Buy Now, Pay Later Changes: What The New Rules Mean For Shoppers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later Changes: What the New Rules Mean for Shoppers

Buy Now, Pay Later (BNPL) services exploded in popularity, offering a seemingly effortless way to spread the cost of purchases. But the carefree days of instant credit are over. New regulations are changing the BNPL landscape, and understanding these changes is crucial for savvy shoppers. This article breaks down the key updates and explains what they mean for your wallet.

The Rise and Fall (and Rise?) of Unregulated BNPL

For years, BNPL services like Klarna, Afterpay (now a part of Square), and Affirm thrived with minimal oversight. Their appeal was simple: instant credit approval, often with little to no credit check, and the ability to pay in installments. This made them particularly attractive to younger generations and those with less-than-perfect credit scores. However, this lack of regulation also led to concerns about overspending, debt accumulation, and a lack of transparency regarding fees and interest charges.

New Rules: A Focus on Consumer Protection

Recent regulatory changes aim to address these concerns, prioritizing consumer protection. While the specific regulations vary by country and region, several common themes emerge:

- Increased Transparency: BNPL providers are now required to be more upfront about fees, interest rates, and repayment terms. This means clearer disclosures at the point of sale, making it easier to compare offers and understand the true cost of using BNPL.

- Credit Checks and Affordability Assessments: Many jurisdictions are mandating stricter credit checks and affordability assessments before approving BNPL applications. This aims to prevent consumers from taking on more debt than they can realistically manage.

- Debt Collection Practices: Regulations are also focusing on fairer and more transparent debt collection practices. Aggressive tactics are being curtailed, and consumers are better protected against unfair treatment.

- Reporting to Credit Bureaus: A significant shift is the increasing trend of BNPL providers reporting payment history to credit bureaus. This means missed payments can negatively impact your credit score, potentially affecting future loan applications and other financial opportunities. This move towards greater credit accountability is a major change from the past.

What This Means for You: A Shopper's Guide to Navigating the New Landscape

The new regulations are designed to protect consumers, but it's still essential to be a responsible borrower:

- Budget Carefully: Before using BNPL, create a budget and ensure you can comfortably afford the repayments. Don't let the ease of the process tempt you into overspending.

- Compare Offers: Don't just settle for the first BNPL option presented. Compare interest rates, fees, and repayment terms across different providers to find the most suitable option.

- Read the Fine Print: Always read the terms and conditions carefully before agreeing to a BNPL agreement. Understand the implications of missed payments and late fees.

- Monitor Your Spending: Keep track of your BNPL transactions and repayments to avoid falling behind.

The Future of Buy Now, Pay Later

The future of BNPL is undoubtedly evolving. The increased regulation signifies a move toward greater responsibility and transparency within the industry. While the convenience of BNPL remains appealing, consumers must be more informed and responsible in their usage. The shift towards stricter regulations signifies a maturing market, prioritizing responsible lending practices and consumer well-being.

Call to Action: Stay informed about the latest regulations in your region by checking your government's financial consumer protection website. Responsible use of BNPL can be a helpful financial tool, but informed use is key.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later Changes: What The New Rules Mean For Shoppers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Femicide In Focus Recent Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025

Femicide In Focus Recent Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025 -

Future Of Match Of The Day Uncertain After Gary Linekers Expected Bbc Exit

May 21, 2025

Future Of Match Of The Day Uncertain After Gary Linekers Expected Bbc Exit

May 21, 2025 -

Fan Frenzy Jon Jones Cryptic Message Sparks Retirement Rumors Aspinall Fight In Limbo

May 21, 2025

Fan Frenzy Jon Jones Cryptic Message Sparks Retirement Rumors Aspinall Fight In Limbo

May 21, 2025 -

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025 -

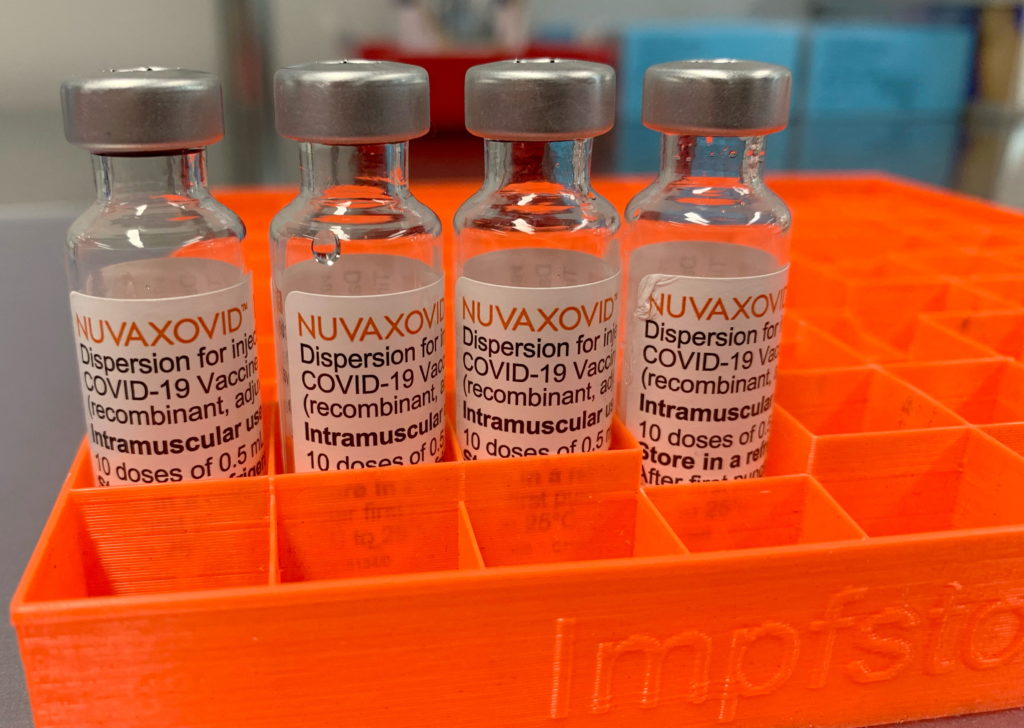

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Latest Posts

-

Jon Jones Ufcs Secrecy Around Aspinall Injury Unacceptable

May 21, 2025

Jon Jones Ufcs Secrecy Around Aspinall Injury Unacceptable

May 21, 2025 -

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025 -

Slight Dip In Us Treasury Yields After Feds Rate Cut Outlook

May 21, 2025

Slight Dip In Us Treasury Yields After Feds Rate Cut Outlook

May 21, 2025 -

Balis Tourism Overhaul Stricter Guidelines To Curb Poor Tourist Behavior

May 21, 2025

Balis Tourism Overhaul Stricter Guidelines To Curb Poor Tourist Behavior

May 21, 2025 -

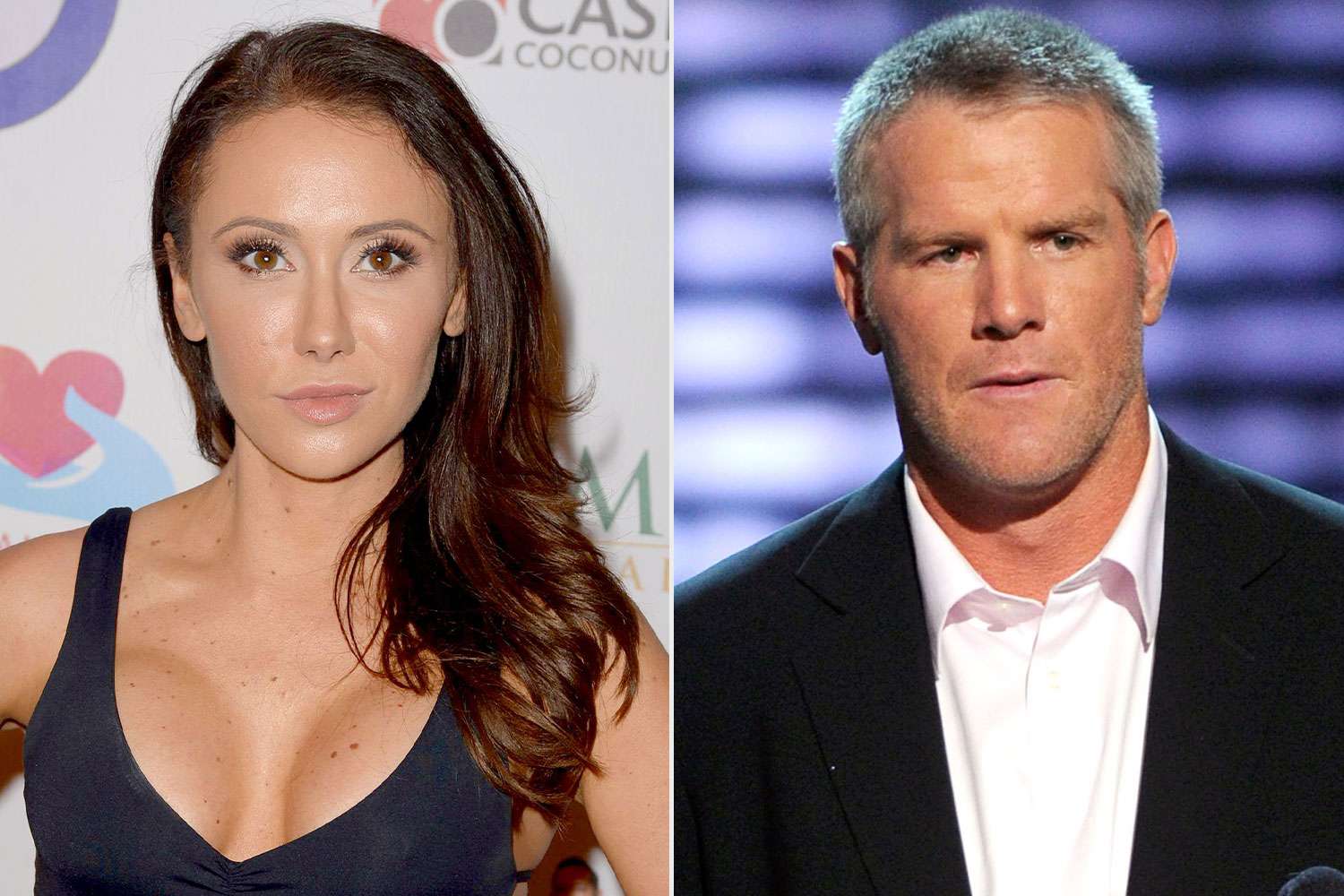

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025