Buy Now, Pay Later: New Rules Aim To Curb Irresponsible Lending

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: New Rules Aim to Curb Irresponsible Lending

Buy Now, Pay Later (BNPL) services exploded in popularity, offering a seemingly effortless way to purchase goods and services. But the ease of access has also raised serious concerns about irresponsible lending and consumer debt. Now, regulators are stepping in with new rules aimed at curbing the potential for financial harm. This article explores the evolving landscape of BNPL and the significant changes on the horizon.

The Rise and Fall (Sort Of) of BNPL's Unfettered Growth

BNPL services, offered by companies like Klarna, Affirm, and Afterpay (now a part of Square), quickly gained traction by offering consumers the ability to split purchases into interest-free installments. This attractive proposition, especially for younger generations, fueled rapid growth. However, this rapid growth wasn't without its drawbacks. Many consumers found themselves overextending their finances, struggling to manage multiple BNPL repayments, and accumulating significant debt. The lack of stringent regulation initially allowed for practices that critics argued were predatory, leading to a surge in consumer complaints.

New Regulations: A Much-Needed Overhaul?

Recognizing the potential for widespread financial harm, regulators in various countries are implementing stricter rules for BNPL providers. These new regulations often include:

- Increased Credit Checks: More thorough credit checks will help assess a consumer's ability to repay before approving loans, reducing the risk of defaults.

- Affordability Assessments: BNPL providers will be required to conduct more robust affordability assessments, ensuring consumers can comfortably manage repayments without jeopardizing their financial stability.

- Clearer Disclosure of Fees and Terms: Greater transparency regarding fees, interest rates (even if initially 0%), and repayment terms will empower consumers to make informed decisions.

- Debt Collection Practices: Stricter regulations on debt collection methods aim to prevent aggressive and harassing tactics employed by some providers.

- Limits on Credit Limits: Some jurisdictions are considering imposing limits on the total amount a consumer can borrow through BNPL services.

Impact on Consumers and the BNPL Industry

These changes will significantly impact both consumers and the BNPL industry. Consumers can expect a more responsible and transparent lending environment, with reduced risks of falling into debt traps. For BNPL providers, the stricter regulations mean adapting their business models to comply with the new rules. This could involve increased operational costs and potentially reduced profitability, forcing them to reassess their lending practices. Companies may need to invest in more sophisticated credit scoring and risk assessment technologies.

The Future of Buy Now, Pay Later

The future of BNPL hinges on responsible lending practices and regulatory oversight. While the new rules aim to curb irresponsible lending, they also need to strike a balance to ensure the continued availability of BNPL as a legitimate and helpful financial tool for consumers who manage it responsibly. The industry is likely to see consolidation, with only the most financially sound and compliant companies surviving.

What Consumers Can Do

Consumers should:

- Budget carefully: Before using BNPL, ensure you can afford the repayments without impacting your other financial obligations.

- Compare providers: Shop around for the best rates and terms before committing to a purchase.

- Use BNPL sparingly: Avoid using multiple BNPL services simultaneously to prevent overextension.

- Pay on time: Late payments can significantly increase the cost of borrowing.

The changes to the BNPL landscape are significant. The new regulations represent a crucial step towards protecting consumers from the potential pitfalls of this increasingly popular payment method. By promoting responsible lending and greater transparency, these regulations aim to ensure the long-term viability and sustainability of the BNPL industry while safeguarding consumer financial well-being. Stay informed about updates in your region to ensure you understand your rights and responsibilities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: New Rules Aim To Curb Irresponsible Lending. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rare St Louis Tornado Leaves Path Of Destruction The Cleanup Begins

May 21, 2025

Rare St Louis Tornado Leaves Path Of Destruction The Cleanup Begins

May 21, 2025 -

Glitter And Conservation A Novel Approach To Saving Wales Water Voles

May 21, 2025

Glitter And Conservation A Novel Approach To Saving Wales Water Voles

May 21, 2025 -

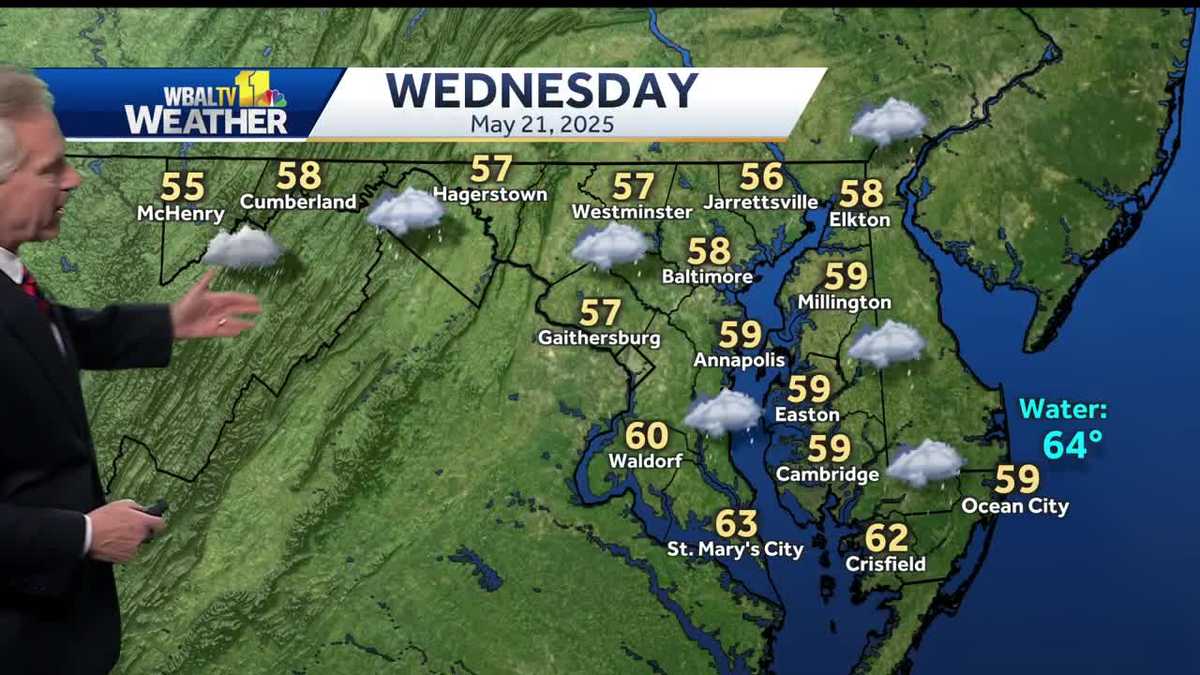

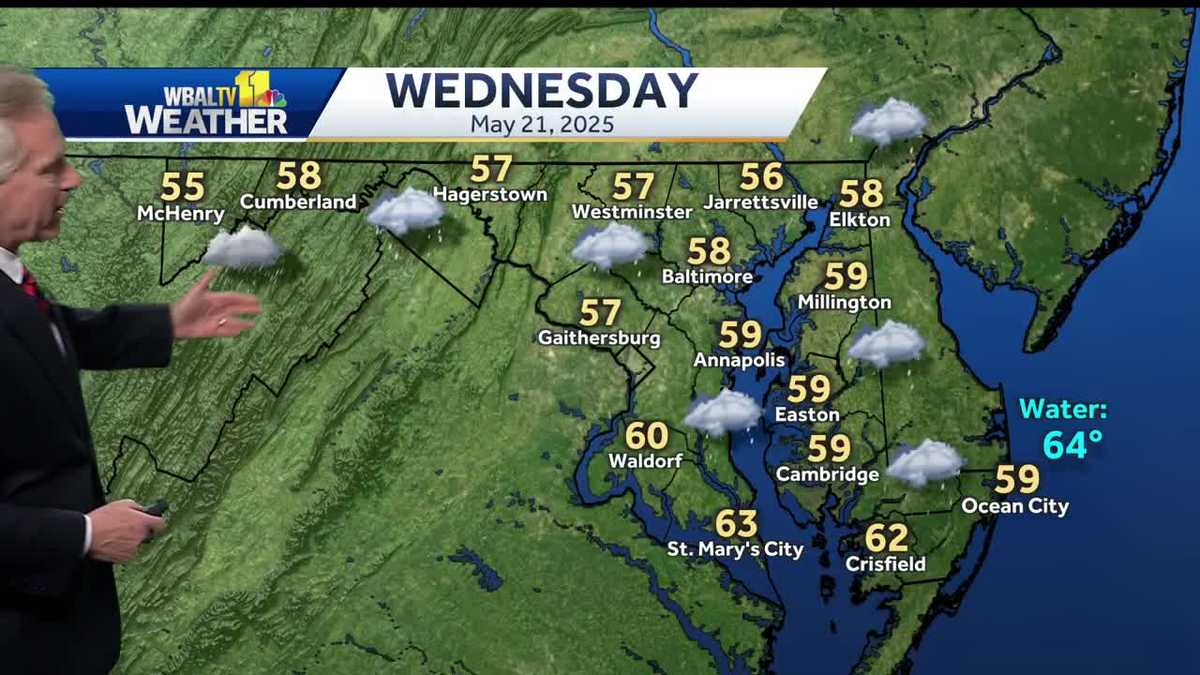

Widespread Rain And Cold Expected Across The Region Wednesday

May 21, 2025

Widespread Rain And Cold Expected Across The Region Wednesday

May 21, 2025 -

A J Perez And The Brett Favre Saga Threats Espns Untold And The Aftermath

May 21, 2025

A J Perez And The Brett Favre Saga Threats Espns Untold And The Aftermath

May 21, 2025 -

Wednesday Weather Region Braces For Rain And Cold

May 21, 2025

Wednesday Weather Region Braces For Rain And Cold

May 21, 2025

Latest Posts

-

Post Office Data Breach Compensation What You Need To Know

May 21, 2025

Post Office Data Breach Compensation What You Need To Know

May 21, 2025 -

Hostage Released Parents Detail Joyful Reunion After Years Of Separation

May 21, 2025

Hostage Released Parents Detail Joyful Reunion After Years Of Separation

May 21, 2025 -

Narco Kitten Cats Prison Smuggling Attempt Foiled In Costa Rica

May 21, 2025

Narco Kitten Cats Prison Smuggling Attempt Foiled In Costa Rica

May 21, 2025 -

Second Man Faces Charges Over Arson Incidents Near Prime Ministers House

May 21, 2025

Second Man Faces Charges Over Arson Incidents Near Prime Ministers House

May 21, 2025 -

Trumps Funding Cuts Lead Sesame Street To Seek New Platform Netflix

May 21, 2025

Trumps Funding Cuts Lead Sesame Street To Seek New Platform Netflix

May 21, 2025