California Insurance Rates Soaring: State Farm Hike Approved

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Insurance Rates Soaring: State Farm Hike Approved, Leaving Consumers Scrambling

California homeowners are facing a significant blow to their wallets as insurance rates continue their upward trajectory. The latest blow comes from State Farm, one of the state's largest insurers, whose rate hike has recently been approved, adding fuel to the already burning fire of rising premiums across the Golden State. This significant increase leaves many Californians scrambling to find affordable coverage and raises serious questions about the future of home insurance in the state.

State Farm's Approved Increase: A Significant Jump

The approved rate increase by State Farm varies by region but represents a substantial jump for many policyholders. While the exact percentages aren't uniformly disclosed, reports indicate increases ranging from double-digits to even higher percentages in certain high-risk areas. This follows a trend of increasing premiums across multiple insurance providers in California, leaving homeowners with fewer options and potentially crippling costs.

Why are California Insurance Rates Skyrocketing?

Several factors contribute to this alarming rise in insurance premiums:

- Wildfires: California's increasingly frequent and devastating wildfires are a primary driver. The cost of rebuilding homes and the increased risk associated with wildfire-prone areas directly impact insurance premiums. Insurance companies are forced to raise rates to cover the escalating claims payouts.

- Climate Change: The ongoing effects of climate change exacerbate wildfire risk and contribute to other natural disasters, such as mudslides and floods. These events increase the overall cost of insurance for all Californians.

- Construction Costs: The cost of building materials and labor has increased significantly, meaning rebuilding after a disaster is far more expensive than in the past. This directly impacts insurance company payouts and subsequently, premiums.

- Litigation: California's legal environment and increased litigation surrounding insurance claims also contribute to higher costs for insurance providers.

What Can Californians Do?

Facing soaring insurance rates can feel overwhelming, but there are steps homeowners can take:

- Shop Around: Compare quotes from multiple insurance providers. Don't automatically renew your policy – actively search for better rates.

- Improve Home Safety: Making your home more fire-resistant can potentially lead to lower premiums. Consider steps such as installing fire-resistant roofing and landscaping.

- Consider Discounts: Many insurers offer discounts for things like security systems, smoke detectors, and multiple policy bundling (auto and home).

- Contact Your Insurance Agent: Discuss your options with your current provider. They may be able to offer alternative plans or explain the reasons behind the rate increase.

- Advocate for Change: Contact your state representatives to voice your concerns and advocate for policies that address the underlying issues driving up insurance costs.

The Future of Home Insurance in California

The rising cost of home insurance in California presents a significant challenge for both homeowners and the state's economy. Addressing the root causes – wildfire prevention, climate change mitigation, and affordable construction – is crucial to finding a long-term solution. Until then, Californians should be prepared for continued pressure on their insurance budgets and proactive in managing their risk.

Keywords: California insurance rates, State Farm, insurance hike, home insurance, wildfire, climate change, insurance premiums, California homeowners, rising insurance costs, affordable insurance, insurance crisis.

Call to Action: Have you experienced a significant increase in your home insurance premiums? Share your story in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Insurance Rates Soaring: State Farm Hike Approved. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Independent Film Friendship Soars Detroit Debut And Expanded Release Details

May 17, 2025

Independent Film Friendship Soars Detroit Debut And Expanded Release Details

May 17, 2025 -

2025 Nba Mock Draft Projection Flagg No 1 Knueppel In Top 5

May 17, 2025

2025 Nba Mock Draft Projection Flagg No 1 Knueppel In Top 5

May 17, 2025 -

Red Carpet Etiquette Understanding Why Guests Defy Protocol

May 17, 2025

Red Carpet Etiquette Understanding Why Guests Defy Protocol

May 17, 2025 -

Beneath The Surface Exploring The Emotional Depth Of Wes Andersons Visual Style

May 17, 2025

Beneath The Surface Exploring The Emotional Depth Of Wes Andersons Visual Style

May 17, 2025 -

Kenley Jansens Impact Early Assessment Of His Role As Angels Closer

May 17, 2025

Kenley Jansens Impact Early Assessment Of His Role As Angels Closer

May 17, 2025

Latest Posts

-

Starmers Albania Visit Controversy And Uks Fastest Economic Growth A News Analysis

May 18, 2025

Starmers Albania Visit Controversy And Uks Fastest Economic Growth A News Analysis

May 18, 2025 -

The Wild Side Of Cannes Unseen Photos From Before The Smartphone Era

May 18, 2025

The Wild Side Of Cannes Unseen Photos From Before The Smartphone Era

May 18, 2025 -

Britains Post Brexit Trajectory A Return To The European Fold

May 18, 2025

Britains Post Brexit Trajectory A Return To The European Fold

May 18, 2025 -

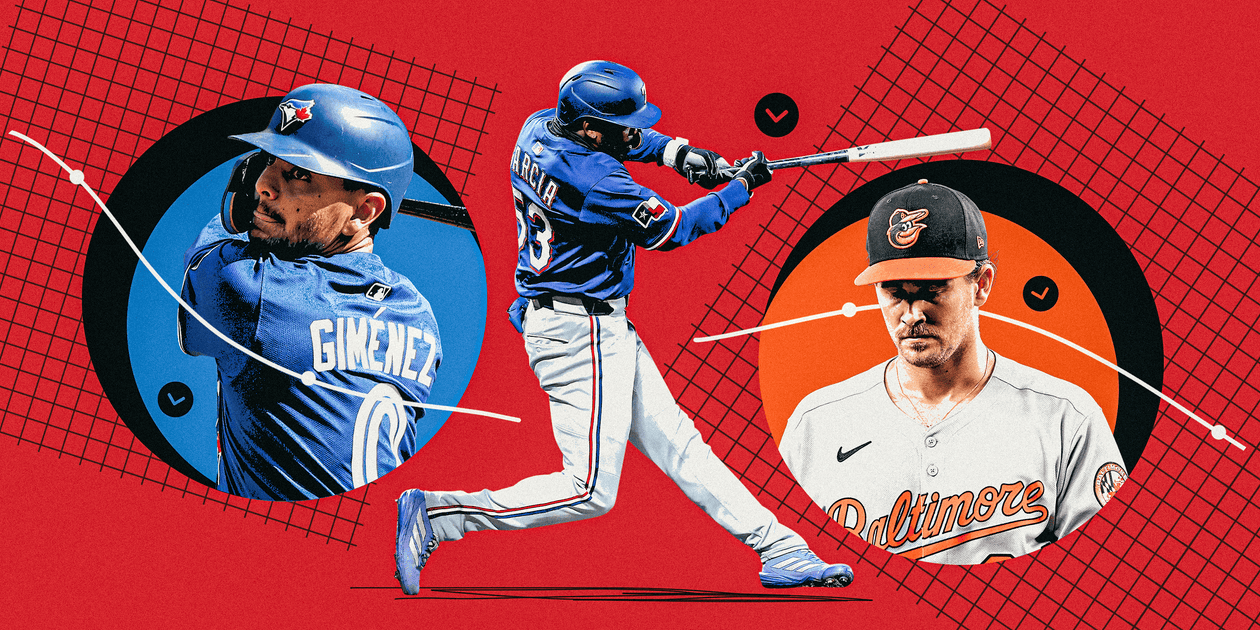

Concerning Trends 10 Early Mlb Statistics To Watch Closely

May 18, 2025

Concerning Trends 10 Early Mlb Statistics To Watch Closely

May 18, 2025 -

Confusion Reigns Initial Reactions To The Russia Ukraine Direct Talks After A Three Year Absence

May 18, 2025

Confusion Reigns Initial Reactions To The Russia Ukraine Direct Talks After A Three Year Absence

May 18, 2025