California Approves Substantial Rate Increase For State Farm Auto Insurance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Approves Substantial Rate Increase for State Farm Auto Insurance: What it Means for Drivers

California drivers face a significant blow to their wallets as the California Department of Insurance (CDI) recently approved a substantial rate increase for State Farm auto insurance. This decision, impacting hundreds of thousands of policyholders, has sparked outrage and raised concerns about the affordability of car insurance in the state. The increase, averaging [Insert Percentage]%, is the largest single jump in premiums seen in recent years, leaving many questioning the future of their insurance coverage.

Understanding the Rate Hike:

The CDI's approval of State Farm's rate increase cites several contributing factors. These include:

- Increased claims costs: The rising cost of vehicle repairs, medical expenses stemming from accidents, and legal fees have significantly impacted State Farm's payouts. The increasing prevalence of expensive advanced driver-assistance systems (ADAS) in newer vehicles also contributes to higher repair costs.

- Inflationary pressures: The ongoing inflationary pressures affecting the entire economy are impacting the insurance industry as well. Increased operational costs and administrative expenses are inevitably passed on to consumers.

- Higher litigation costs: California's legal environment contributes to increased litigation costs for insurance companies. Higher payouts in settlements and judgments directly influence premium calculations.

- Increased frequency and severity of accidents: While specific data may vary, a general trend of increased accident rates and more severe accidents in certain areas of California is a factor.

What This Means for California Drivers:

This significant rate increase will undoubtedly impact many California drivers. For some, it might mean:

- Higher monthly premiums: Expect a noticeable increase in your monthly insurance payments. The exact amount will depend on your specific policy and coverage level.

- Reduced coverage: Some drivers may be forced to reduce their coverage to manage the increased costs, potentially leaving them with less protection in the event of an accident.

- Difficulty in affording insurance: For those already struggling to afford car insurance, this increase could be a significant financial burden, potentially leading to lapse in coverage.

Alternatives and What You Can Do:

Facing a substantial increase in your car insurance premiums can be frustrating. Here are some steps you can take:

- Shop around for alternative providers: Don't be afraid to compare quotes from other insurance companies. Several online comparison tools can help you quickly find the best rates for your needs. [Link to a reputable insurance comparison website].

- Review your coverage: Assess your current coverage levels. Do you really need all the add-ons? Reducing unnecessary coverage can help lower your premium.

- Improve your driving record: Maintaining a clean driving record is one of the best ways to secure lower insurance rates. Avoid speeding tickets and accidents to keep your premiums as low as possible.

- Consider increasing your deductible: Choosing a higher deductible can result in lower premiums, but remember that you'll have to pay more out-of-pocket in the event of a claim.

Looking Ahead:

This State Farm rate increase is likely to trigger similar actions from other major insurance providers in California. The ongoing debate about affordability and the regulatory environment surrounding auto insurance in the state will continue to be a hot topic. It's crucial for California drivers to stay informed and actively manage their insurance costs to avoid unexpected financial burdens.

Call to Action: Contact your insurance provider to understand the impact of this increase on your specific policy and explore options for managing your premiums. Don't hesitate to shop around and compare rates to ensure you're getting the best possible coverage at the most affordable price.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Approves Substantial Rate Increase For State Farm Auto Insurance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Funniest Cannes Photos Before Everyone Had A Camera Phone

May 17, 2025

Funniest Cannes Photos Before Everyone Had A Camera Phone

May 17, 2025 -

Against All Odds Sole Survivor Of Deadly 400 Foot Climbing Accident Recounts Ordeal

May 17, 2025

Against All Odds Sole Survivor Of Deadly 400 Foot Climbing Accident Recounts Ordeal

May 17, 2025 -

England And Wales Mps Debate Revised Assisted Dying Bill

May 17, 2025

England And Wales Mps Debate Revised Assisted Dying Bill

May 17, 2025 -

Update Chris Brown Charged In Connection With London Nightclub Assault

May 17, 2025

Update Chris Brown Charged In Connection With London Nightclub Assault

May 17, 2025 -

Cold Shooting Dooms Dallas 5 Post Game Thoughts From Stars Jets Game 5

May 17, 2025

Cold Shooting Dooms Dallas 5 Post Game Thoughts From Stars Jets Game 5

May 17, 2025

Latest Posts

-

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025 -

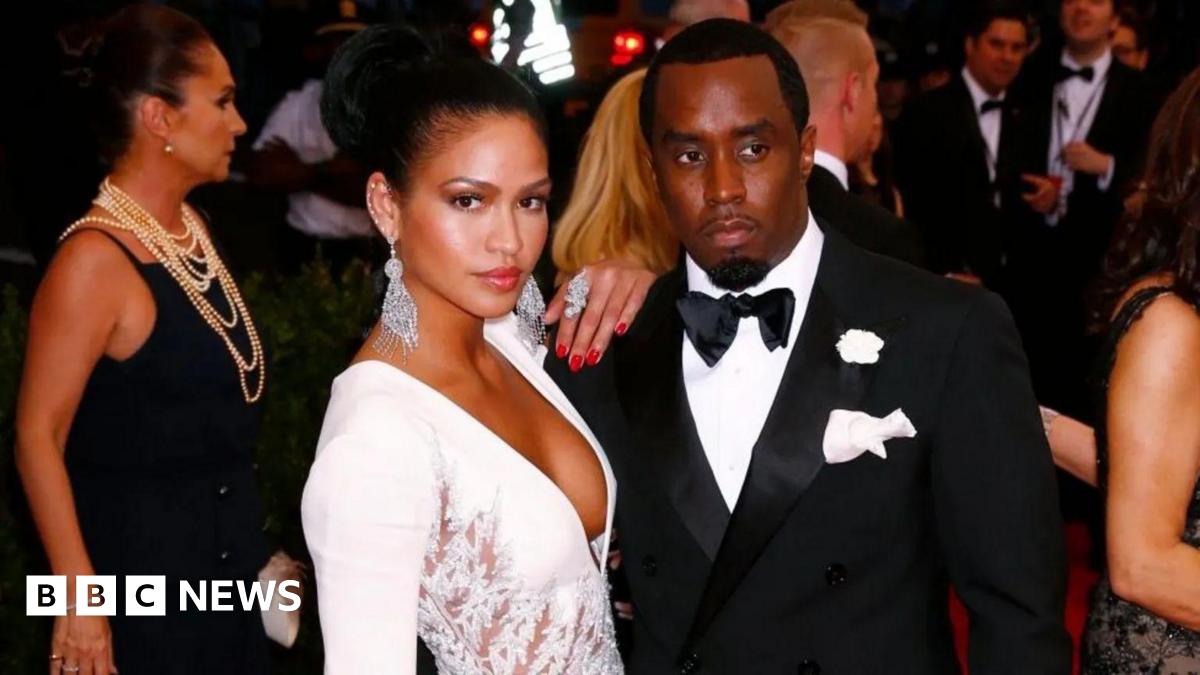

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025 -

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025 -

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025 -

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025