California Authorizes Significant Rate Increase For State Farm Insurance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Authorizes Significant Rate Increase for State Farm Insurance: What it Means for Policyholders

California homeowners and drivers insured by State Farm are facing a significant blow to their wallets. The California Department of Insurance (CDI) recently authorized a substantial rate increase for State Farm insurance policies, sparking concerns and prompting questions about the future of affordability in the Golden State's insurance market. This substantial hike affects both auto and homeowners insurance, impacting thousands across the state.

How Much Will Premiums Increase?

The exact percentage increase varies depending on location, policy type, and coverage specifics. However, reports suggest increases ranging from 10% to 20% for auto insurance and even higher for homeowners insurance in some areas. State Farm cited increased claims costs, particularly due to inflation, severe weather events, and rising repair expenses, as justification for the request. The CDI, after careful review, approved the increases, emphasizing the need for insurers to maintain financial stability while still ensuring reasonable rates for consumers.

Why the Increase? Understanding the Factors at Play

Several factors contributed to State Farm's request and the CDI's eventual approval. These include:

- Inflation: The rising cost of materials, labor, and repairs significantly impacts claim payouts. Replacing a damaged vehicle or repairing a home after a fire or other incident now costs substantially more than in previous years.

- Severe Weather: California, like much of the US, is experiencing more frequent and intense extreme weather events. Wildfires, floods, and storms lead to a higher volume and severity of claims.

- Supply Chain Issues: Ongoing supply chain disruptions continue to impact repair times and costs, further exacerbating the problem. The availability of parts for vehicles and building materials for homes remains a significant challenge.

- Increased Litigation: Rising legal costs associated with insurance claims also play a role in driving up premiums.

What Can Policyholders Do?

Facing a significant premium increase can be daunting. However, policyholders have options:

- Shop Around: It's crucial to compare quotes from other insurance providers to see if you can find a more affordable option. Use online comparison tools to streamline the process.

- Review Your Coverage: Carefully review your policy and consider whether you need the same level of coverage. Reducing coverage levels might lower your premiums, but ensure you maintain adequate protection.

- Improve Your Risk Profile: Taking steps to mitigate risk, such as installing security systems or making home improvements, could potentially lead to discounts from some insurers.

- Contact State Farm Directly: Reach out to your State Farm agent to discuss your options and explore potential payment plans or discounts.

Looking Ahead: The Future of California Insurance

This significant rate increase from State Farm highlights the ongoing challenges in California's insurance market. Experts predict that this might not be an isolated incident, with other insurers potentially following suit. The rising costs of claims and the increasing frequency of severe weather events are likely to continue impacting insurance premiums in the years to come. Policyholders need to be proactive in managing their insurance costs and staying informed about changes in the market. Further updates and analysis on this developing situation will be provided as they become available. .

Call to Action: Have you been affected by this rate increase? Share your experiences in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Authorizes Significant Rate Increase For State Farm Insurance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Conversation With Wes Anderson The Phoenician Scheme Cannes And Why You Need To See His Movies Twice

May 17, 2025

A Conversation With Wes Anderson The Phoenician Scheme Cannes And Why You Need To See His Movies Twice

May 17, 2025 -

Revolutionizing Olympic Transport La 28s Car Free Plan With Budget Friendly Air Taxis

May 17, 2025

Revolutionizing Olympic Transport La 28s Car Free Plan With Budget Friendly Air Taxis

May 17, 2025 -

Jansens Role As Angels Closer A Real Game Changer

May 17, 2025

Jansens Role As Angels Closer A Real Game Changer

May 17, 2025 -

Severe Structural Issues Alleged Lawsuit Targets New York City Skyscraper

May 17, 2025

Severe Structural Issues Alleged Lawsuit Targets New York City Skyscraper

May 17, 2025 -

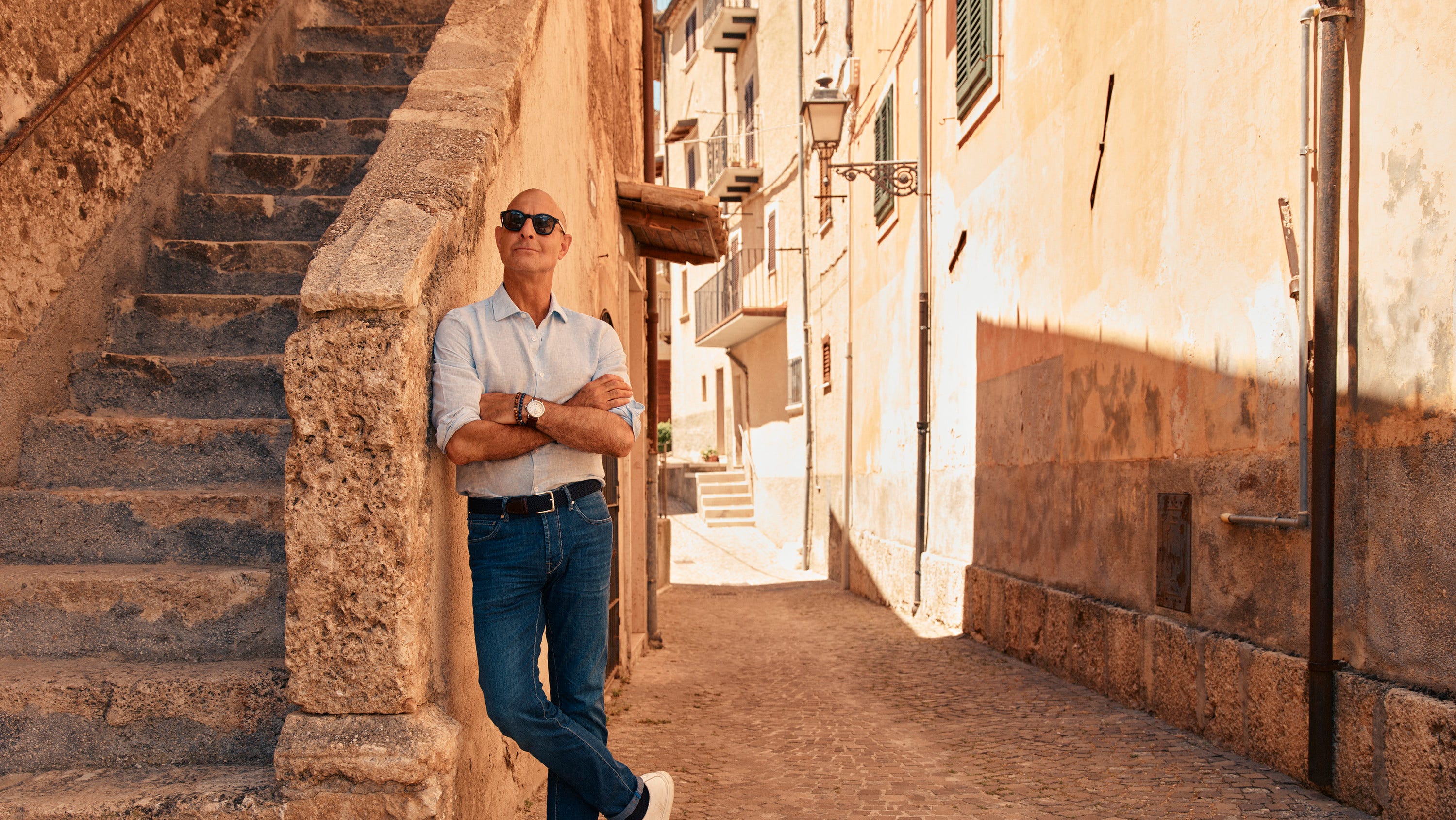

Stanley Tuccis Italian Food Adventure A Dish By Dish Exploration Of Italy

May 17, 2025

Stanley Tuccis Italian Food Adventure A Dish By Dish Exploration Of Italy

May 17, 2025

Latest Posts

-

Russia E Ucrania Vaticano Se Dispoe A Mediador Para O Fim Da Guerra

May 18, 2025

Russia E Ucrania Vaticano Se Dispoe A Mediador Para O Fim Da Guerra

May 18, 2025 -

50 Cents Scathing Attack On Jay Z And Diddy What Happened

May 18, 2025

50 Cents Scathing Attack On Jay Z And Diddy What Happened

May 18, 2025 -

Destination X Bus Jeffrey Dean Morgan Reveals All In New Video

May 18, 2025

Destination X Bus Jeffrey Dean Morgan Reveals All In New Video

May 18, 2025 -

Treasonous Remark Ignites Feud Between Trump And Springsteen

May 18, 2025

Treasonous Remark Ignites Feud Between Trump And Springsteen

May 18, 2025 -

Diddy Trial How Forensic Psychology Shapes The Case

May 18, 2025

Diddy Trial How Forensic Psychology Shapes The Case

May 18, 2025