Buy Now, Pay Later: The New Rules Designed To Safeguard Shoppers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: The New Rules Designed to Safeguard Shoppers

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. But this rapid growth has also raised concerns about consumer debt and financial vulnerability. Recognizing these risks, regulators worldwide are stepping in with new rules designed to protect shoppers from the potential pitfalls of BNPL. This article delves into the emerging regulations and what they mean for consumers.

The Rise and Fall (and Rise Again) of BNPL

BNPL's appeal is undeniable: instant gratification without the immediate financial burden. This model, offered by companies like Klarna, Afterpay (now part of Square), and Affirm, allows consumers to split purchases into interest-free installments. However, the lack of upfront cost can easily mask the total expense, leading to overspending and potential debt traps. This has prompted governments to intervene, aiming to bring more transparency and consumer protection to the sector.

New Rules: A Global Shift Towards Consumer Protection

Several countries are implementing or considering significant changes to how BNPL operates. These regulations generally focus on several key areas:

- Increased Transparency: Regulations are mandating clearer disclosure of fees, repayment schedules, and the total cost of the purchase. Consumers need to understand exactly what they're agreeing to before committing.

- Credit Checks and Affordability Assessments: Some jurisdictions are introducing requirements for BNPL providers to conduct credit checks or assess a customer's ability to repay before approving a loan. This helps prevent consumers from taking on debt they can't handle.

- Debt Collection Practices: Stricter regulations are being put in place to govern how BNPL providers collect overdue payments, protecting consumers from aggressive or unfair debt collection tactics. This includes limitations on the use of aggressive communication methods.

- Data Protection and Privacy: The handling of consumer data by BNPL companies is also coming under increased scrutiny. New regulations emphasize the importance of data security and consumer privacy rights.

What Does This Mean for Consumers?

These new rules ultimately aim to create a safer and more responsible BNPL landscape. Consumers can expect:

- Greater clarity: It will be easier to understand the true cost of using BNPL services.

- Reduced risk of over-indebtedness: Affordability checks should prevent consumers from taking on unsustainable levels of debt.

- Fairer debt collection practices: Consumers will be better protected from unfair or aggressive debt recovery methods.

The Future of BNPL:

The future of BNPL hinges on responsible innovation and effective regulation. While the convenience of BNPL remains attractive, the emphasis is shifting towards ensuring that this convenience doesn't come at the expense of consumer financial well-being. Expect to see further regulatory developments in the coming years as governments strive to strike a balance between innovation and consumer protection.

Further Reading:

For more information on BNPL regulation in your specific country, it's recommended to consult your local financial regulatory authority's website. You can also find valuable resources on financial literacy and responsible borrowing from organizations like the [insert relevant national or international financial literacy organization link here].

Call to Action: Before using a BNPL service, always carefully read the terms and conditions, understand the repayment schedule, and assess whether you can comfortably afford the purchase. Responsible borrowing is key to avoiding financial hardship.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: The New Rules Designed To Safeguard Shoppers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Medical Emergency

May 20, 2025

Lufthansa Plane Flies Without Pilot For 10 Minutes Following Medical Emergency

May 20, 2025 -

Combating Femicide Addressing The Root Causes Of Violence Against Women

May 20, 2025

Combating Femicide Addressing The Root Causes Of Violence Against Women

May 20, 2025 -

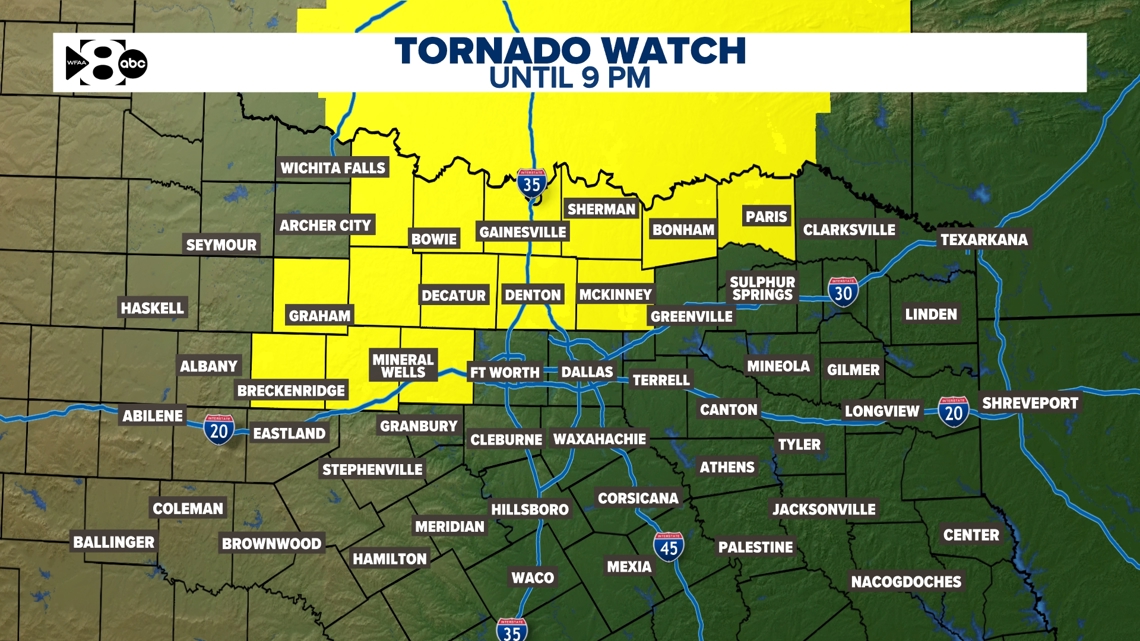

Dfw Weather Cold Front Brings Chilly Start To The Week

May 20, 2025

Dfw Weather Cold Front Brings Chilly Start To The Week

May 20, 2025 -

Jamie Lee Curtis Discusses Lasting Friendship With Lindsay Lohan Following Freaky Friday

May 20, 2025

Jamie Lee Curtis Discusses Lasting Friendship With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

Joe Biden Prostate Cancer Diagnosis Details And Updates

May 20, 2025

Joe Biden Prostate Cancer Diagnosis Details And Updates

May 20, 2025

Latest Posts

-

Jeremy Bowen On Growing International Backlash Against Israels Gaza Assault

May 21, 2025

Jeremy Bowen On Growing International Backlash Against Israels Gaza Assault

May 21, 2025 -

Ubisofts Reasoning No Animal Killing In Assassins Creed Shadows

May 21, 2025

Ubisofts Reasoning No Animal Killing In Assassins Creed Shadows

May 21, 2025 -

New Orleans Inmate Manhunt Fourth Escapee Captured Amidst Staff Evacuations

May 21, 2025

New Orleans Inmate Manhunt Fourth Escapee Captured Amidst Staff Evacuations

May 21, 2025 -

2025 League Of Legends Hall Of Famer Revealed By Riot Will The Skin Be Affordable

May 21, 2025

2025 League Of Legends Hall Of Famer Revealed By Riot Will The Skin Be Affordable

May 21, 2025 -

League Of Legends 2025 Hall Of Fame Concerns Over Potential Skin Price

May 21, 2025

League Of Legends 2025 Hall Of Fame Concerns Over Potential Skin Price

May 21, 2025