Buy Now, Pay Later Reforms: Protecting Consumers From Unfair Practices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later Reforms: Protecting Consumers from Unfair Practices

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to finance purchases. But this convenience comes with potential pitfalls, leading to calls for widespread reforms to protect consumers from unfair practices. Recent reports highlight growing concerns about debt traps, hidden fees, and a lack of transparency surrounding these services. This article delves into the key issues and explores the reforms currently underway to safeguard consumers.

The Rise of BNPL and its Associated Risks

BNPL services, offered by companies like Klarna, Afterpay, and Affirm, allow shoppers to split purchases into interest-free installments. This seemingly attractive proposition has fueled their rapid growth, particularly among younger demographics. However, the ease of access can mask significant financial risks. Many consumers underestimate the cumulative impact of multiple BNPL loans, potentially leading to overwhelming debt.

Key Concerns Driving Reform Efforts:

- Debt Accumulation: The ease of obtaining BNPL loans can encourage overspending and lead to accumulating debt across multiple providers, creating a difficult-to-manage financial situation. This is particularly problematic for individuals with limited financial literacy.

- Hidden Fees and Charges: While advertised as "interest-free," many BNPL services levy late payment fees, which can quickly escalate the total cost of a purchase. These fees are often not clearly disclosed at the point of sale.

- Impact on Credit Scores: While some BNPL providers report payment history to credit bureaus, others don't. This lack of standardization can negatively impact consumers' credit scores, hindering their ability to access other forms of credit in the future.

- Aggressive Marketing Tactics: Critics argue that the aggressive marketing strategies employed by BNPL companies often target vulnerable consumers, downplaying the risks and emphasizing the convenience.

- Lack of Transparency: The lack of clear and upfront information about fees, repayment schedules, and the impact on credit scores contributes to consumer confusion and potential financial hardship.

Proposed Reforms and Regulatory Actions:

Governments worldwide are responding to these concerns with proposed reforms aimed at increasing consumer protection. These include:

- Increased Transparency: Regulations are being introduced to mandate clearer disclosure of fees, repayment terms, and the potential impact on credit scores.

- Stricter Credit Checks: Some jurisdictions are considering requiring more robust credit checks before approving BNPL loans to prevent irresponsible lending.

- Debt Collection Practices: Regulations are being implemented to curb aggressive debt collection tactics employed by some BNPL providers.

- Improved Consumer Education: Initiatives are underway to educate consumers about the risks and responsible use of BNPL services.

The Path Forward: Striking a Balance Between Innovation and Consumer Protection:

The future of BNPL hinges on finding a balance between fostering innovation and ensuring responsible lending practices. While these services can offer legitimate financial benefits to consumers, robust regulation is crucial to prevent widespread financial harm. The proposed reforms represent a significant step towards achieving this balance, protecting consumers from unfair practices and promoting responsible use of BNPL services. Further monitoring and adjustments will be necessary to ensure the effectiveness of these reforms in the long term.

Call to Action: Learn more about the BNPL regulations in your area and practice responsible borrowing habits. [Link to a relevant government website or consumer protection agency].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later Reforms: Protecting Consumers From Unfair Practices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 21, 2025

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 21, 2025 -

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025 -

Femicide Understanding The Problem And Working Towards Solutions

May 21, 2025

Femicide Understanding The Problem And Working Towards Solutions

May 21, 2025 -

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Climb Higher

May 21, 2025

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Climb Higher

May 21, 2025 -

Autonomous Vehicles In The Uk Ubers Readiness And The 2027 Challenge

May 21, 2025

Autonomous Vehicles In The Uk Ubers Readiness And The 2027 Challenge

May 21, 2025

Latest Posts

-

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025 -

Political Fallout Sesame Street Shifts To Netflix After Funding Dispute

May 21, 2025

Political Fallout Sesame Street Shifts To Netflix After Funding Dispute

May 21, 2025 -

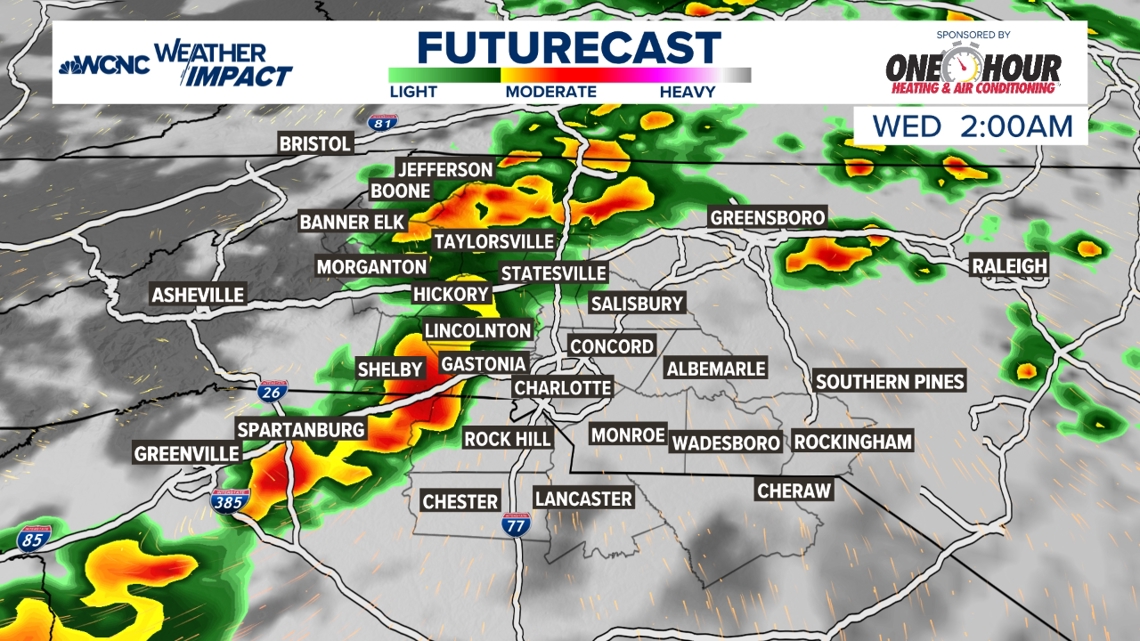

Limited Chance Of Severe Weather Tuesday Night Forecast Update

May 21, 2025

Limited Chance Of Severe Weather Tuesday Night Forecast Update

May 21, 2025 -

Post Office Data Breach Details Of Compensation Payments

May 21, 2025

Post Office Data Breach Details Of Compensation Payments

May 21, 2025 -

Sesame Street Finds New Home On Netflix After Trump Funding Loss

May 21, 2025

Sesame Street Finds New Home On Netflix After Trump Funding Loss

May 21, 2025