California Homeowners: How State Farm's Emergency Rate Increase Impacts Your Premiums

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Homeowners: How State Farm's Emergency Rate Increase Impacts Your Premiums

California homeowners are facing a significant blow to their budgets as State Farm, one of the state's largest insurers, announces emergency rate increases. This move, affecting hundreds of thousands of policyholders, highlights the growing challenges in California's insurance market and leaves many wondering what this means for their premiums and future coverage. Understanding the implications is crucial for navigating this turbulent period.

State Farm's Justification for the Increase

State Farm cites escalating wildfire risks and increased costs of claims as the primary reasons behind the emergency rate hike. The company, in filings with the California Department of Insurance (CDI), points to a dramatic surge in the frequency and severity of wildfires, leading to significantly higher payouts. This, coupled with rising construction and repair costs, puts immense pressure on the insurer's financial stability. They argue that the rate increase is necessary to maintain solvency and continue providing coverage to California homeowners.

How Much Will Premiums Increase?

The percentage increase varies depending on several factors, including location, the type of dwelling, and the coverage level. While State Farm hasn't released a uniform percentage, reports suggest increases ranging from 10% to over 40% in some high-risk areas. This significant jump can place a considerable strain on household budgets, especially for those already struggling with rising living costs. Homeowners are urged to carefully review their policy documents and contact State Farm directly to understand the specific impact on their premiums.

What Can Homeowners Do?

Facing a substantial premium increase can feel overwhelming, but several options exist for California homeowners:

-

Shop around for alternative insurance providers: Comparing quotes from multiple insurers can help you find a more competitive rate. Websites like [insert reputable insurance comparison site link here] can simplify this process. Be aware, however, that finding comparable coverage in high-risk areas might be challenging.

-

Review your coverage: Consider whether your current coverage level is necessary. Reducing coverage might lower your premiums, but it's crucial to balance cost savings against potential risks.

-

Implement home safety measures: Many insurers offer discounts for homeowners who take steps to mitigate wildfire risks. These include creating defensible space around your home, installing fire-resistant roofing, and upgrading your home's sprinkler system. Check with State Farm and other providers for available discounts.

-

Contact your insurance agent: Don't hesitate to discuss your concerns and explore available options with your State Farm agent. They can provide personalized advice and help you understand your policy better.

-

Consider government assistance programs: Depending on your circumstances, you may be eligible for government assistance programs designed to help homeowners with insurance costs. Research state and local resources to learn more.

The Broader Context: California's Insurance Crisis

State Farm's rate increase is part of a larger trend affecting California's insurance market. The increasing frequency and severity of wildfires, combined with stricter building codes and rising construction costs, are creating a challenging environment for insurers. This situation leads to higher premiums, reduced availability of insurance, and growing concerns about the accessibility of homeowners insurance in the state. The California Department of Insurance is actively working to address these issues, but finding sustainable solutions remains a significant challenge.

Looking Ahead:

This situation underscores the importance of proactive risk management and financial planning for California homeowners. Regularly reviewing your insurance coverage, exploring mitigation strategies, and staying informed about changes in the insurance market are vital steps in protecting your home and your financial well-being. The increasing cost of homeowners insurance in California necessitates careful consideration and a proactive approach to safeguarding your property. Remember to contact your insurance provider directly for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Homeowners: How State Farm's Emergency Rate Increase Impacts Your Premiums. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The Velvet Rope Analyzing Red Carpet Rule Infractions

May 17, 2025

Beyond The Velvet Rope Analyzing Red Carpet Rule Infractions

May 17, 2025 -

Israeli Aid Plan Rejected Massive Protests Erupt Across Gaza

May 17, 2025

Israeli Aid Plan Rejected Massive Protests Erupt Across Gaza

May 17, 2025 -

Loutos Recalled Wrobleski Optioned Dodgers Bullpen Shuffle

May 17, 2025

Loutos Recalled Wrobleski Optioned Dodgers Bullpen Shuffle

May 17, 2025 -

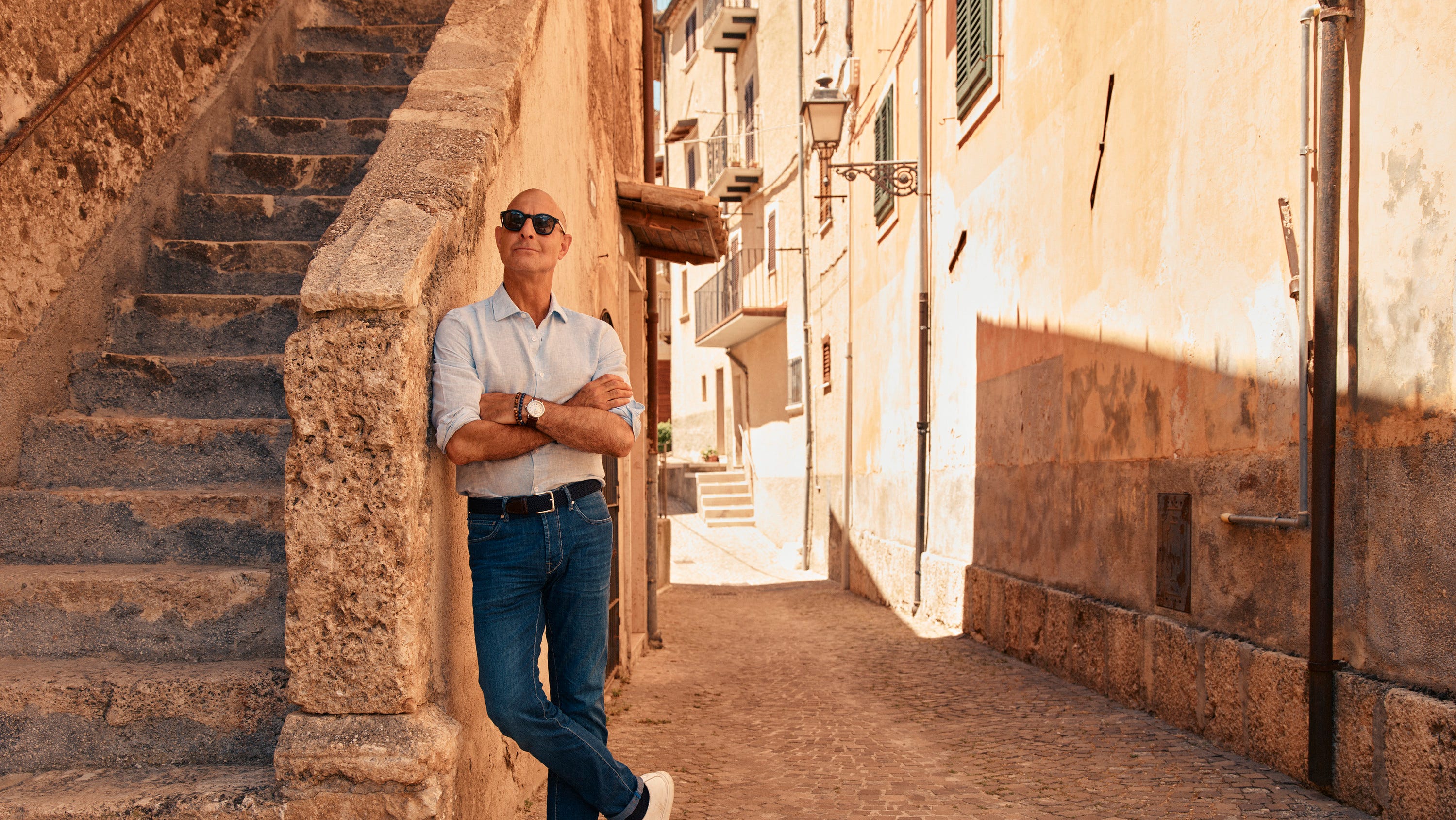

A Dish At A Time Stanley Tuccis Italian Food Exploration

May 17, 2025

A Dish At A Time Stanley Tuccis Italian Food Exploration

May 17, 2025 -

Friendship Movie Top Ten Market Debut Detroit Showing And New Films

May 17, 2025

Friendship Movie Top Ten Market Debut Detroit Showing And New Films

May 17, 2025

Latest Posts

-

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025 -

Dodgers Kenley Jansen A Costly Walk Off Home Run In Recent Game

May 18, 2025

Dodgers Kenley Jansen A Costly Walk Off Home Run In Recent Game

May 18, 2025 -

Friendship Soars Detroit Celebrates Local Success Specialty Film Preview Announced

May 18, 2025

Friendship Soars Detroit Celebrates Local Success Specialty Film Preview Announced

May 18, 2025 -

Kenley Jansen Gives Up Walk Off Home Run Impact On Dodgers Playoff Hopes

May 18, 2025

Kenley Jansen Gives Up Walk Off Home Run Impact On Dodgers Playoff Hopes

May 18, 2025 -

Wes Andersons The Phoenician Scheme Cannes Repeat Viewings And Directorial Genius

May 18, 2025

Wes Andersons The Phoenician Scheme Cannes Repeat Viewings And Directorial Genius

May 18, 2025