Buy Now, Pay Later: Understanding The Implications Of The New Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Understanding the Implications of the New Regulations

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. But this rapid growth has brought increased scrutiny, leading to significant new regulations designed to protect consumers and ensure responsible lending practices. Understanding these changes is crucial for both businesses and consumers alike. This article delves into the implications of these new regulations and what they mean for the future of BNPL.

The Rise and Fall (and Rise Again?) of Unregulated BNPL

The initial appeal of BNPL was undeniable. Zero-interest options, instant approvals, and the ability to spread payments over several weeks or months made it a tempting alternative to traditional credit cards, especially for younger generations. This ease of access, however, also meant a lack of stringent regulation, leading to concerns about:

- Overspending and Debt Accumulation: The simplicity of BNPL services can mask the reality of accumulating debt, potentially leading consumers into financial difficulty if they are unable to manage their repayments effectively.

- Lack of Transparency: Fees and interest charges weren't always clearly disclosed, making it difficult for consumers to fully understand the true cost of using BNPL.

- Impact on Credit Scores: While some BNPL providers now report payment history to credit bureaus, this wasn't always the case, leaving a gap in the credit reporting system.

New Regulations: A Turning Point for BNPL

Recognizing these risks, regulators worldwide are implementing stricter rules for BNPL providers. These regulations vary by country, but generally aim to:

- Increase Transparency: Clearer disclosure of fees, interest rates, and repayment terms is now mandatory in many jurisdictions. Consumers are better informed about the true cost of their purchases.

- Improve Credit Reporting: Many jurisdictions are requiring BNPL providers to report payment history to credit bureaus, allowing for a more accurate reflection of a consumer's creditworthiness.

- Implement Affordability Checks: Some regulations mandate affordability checks to ensure that consumers can realistically manage their repayments before approving a BNPL loan. This helps prevent consumers from taking on more debt than they can handle.

- Strengthen Consumer Protections: Regulations often include stronger consumer protection measures, such as clearer dispute resolution processes and limits on the number of BNPL loans a consumer can take out simultaneously.

What This Means for Businesses

For businesses that offer BNPL as a payment option, these regulations mean:

- Increased Compliance Costs: Meeting the new regulatory requirements will necessitate changes to their systems and processes, leading to increased operational costs.

- Shift in Marketing Strategies: Marketing materials must now accurately reflect the costs and terms of BNPL services, avoiding misleading or deceptive claims.

- Potential Impact on Sales: Stricter affordability checks may lead to a decrease in the number of approved BNPL transactions, potentially impacting sales.

What This Means for Consumers

For consumers, the new regulations provide:

- Greater Financial Protection: Improved transparency and affordability checks help consumers make more informed decisions and avoid excessive debt.

- Better Credit Score Management: Accurate credit reporting allows for a more complete picture of a consumer's credit history, benefiting their long-term financial health.

- Reduced Risk of Overspending: The increased scrutiny on BNPL providers should help to curb impulsive spending and prevent consumers from falling into debt traps.

The Future of BNPL

The future of Buy Now, Pay Later hinges on responsible lending practices and adherence to the new regulations. While the stricter rules may present challenges for both businesses and consumers, they ultimately aim to foster a more sustainable and ethical BNPL landscape. The increased transparency and consumer protections should lead to a more responsible use of BNPL, benefiting both consumers and the wider economy.

Call to Action: Stay informed about the specific BNPL regulations in your region to make informed financial decisions. Understanding the terms and conditions before using a BNPL service is crucial for responsible financial management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Understanding The Implications Of The New Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Netflix The Solution Sesame Street After Trumps Funding Withdrawal

May 21, 2025

Is Netflix The Solution Sesame Street After Trumps Funding Withdrawal

May 21, 2025 -

Gazas Humanitarian Catastrophe Examining The Roots Of The Crisis

May 21, 2025

Gazas Humanitarian Catastrophe Examining The Roots Of The Crisis

May 21, 2025 -

Is Jon Jones Leaving The Ufc Aspinall Stalemate And Retirement Hints Analyzed

May 21, 2025

Is Jon Jones Leaving The Ufc Aspinall Stalemate And Retirement Hints Analyzed

May 21, 2025 -

Broken Dreams An Olympic Gold Medalist Exposes The Dark Side Of Elite Sports

May 21, 2025

Broken Dreams An Olympic Gold Medalist Exposes The Dark Side Of Elite Sports

May 21, 2025 -

Criminal Records And Private Data Of Legal Aid Clients Exposed In Cyberattack

May 21, 2025

Criminal Records And Private Data Of Legal Aid Clients Exposed In Cyberattack

May 21, 2025

Latest Posts

-

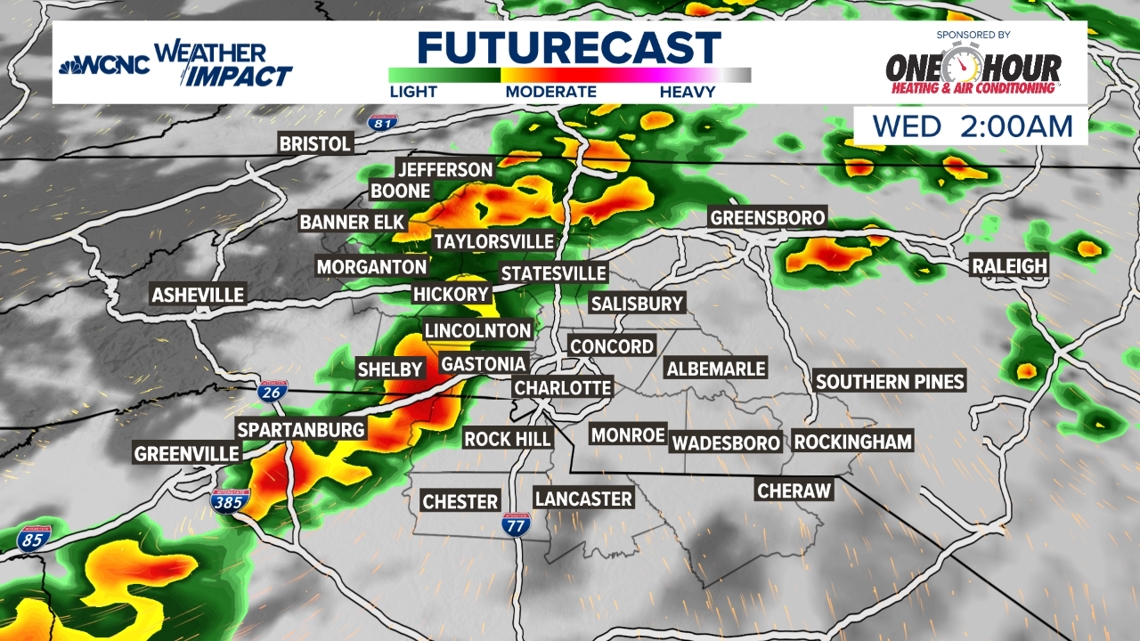

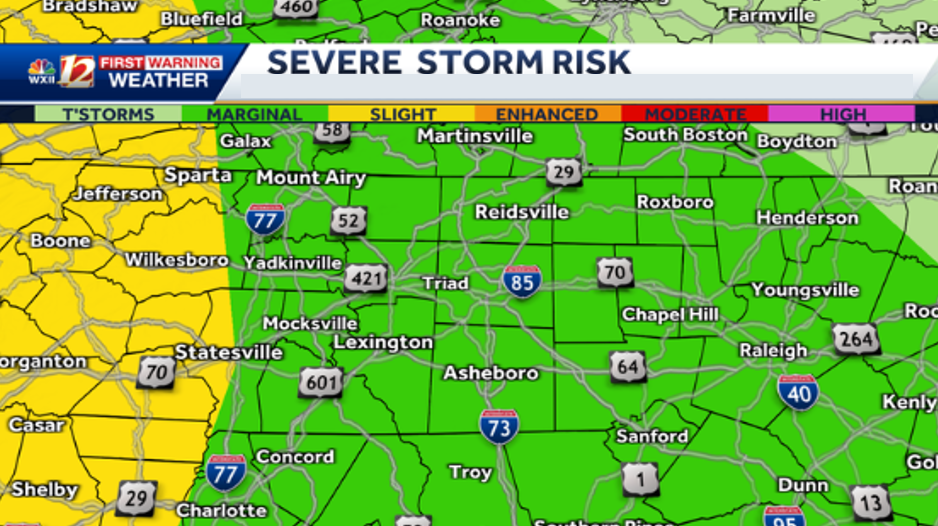

Weather Update Very Low Probability Of Severe Storms Late Tuesday

May 21, 2025

Weather Update Very Low Probability Of Severe Storms Late Tuesday

May 21, 2025 -

Post Office Data Breach Victims Awarded Hundreds In Compensation

May 21, 2025

Post Office Data Breach Victims Awarded Hundreds In Compensation

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation Aiming For Increased Corporate Value Across 13 Industries

May 21, 2025

160 Japanese Firms Compete In Nature Conservation Aiming For Increased Corporate Value Across 13 Industries

May 21, 2025 -

North Carolina Under Severe Weather Threat Rain And Storms Expected Overnight

May 21, 2025

North Carolina Under Severe Weather Threat Rain And Storms Expected Overnight

May 21, 2025 -

Familys Fury New Law Under Fire For Impact On Child Protection And Paedophile Parental Rights

May 21, 2025

Familys Fury New Law Under Fire For Impact On Child Protection And Paedophile Parental Rights

May 21, 2025