California Drivers: How State Farm's Emergency Rate Increase Affects Your Premiums

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Drivers: How State Farm's Emergency Rate Increase Affects Your Premiums

California drivers are facing a sudden jolt to their budgets as State Farm, the nation's largest auto insurer, implements emergency rate increases across the state. This move, impacting hundreds of thousands of Californians, has sparked widespread concern and raised questions about the affordability of car insurance in the Golden State. Understanding the impact and what you can do is crucial.

Why the Emergency Rate Hike?

State Farm cites soaring costs related to auto repair, inflated claims payouts, and increased litigation as the primary reasons for the emergency rate adjustments. These factors, exacerbated by inflation and supply chain disruptions, have significantly impacted the company's profitability in California. The insurer argues that these emergency increases are necessary to maintain financial stability and continue providing coverage to its policyholders. This isn't an isolated incident; many insurance companies across the US are experiencing similar pressures, leading to similar rate adjustments in various states.

How Much Will Premiums Increase?

The percentage increase varies depending on several factors, including location, driving history, and the type of coverage. While State Farm hasn't released exact figures for each policyholder, reports suggest increases ranging from 5% to 20% or even higher in some cases. This means significant added expense for many Californians already struggling with the rising cost of living. The company has pledged to communicate the specific increase to each affected policyholder directly.

What Can California Drivers Do?

Facing a higher insurance bill can be stressful. Here's what you can do:

- Review your coverage: Carefully examine your current policy. Do you need all the coverage you have? Consider if you can reduce coverage amounts (while still maintaining adequate protection) to lower your premium.

- Shop around: Don't assume State Farm offers the best rates. Compare quotes from other reputable insurers in California. Several online comparison tools can streamline this process. Remember to compare apples to apples – ensure coverage levels are consistent across different quotes.

- Improve your driving record: Maintaining a clean driving record is one of the most effective ways to lower your car insurance premiums. Defensive driving courses can also lead to discounts.

- Bundle your insurance: If you also need homeowners or renters insurance, bundling policies with the same insurer often results in significant savings.

- Explore discounts: Many insurers offer discounts for things like good student status, anti-theft devices, and safe driving programs. Make sure you're taking advantage of any available discounts.

- Contact State Farm directly: If you have questions or concerns about your specific increase, reach out to your State Farm agent.

The Bigger Picture: The Future of Car Insurance in California

State Farm's emergency rate increase highlights a broader issue affecting the affordability of car insurance in California. The rising costs of vehicle repairs, medical care, and legal fees are all contributing factors. This situation underscores the importance of responsible driving, proactive policy management, and careful comparison shopping to ensure you're getting the best possible coverage at a price you can afford.

Call to Action: Take control of your car insurance costs today. Compare quotes, review your policy, and explore ways to save money. Don't hesitate to seek advice from a qualified insurance professional if needed.

Keywords: State Farm, California car insurance, car insurance rates, emergency rate increase, auto insurance, California drivers, insurance premiums, cost of car insurance, compare car insurance, California insurance, auto repair costs, insurance comparison, save money on car insurance, insurance quotes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Drivers: How State Farm's Emergency Rate Increase Affects Your Premiums. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chris Brown Arrested And Charged Details Of London Nightclub Assault Allegations

May 18, 2025

Chris Brown Arrested And Charged Details Of London Nightclub Assault Allegations

May 18, 2025 -

Vaticano Como Ponte Iniciativa De Mediacao Entre Moscou E Kiev

May 18, 2025

Vaticano Como Ponte Iniciativa De Mediacao Entre Moscou E Kiev

May 18, 2025 -

Cassies Court Testimony Prompts 50 Cents Plea Deal Advice For Diddy

May 18, 2025

Cassies Court Testimony Prompts 50 Cents Plea Deal Advice For Diddy

May 18, 2025 -

Triple A Pitcher Joins Dodgers Roster Update And Analysis

May 18, 2025

Triple A Pitcher Joins Dodgers Roster Update And Analysis

May 18, 2025 -

Ethical Concerns Surface Over State Officials Rome Trip Partially Sponsored By Industry

May 18, 2025

Ethical Concerns Surface Over State Officials Rome Trip Partially Sponsored By Industry

May 18, 2025

Latest Posts

-

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025 -

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025 -

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025 -

Diddy Trial Testimony A Recap Of Cassie Ventura And Dawn Richards Appearances

May 18, 2025

Diddy Trial Testimony A Recap Of Cassie Ventura And Dawn Richards Appearances

May 18, 2025 -

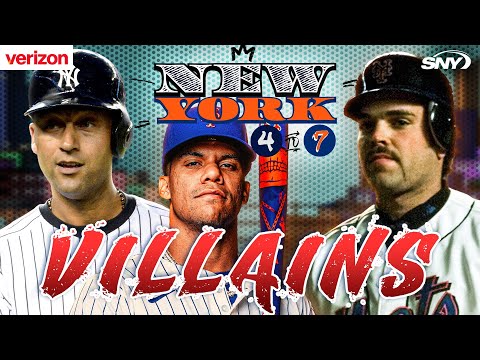

Subway Series Villains The All Time Worst Mets And Yankees

May 18, 2025

Subway Series Villains The All Time Worst Mets And Yankees

May 18, 2025