Buy Now, Pay Later: Enhanced Consumer Protections Under New Rules

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Enhanced Consumer Protections Under New Rules

Buy now, pay later (BNPL) services have exploded in popularity, offering consumers a convenient way to finance purchases. But this rapid growth has also raised concerns about consumer debt and financial protection. Responding to these concerns, new regulations are rolling out across various jurisdictions, significantly enhancing consumer safeguards within the BNPL landscape. These changes aim to provide greater transparency and prevent borrowers from falling into unsustainable debt cycles.

What are the new rules changing?

The specific regulations vary by region, but several key themes emerge. Many jurisdictions are implementing measures aimed at:

-

Increased Transparency: Consumers will receive clearer information about the total cost of their purchases, including interest charges (if any) and late payment fees. This improved transparency is crucial for informed decision-making. Expect to see more readily available information on APR (Annual Percentage Rate) and repayment schedules.

-

Credit Checks and Affordability Assessments: Some jurisdictions are mandating stricter credit checks or affordability assessments before BNPL agreements are approved. This aims to prevent consumers from taking on more debt than they can manage. Lenders will be required to verify a consumer's ability to repay before approving the loan.

-

Improved Debt Collection Practices: New rules often place limits on aggressive debt collection tactics and require lenders to provide clear communication with struggling borrowers. This includes more flexible repayment options and clear pathways for resolving disputes.

-

Stronger Regulatory Oversight: Financial regulators are increasing their oversight of the BNPL industry, ensuring compliance with the new rules and protecting consumers from predatory lending practices. This involves regular audits and the ability to impose penalties on companies that violate regulations.

Who benefits from these changes?

The primary beneficiaries of these enhanced consumer protections are, of course, the consumers themselves. These regulations are designed to:

-

Prevent Over-Indebtedness: By promoting transparency and affordability checks, the new rules aim to prevent consumers from accumulating unsustainable levels of debt through BNPL services.

-

Promote Responsible Borrowing: Clearer information empowers consumers to make informed decisions about their finances and encourages responsible borrowing habits.

-

Improve Financial Well-being: By safeguarding against predatory lending and facilitating fairer debt collection practices, these regulations contribute to improved overall financial well-being.

What should consumers do?

Even with these enhanced protections, it's crucial for consumers to remain vigilant. Remember to:

-

Compare different BNPL options: Don't settle for the first offer you see. Shop around and compare fees, interest rates, and repayment terms.

-

Understand the terms and conditions: Carefully read the fine print before agreeing to a BNPL agreement. Pay close attention to late payment fees and interest charges.

-

Budget responsibly: Only use BNPL for purchases you can comfortably afford to repay within the agreed-upon timeframe.

-

Seek help if you're struggling: If you're having trouble making repayments, contact your lender immediately to discuss possible solutions. Many organizations offer free debt counseling services.

The Future of BNPL:

The introduction of these strengthened regulations marks a significant step towards ensuring the responsible growth of the BNPL industry. While BNPL offers undeniable convenience, these new rules emphasize the importance of consumer protection and responsible lending practices. The future of BNPL hinges on a balance between innovation and consumer safety, a balance these new regulations strive to achieve. We can expect further refinements and adjustments to these regulations as the industry continues to evolve and consumer needs adapt. Stay informed about the latest updates in your region to ensure you understand your rights and responsibilities as a BNPL user.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Enhanced Consumer Protections Under New Rules. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis Lindsay Lohan Always Kept It Real With Me

May 20, 2025

Jamie Lee Curtis Lindsay Lohan Always Kept It Real With Me

May 20, 2025 -

Former Olympic Swimmer Speaks Out Against Coachs Abusive Methods

May 20, 2025

Former Olympic Swimmer Speaks Out Against Coachs Abusive Methods

May 20, 2025 -

Australian Interest Rates Fall To 3 85 Lowest Since May 2023

May 20, 2025

Australian Interest Rates Fall To 3 85 Lowest Since May 2023

May 20, 2025 -

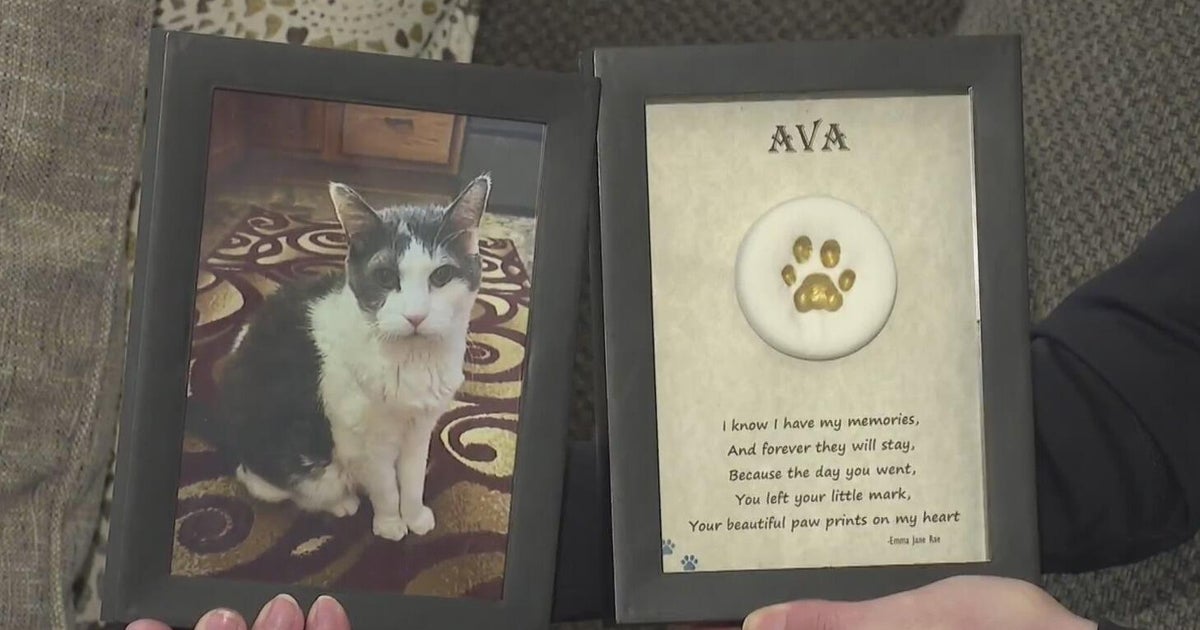

Lost Pets Honored Memorial Service After Funeral Home Cremains Scandal

May 20, 2025

Lost Pets Honored Memorial Service After Funeral Home Cremains Scandal

May 20, 2025 -

5 Billion Invested The Rise Of Bitcoin Etfs And Directional Betting

May 20, 2025

5 Billion Invested The Rise Of Bitcoin Etfs And Directional Betting

May 20, 2025

Latest Posts

-

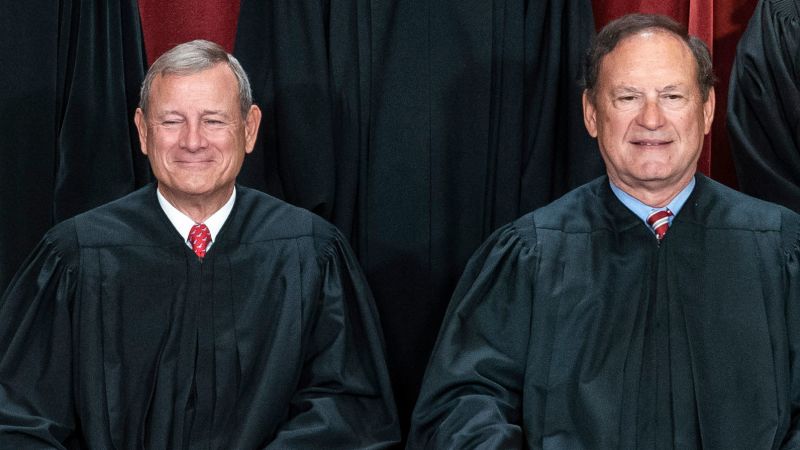

Supreme Court Justices Alito And Roberts Reflecting On Their Tenure

May 20, 2025

Supreme Court Justices Alito And Roberts Reflecting On Their Tenure

May 20, 2025 -

Strip The Duck Fan Fury Over Jon Jones Latest Tom Aspinall Remarks

May 20, 2025

Strip The Duck Fan Fury Over Jon Jones Latest Tom Aspinall Remarks

May 20, 2025 -

Addressing Tourist Misconduct Bali Introduces New Behavioral Guidelines

May 20, 2025

Addressing Tourist Misconduct Bali Introduces New Behavioral Guidelines

May 20, 2025 -

Two Influencers Two Murders Colombian Model And Mexican Influencer Deaths Fuel Femicide Outrage

May 20, 2025

Two Influencers Two Murders Colombian Model And Mexican Influencer Deaths Fuel Femicide Outrage

May 20, 2025 -

Investigating A Prehistoric Puzzle The Pachyrhinosaurus Die Off In Canada

May 20, 2025

Investigating A Prehistoric Puzzle The Pachyrhinosaurus Die Off In Canada

May 20, 2025