Buy Now, Pay Later: Increased Regulation Aims To Protect Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Increased Regulation Aims to Protect Consumers

The explosive growth of Buy Now, Pay Later (BNPL) services has led to a surge in consumer debt and calls for tighter regulation. From offering seemingly effortless online purchases to embedding themselves into everyday spending, BNPL schemes have become ubiquitous. But with this convenience comes a growing concern: are consumers adequately protected? Recent regulatory crackdowns suggest a shift towards safeguarding users from the potential pitfalls of this increasingly popular payment method.

Buy Now, Pay Later, or BNPL, allows consumers to purchase goods and services and pay for them in installments, usually over a short period, interest-free. This seemingly attractive offer has fuelled its popularity, particularly among younger demographics and those with limited access to traditional credit. However, the lack of stringent regulation initially meant that many consumers found themselves trapped in a cycle of debt, unaware of the potential consequences of missed payments or accumulating fees.

The Rising Tide of Consumer Debt

The rapid expansion of BNPL has been accompanied by a significant increase in consumer debt. Many users, enticed by the ease of access, overspend, leading to financial hardship. A recent report by [insert reputable financial source here, e.g., the Consumer Financial Protection Bureau] highlighted a sharp rise in complaints related to BNPL services, including difficulties in managing multiple accounts, unexpected fees, and damaging impacts on credit scores. This underscored the urgent need for regulatory intervention.

Increased Scrutiny and Regulatory Changes

Recognizing the potential risks, governments worldwide are implementing stricter regulations on BNPL providers. These changes aim to:

- Enhance consumer protection: Regulations are focusing on improving transparency regarding fees, interest charges, and repayment terms. Clearer disclosures are mandatory, preventing hidden costs and surprises for users.

- Improve credit reporting: Many jurisdictions are working towards integrating BNPL payments into credit reports, offering a more comprehensive view of a consumer's financial standing and potentially mitigating irresponsible borrowing.

- Strengthen debt collection practices: Rules are being put in place to regulate debt collection practices, protecting consumers from aggressive tactics and ensuring fair treatment.

- Limit irresponsible lending: Regulations are targeting lenders to ensure they are assessing the affordability of BNPL loans for consumers, preventing over-indebtedness.

These measures vary across different countries. For example, [mention specific regulatory changes in a major market, e.g., the UK's Financial Conduct Authority's new rules]. However, the overarching goal remains consistent: to strike a balance between fostering innovation in the financial technology sector and protecting vulnerable consumers.

The Future of Buy Now, Pay Later

The future of BNPL hinges on responsible lending practices and robust regulatory frameworks. While the convenience and accessibility of BNPL remain appealing, consumers need to be aware of the potential risks and utilize these services responsibly. Providers, too, must adapt to comply with the evolving regulatory landscape and prioritize responsible lending.

Tips for Consumers Using BNPL:

- Budget carefully: Only use BNPL for purchases you can comfortably afford to repay.

- Read the terms and conditions: Understand the fees, interest rates, and repayment schedule before committing.

- Manage multiple accounts responsibly: Avoid spreading yourself too thin across numerous BNPL services.

- Pay on time: Missed payments can lead to significant fees and negatively impact your credit score.

The increased regulation surrounding BNPL is a positive step towards protecting consumers. However, ongoing vigilance and informed consumer behavior are crucial in mitigating the risks associated with this popular payment method. The long-term success of BNPL will depend on its responsible implementation and adherence to strong consumer protection measures. This evolution ensures a more sustainable and equitable financial landscape for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Increased Regulation Aims To Protect Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

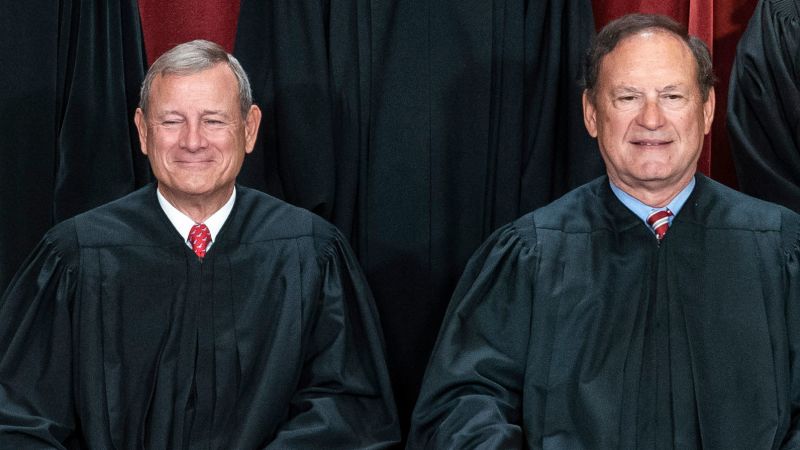

Supreme Court Justices Alito And Roberts A Look Back At Their Tenures

May 21, 2025

Supreme Court Justices Alito And Roberts A Look Back At Their Tenures

May 21, 2025 -

Urgent Search Child Missing After Train Kills Two Adults Injures Others

May 21, 2025

Urgent Search Child Missing After Train Kills Two Adults Injures Others

May 21, 2025 -

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025 -

The Last Of Us Proves Less Action More Feeling

May 21, 2025

The Last Of Us Proves Less Action More Feeling

May 21, 2025 -

Institutional Money Drives 5 B Bitcoin Etf Rush

May 21, 2025

Institutional Money Drives 5 B Bitcoin Etf Rush

May 21, 2025

Latest Posts

-

Tom Aspinall Responds Fan Fury Over Jon Jones Strip The Duck Comment On Potential Fight

May 21, 2025

Tom Aspinall Responds Fan Fury Over Jon Jones Strip The Duck Comment On Potential Fight

May 21, 2025 -

Is Your Child Ready To Give Up Their Pacifier Or Thumb Expert Advice

May 21, 2025

Is Your Child Ready To Give Up Their Pacifier Or Thumb Expert Advice

May 21, 2025 -

Death Of The Dinosaurs New Discoveries At A Canadian Pachyrhinosaurus Site

May 21, 2025

Death Of The Dinosaurs New Discoveries At A Canadian Pachyrhinosaurus Site

May 21, 2025 -

Former Olympic Swimmer Exposes The Dark Side Of High Performance Coaching

May 21, 2025

Former Olympic Swimmer Exposes The Dark Side Of High Performance Coaching

May 21, 2025 -

Putins Public Dismissal Of Trump A New Era In Us Russia Relations

May 21, 2025

Putins Public Dismissal Of Trump A New Era In Us Russia Relations

May 21, 2025