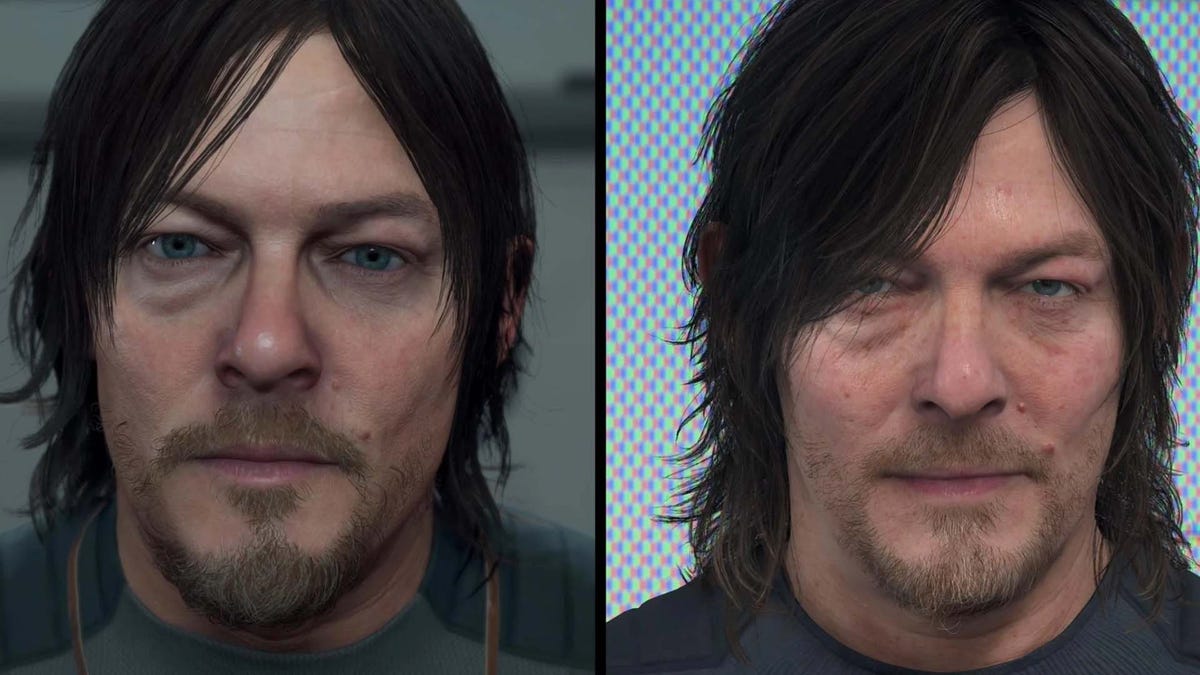

Familiar Face New Game Analyzing Norman Reedus Portrayal In Death Stranding 2

Jun 27, 2025

Familiar Face New Game Analyzing Norman Reedus Portrayal In Death Stranding 2

Jun 27, 2025 -

Sprinter Chris Robinson Race Win Amidst Wardrobe Failure

Jun 27, 2025

Sprinter Chris Robinson Race Win Amidst Wardrobe Failure

Jun 27, 2025 -

Where Is Ayatollah Khamenei Unconfirmed Reports Spark Speculation

Jun 27, 2025

Where Is Ayatollah Khamenei Unconfirmed Reports Spark Speculation

Jun 27, 2025

Latest Posts

-

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025

Love You Dad Chet Hanks Pays Tribute To Tom Hanks In New Video

Jun 27, 2025 -

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025

Tragic Hike Drone Video Shows Juliana Marins Before Deadly Accident In Brazil

Jun 27, 2025 -

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025

Warwickshire Council Leaders Shock Resignation 18 Year Old Takes The Reins

Jun 27, 2025 -

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025

100 Degree Heatwave Texas Power Grid Prepared To Avoid Blackouts

Jun 27, 2025 -

Breaking Barriers From Benefits To Employment

Jun 27, 2025

Breaking Barriers From Benefits To Employment

Jun 27, 2025