Buy Now, Pay Later: Changes To Protect Consumers From Financial Harm

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Changes to Protect Consumers from Financial Harm

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering a seemingly effortless way to purchase goods and services. But the ease of access has also raised concerns about potential financial harm to consumers. Recent changes in regulations and industry practices aim to address these concerns and better protect consumers from spiraling debt. This article explores the key shifts in the BNPL landscape and what they mean for you.

The Rise and Fall (and Rise Again) of BNPL's Popularity:

BNPL's rapid growth saw it become a ubiquitous payment option, integrated into countless online and in-store retailers. Its appeal is clear: split payments, often interest-free, make larger purchases more manageable. However, this convenience masked potential risks. Many consumers found themselves juggling multiple BNPL accounts, leading to difficulties tracking payments and potentially accumulating significant debt. The lack of robust consumer protection measures initially exacerbated the problem.

Changes in the Regulatory Landscape:

Recognizing the growing risks, regulators worldwide are stepping in. These changes are multifaceted and vary by jurisdiction, but common themes emerge:

- Increased Transparency: New regulations are mandating greater transparency regarding fees, interest rates, and repayment terms. Consumers now have a clearer understanding of the total cost of using BNPL services.

- Credit Reporting: A significant shift involves integrating BNPL repayments into credit reports. This move holds consumers accountable for their payments and allows lenders to assess their creditworthiness more accurately. Missing payments can negatively impact credit scores, potentially affecting future borrowing opportunities. This is a crucial development in protecting both consumers and the financial system.

- Affordability Checks: Several jurisdictions are implementing stricter affordability checks before approving BNPL loans. This helps prevent consumers from taking on more debt than they can reasonably manage. These checks often involve assessing income and existing debt levels.

- Debt Management Tools: Many BNPL providers are now incorporating debt management tools and resources to help consumers better manage their accounts and avoid falling behind on payments. This includes features like payment reminders and debt consolidation options.

What Consumers Should Do:

Even with increased regulations, responsible use of BNPL remains crucial. Consider these tips:

- Only use BNPL for purchases you can afford: Avoid using it impulsively. Remember, you are still responsible for repaying the full amount.

- Track your payments meticulously: Use a budgeting app or spreadsheet to keep track of all your BNPL accounts and payment due dates.

- Read the terms and conditions carefully: Understand all fees, interest rates, and repayment schedules before using any BNPL service.

- Avoid overextending yourself: Don't apply for more BNPL accounts than you can comfortably manage.

The Future of Buy Now, Pay Later:

The future of BNPL likely involves a more balanced approach. While the convenience of these services remains attractive, the emphasis is shifting towards responsible lending and consumer protection. The changes discussed here represent a significant step towards a more sustainable and safer BNPL landscape. The industry's evolution is ongoing, and continued monitoring of regulatory changes and provider practices is essential for consumers.

Further Reading: [Link to a relevant government consumer protection website] [Link to a reputable financial advice article]

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a financial professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Changes To Protect Consumers From Financial Harm. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Fans Erupt Jon Jones Controversial Aspinall Comments Explained

May 20, 2025

Ufc Fans Erupt Jon Jones Controversial Aspinall Comments Explained

May 20, 2025 -

2027 The Year For Driverless Cars In The Uk Uber Weighs In

May 20, 2025

2027 The Year For Driverless Cars In The Uk Uber Weighs In

May 20, 2025 -

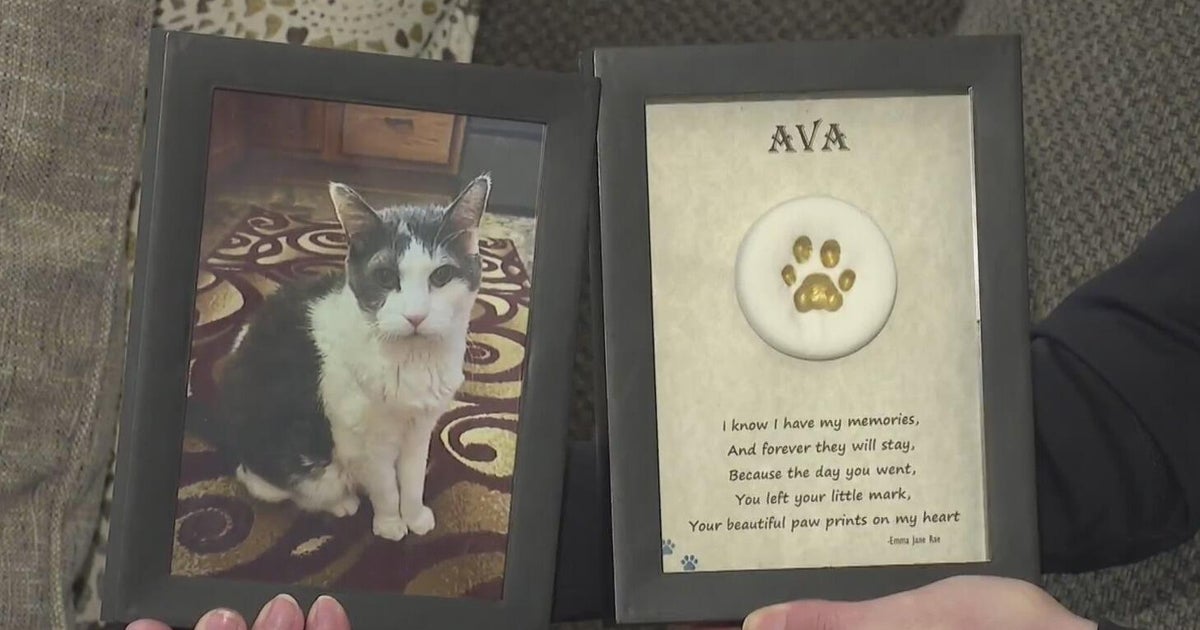

Community Mourns Memorial For Pets Affected By Funeral Home Crematory Error

May 20, 2025

Community Mourns Memorial For Pets Affected By Funeral Home Crematory Error

May 20, 2025 -

Helldivers 2 Masters Of Ceremony Warbond Drops Arrive May 15th

May 20, 2025

Helldivers 2 Masters Of Ceremony Warbond Drops Arrive May 15th

May 20, 2025 -

Kentucky Tornado Damage Aerial Views Reveal Devastation

May 20, 2025

Kentucky Tornado Damage Aerial Views Reveal Devastation

May 20, 2025

Latest Posts

-

A J Perez On Brett Favre Threats Untold And The Fall Of Favre

May 21, 2025

A J Perez On Brett Favre Threats Untold And The Fall Of Favre

May 21, 2025 -

10 Minute Pilotless Flight Lufthansa Investigation Uncovers Co Pilots Collapse

May 21, 2025

10 Minute Pilotless Flight Lufthansa Investigation Uncovers Co Pilots Collapse

May 21, 2025 -

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025 -

Is Your Child Ready To Stop Sucking Their Thumb Or Pacifier A Parents Guide

May 21, 2025

Is Your Child Ready To Stop Sucking Their Thumb Or Pacifier A Parents Guide

May 21, 2025 -

Breaking Point Olympic Champions Harrowing Account Of Abusive Coaching Practices

May 21, 2025

Breaking Point Olympic Champions Harrowing Account Of Abusive Coaching Practices

May 21, 2025