Buy Now Pay Later Reforms: A Guide To The New Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now Pay Later Reforms: A Guide to the New Regulations

Buy Now Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth has also raised concerns about debt accumulation and consumer protection. This has led to significant reforms and new regulations aimed at safeguarding consumers and promoting responsible lending practices. This article provides a comprehensive guide to understanding these crucial changes.

What are Buy Now Pay Later Services?

BNPL services allow consumers to spread the cost of purchases over several interest-free installments. Unlike traditional credit cards, they often involve a soft credit check, making them appealing to those with limited or damaged credit histories. Popular BNPL providers include Afterpay, Klarna, Affirm, and PayPal's Pay in 4. However, this ease of access has also contributed to concerns regarding overspending and potential debt traps.

The Rise of Regulation: Addressing Consumer Concerns

The lack of stringent regulation in the early days of BNPL led to several issues:

- High default rates: The ease of access sometimes led to consumers taking on more debt than they could manage.

- Lack of transparency: Fees and charges weren't always clearly explained, leading to unexpected costs for consumers.

- Impact on credit scores: While some BNPL providers don't report to credit bureaus, others do, and missed payments can negatively impact credit scores.

- Aggressive marketing: Concerns were raised about the aggressive marketing tactics employed by some BNPL providers, targeting vulnerable consumers.

These issues prompted regulators worldwide to intervene, implementing significant reforms designed to address these concerns.

Key Aspects of the New BNPL Regulations:

The specific regulations vary by country and region, but several common themes emerge:

- Enhanced consumer protection: New rules mandate clearer disclosure of fees, repayment terms, and potential consequences of missed payments. Consumers are better informed about the total cost of their purchases.

- Credit reporting requirements: Many jurisdictions now require BNPL providers to report consumer payment history to credit bureaus, promoting responsible borrowing and providing a more accurate reflection of creditworthiness.

- Affordability assessments: Lenders are increasingly required to perform affordability checks before approving BNPL applications, ensuring consumers can realistically manage their repayments. This helps prevent consumers from taking on debt they can't afford.

- Debt management tools: Some regulations encourage BNPL providers to offer resources and tools to help consumers manage their debt and avoid default.

- Stricter licensing and oversight: BNPL providers are now subject to greater scrutiny and licensing requirements, ensuring they operate within a regulated framework.

What This Means for Consumers:

The new regulations offer several benefits for consumers:

- Greater transparency: You'll have a clearer understanding of the costs and terms before committing to a BNPL purchase.

- Improved protection against debt: Affordability checks and stricter lending practices help prevent overspending and financial hardship.

- More accurate credit scoring: Accurate reporting to credit bureaus provides a more comprehensive picture of your creditworthiness.

Staying Informed:

Keeping abreast of the latest regulations in your region is crucial. Check your country's financial regulator website for detailed information on the specific rules governing BNPL services. Understanding these changes empowers you to use BNPL responsibly and avoid potential pitfalls.

Conclusion:

The reforms surrounding BNPL services represent a significant step towards greater consumer protection and responsible lending practices. By understanding these changes and utilizing BNPL services cautiously, consumers can leverage the convenience of these payment options while mitigating potential risks. Remember, always borrow responsibly and within your means.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now Pay Later Reforms: A Guide To The New Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tragic Railroad Accident Family Struck By Train Leaving Children Injured

May 21, 2025

Tragic Railroad Accident Family Struck By Train Leaving Children Injured

May 21, 2025 -

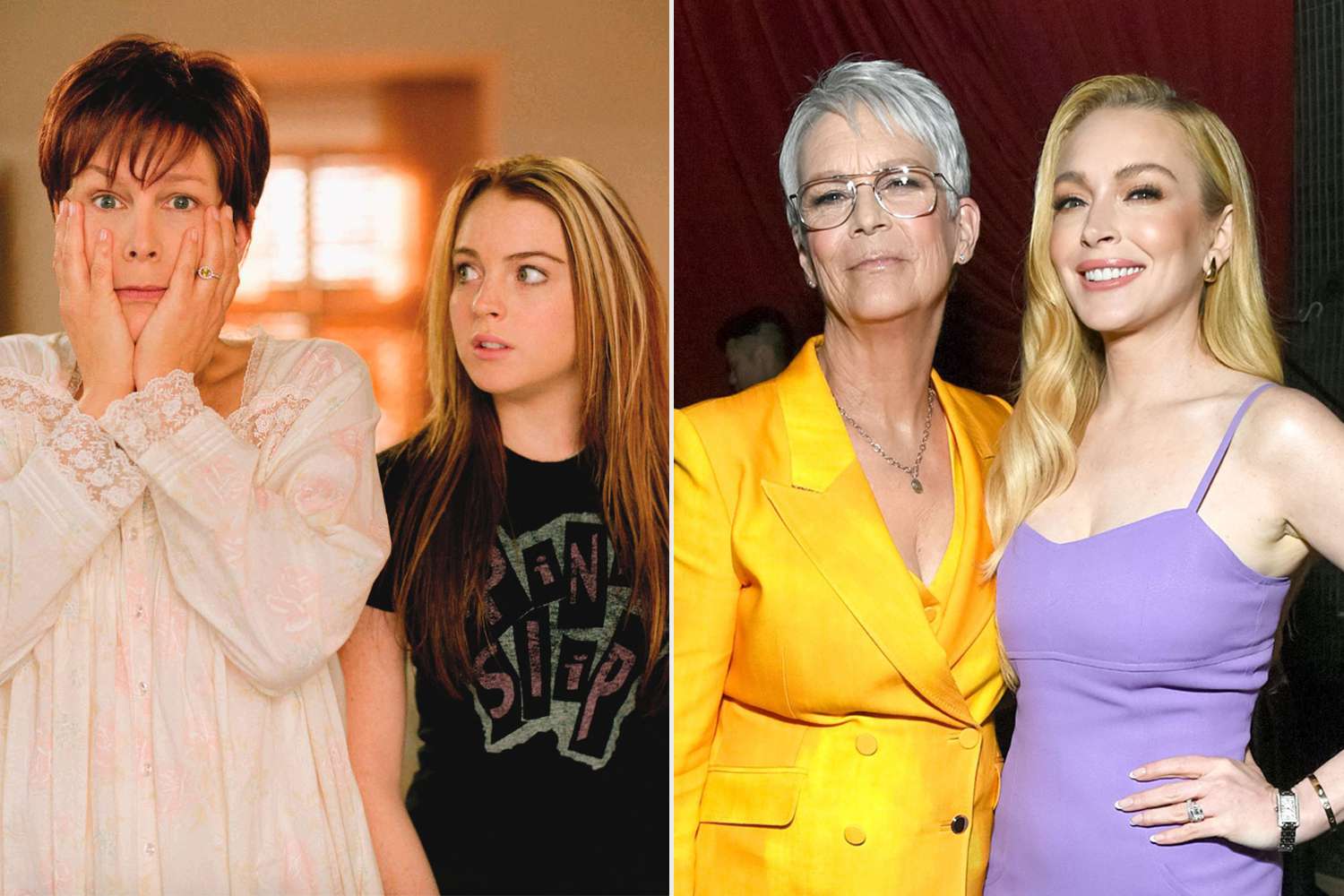

Jamie Lee Curtis Talks Lindsay Lohan An Exclusive Update On Their Post Freaky Friday Friendship

May 21, 2025

Jamie Lee Curtis Talks Lindsay Lohan An Exclusive Update On Their Post Freaky Friday Friendship

May 21, 2025 -

Tom Aspinall Negotiations Stall Jon Jones I M Done Tweet Sparks Retirement Rumors

May 21, 2025

Tom Aspinall Negotiations Stall Jon Jones I M Done Tweet Sparks Retirement Rumors

May 21, 2025 -

Police Investigate Church Break In Two Boys Suspected Of Defecating On Bathroom Floor

May 21, 2025

Police Investigate Church Break In Two Boys Suspected Of Defecating On Bathroom Floor

May 21, 2025 -

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Co Pilots Medical Emergency

May 21, 2025

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Co Pilots Medical Emergency

May 21, 2025

Latest Posts

-

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025 -

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025 -

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025 -

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025 -

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025