Buy Now, Pay Later: Stricter Credit Checks Impact Consumer Spending

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Stricter Credit Checks Impact Consumer Spending

The once-booming Buy Now, Pay Later (BNPL) industry is facing a significant shift as stricter credit checks become the norm. This change is already impacting consumer spending and could reshape the future of retail finance.

The rapid growth of BNPL services in recent years has been undeniable. Offering consumers the enticing prospect of instant gratification without immediate payment, platforms like Klarna, Afterpay (now part of Square), and Affirm became embedded in online shopping experiences. However, concerns over rising debt levels and irresponsible lending practices have prompted regulators worldwide to intervene, leading to a tightening of lending criteria.

This crackdown means that obtaining BNPL financing is no longer as straightforward as it once was. Many providers are now conducting more thorough credit checks, similar to those used for traditional credit cards. This shift is having a direct impact on consumer spending, with some shoppers finding their applications rejected or offered lower credit limits.

H2: The Impact on Consumers

The stricter credit checks are impacting consumers in several key ways:

- Reduced Spending Power: Consumers previously relying on BNPL for larger purchases are now finding themselves with less accessible credit, limiting their spending capacity. This is particularly noticeable for younger generations who have built less robust credit histories.

- Shift in Shopping Habits: Many consumers are adjusting their shopping habits, opting for cheaper alternatives or delaying purchases altogether. This shift is impacting various sectors, from fashion and electronics to home goods and travel.

- Increased Reliance on Traditional Credit: With BNPL becoming less accessible, some consumers are turning to traditional credit cards, potentially increasing their overall debt burden if not managed carefully. This highlights the importance of financial literacy and responsible credit management.

H2: The Future of BNPL

The future of the BNPL industry hinges on its ability to adapt to the new regulatory landscape. While the stricter credit checks aim to protect consumers from excessive debt, they also risk stifling innovation and growth within the sector. We're likely to see:

- Increased focus on responsible lending: BNPL providers will need to prioritize responsible lending practices, demonstrating a commitment to consumer welfare and financial stability. This may involve more robust affordability assessments and improved customer education initiatives.

- More sophisticated risk assessment tools: Companies are investing in advanced technologies and data analytics to refine their risk assessment models, ensuring responsible lending while minimizing the impact on creditworthy consumers.

- A shift towards a more diverse customer base: Providers may increasingly target consumers with established credit histories, reducing reliance on those with limited or no credit history.

H3: What Consumers Can Do

Consumers can mitigate the impact of stricter BNPL credit checks by:

- Building a strong credit history: Paying bills on time and managing existing credit responsibly are crucial for improving credit scores and increasing the likelihood of BNPL approval.

- Exploring alternative payment options: Consider using traditional credit cards responsibly or exploring other financing options like personal loans.

- Budgeting carefully: Before making any purchase, carefully consider your budget and ensure you can afford the repayments without jeopardizing your financial stability.

The tightening of credit checks within the BNPL sector represents a significant shift in the financial landscape. While aimed at promoting responsible lending and protecting consumers, it's crucial to understand the implications for both businesses and consumers. The coming months will be pivotal in determining the long-term trajectory of this rapidly evolving industry. Learn more about responsible credit management by visiting [link to a reputable financial literacy website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Stricter Credit Checks Impact Consumer Spending. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Busiest Uk Airports Hike Kiss And Fly Parking Fees Rac Analysis

Jul 19, 2025

Busiest Uk Airports Hike Kiss And Fly Parking Fees Rac Analysis

Jul 19, 2025 -

The Future Of Programming Gabe Newells Insight On Ais Disruptive Power

Jul 19, 2025

The Future Of Programming Gabe Newells Insight On Ais Disruptive Power

Jul 19, 2025 -

European Free Riding On Us Defense Merzs Controversial Claim

Jul 19, 2025

European Free Riding On Us Defense Merzs Controversial Claim

Jul 19, 2025 -

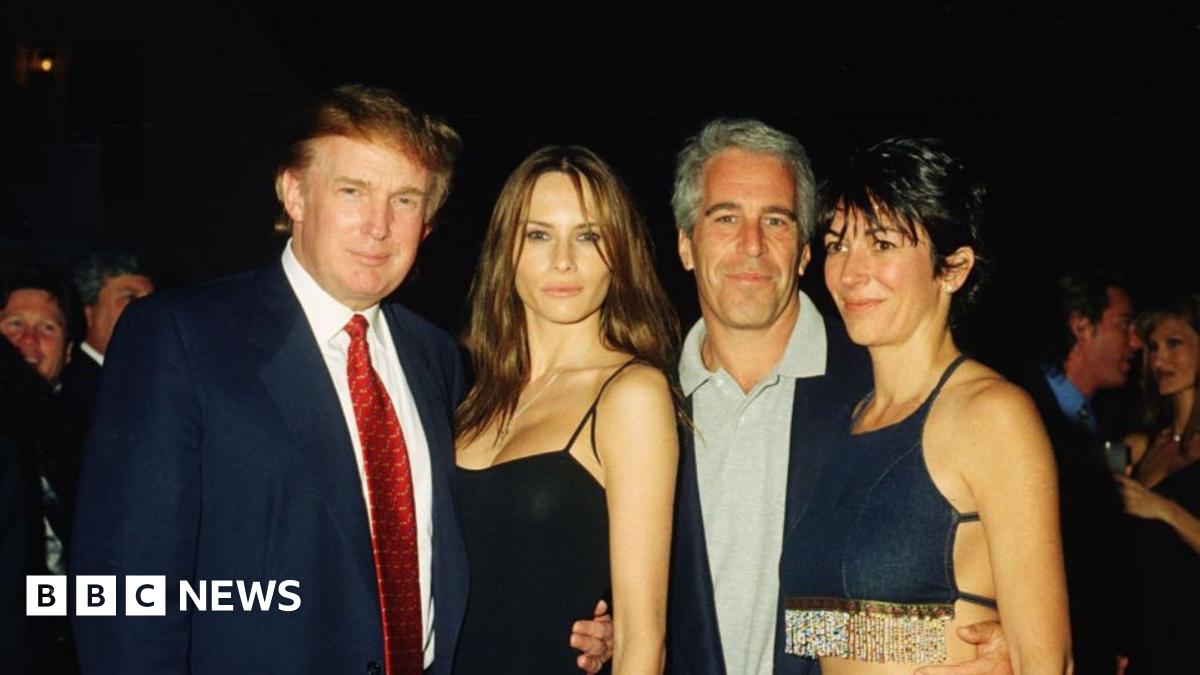

Public Outcry Leads To Trumps Release Of Further Epstein Information

Jul 19, 2025

Public Outcry Leads To Trumps Release Of Further Epstein Information

Jul 19, 2025 -

Camillas 78th Birthday A New Official Photograph Unveiled

Jul 19, 2025

Camillas 78th Birthday A New Official Photograph Unveiled

Jul 19, 2025

Latest Posts

-

Epsteins Shadow The Enduring Impact On The Maga Movement

Jul 20, 2025

Epsteins Shadow The Enduring Impact On The Maga Movement

Jul 20, 2025 -

Astronomers Unexpected Coldplay Concert Moment Captures Attention

Jul 20, 2025

Astronomers Unexpected Coldplay Concert Moment Captures Attention

Jul 20, 2025 -

The Edge Of Fate Raid Launch Date Time And Destiny 2 Strategies

Jul 20, 2025

The Edge Of Fate Raid Launch Date Time And Destiny 2 Strategies

Jul 20, 2025 -

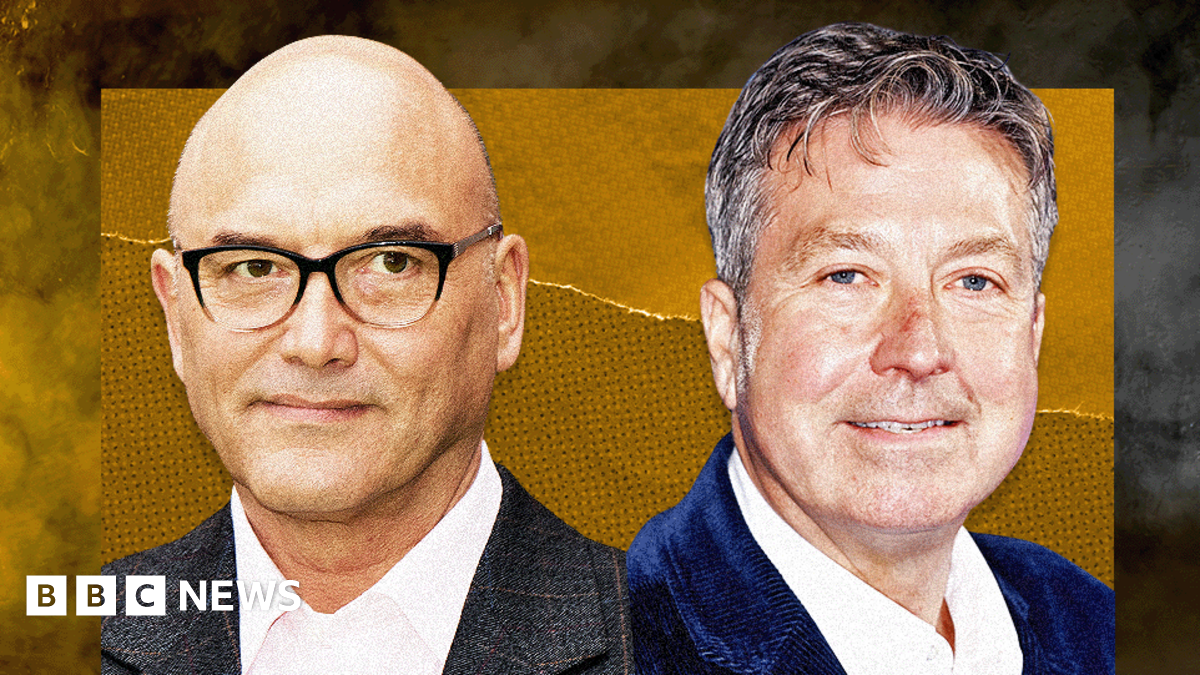

Master Chefs Future Uncertain After Wallace And Torodes Sacking

Jul 20, 2025

Master Chefs Future Uncertain After Wallace And Torodes Sacking

Jul 20, 2025 -

Barroso Filha Reside No Brasil Noticias De Deportacao Sao Falsas

Jul 20, 2025

Barroso Filha Reside No Brasil Noticias De Deportacao Sao Falsas

Jul 20, 2025