California Insurance Rates To Rise: State Farm Gets Double-Digit Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Insurance Rates to Rise: State Farm Leads with Double-Digit Hike

California homeowners are bracing for a significant increase in insurance premiums, with State Farm announcing a double-digit percentage jump in rates. This announcement throws fuel on the already burning fire of California's insurance crisis, leaving many residents worried about affordability and accessibility. The rising costs are attributed to a confluence of factors, including increased wildfire risk, escalating construction costs, and a shrinking insurance market in the state.

State Farm's Double-Digit Increase: A Leading Indicator

State Farm, one of California's largest homeowners insurance providers, has confirmed double-digit percentage increases across numerous regions of the state. While the exact figures vary by location and specific policy details, the sheer magnitude of the increase signals a broader trend impacting the entire insurance market. This isn't just a State Farm problem; other major insurers are expected to follow suit, potentially leading to even wider affordability challenges. This development comes as a harsh blow to many Californians already struggling with the high cost of living.

Why are California Insurance Premiums Skyrocketing?

Several interconnected factors contribute to the dramatic rise in insurance premiums in California:

-

Increased Wildfire Risk: The increasing frequency and intensity of wildfires in California have significantly raised insurance risk. Areas deemed high-risk face the most substantial premium increases, reflecting the heightened probability of property damage and losses. The devastating wildfires in recent years have resulted in billions of dollars in insured losses, forcing insurers to re-evaluate their risk assessments.

-

Soaring Construction Costs: The cost of rebuilding homes after a disaster, like a wildfire or earthquake, has escalated dramatically. The price of lumber, labor, and other materials continues to climb, making it more expensive for insurers to cover potential losses. This increased cost of reconstruction directly translates to higher premiums for homeowners.

-

Shrinking Insurance Market: Several major insurers have reduced their exposure in California due to the high risk and financial losses associated with wildfires and other natural disasters. This decreased competition in the market further contributes to rising premiums, as fewer companies are competing for customers.

What Can California Homeowners Do?

Facing these rising costs, homeowners can take several steps to mitigate the impact:

- Shop Around: Compare quotes from multiple insurers to find the best rates. Utilizing online comparison tools can streamline this process.

- Improve Home Safety: Implementing fire-resistant landscaping and home modifications can potentially reduce your premium. Consult with your insurer about eligible safety measures.

- Consider Discounts: Explore discounts offered by insurers for things like security systems, fire-resistant roofing, and bundled insurance policies.

- Advocate for Change: Contact your state representatives to voice your concerns about rising insurance costs and advocate for policies that address the root causes of the crisis.

The Future of California Home Insurance

The escalating cost of home insurance in California represents a significant challenge for both homeowners and policymakers. The state needs to address the underlying issues driving these increases, including wildfire mitigation, building codes, and potentially exploring alternative insurance mechanisms. The long-term solution requires a multifaceted approach involving insurers, government agencies, and homeowners themselves. The coming months will be crucial in determining how the state navigates this increasingly precarious situation. Stay informed and proactive to protect your home and financial future.

Keywords: California insurance, insurance rates, State Farm, homeowners insurance, wildfire risk, insurance crisis, California wildfires, rising insurance costs, home insurance premiums, insurance affordability, California home insurance, insurance market, construction costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Insurance Rates To Rise: State Farm Gets Double-Digit Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mlb Kenley Jansen Officially Named Angels Closer

May 18, 2025

Mlb Kenley Jansen Officially Named Angels Closer

May 18, 2025 -

Late Game Heartbreak Kenley Jansen Gives Up Walk Off Home Run

May 18, 2025

Late Game Heartbreak Kenley Jansen Gives Up Walk Off Home Run

May 18, 2025 -

Beyond The Pastel Palettes Uncovering The Underlying Sadness In Wes Andersons Work

May 18, 2025

Beyond The Pastel Palettes Uncovering The Underlying Sadness In Wes Andersons Work

May 18, 2025 -

An Interview With Wes Anderson Delving Into The Heartbreak At The Core Of His Style

May 18, 2025

An Interview With Wes Anderson Delving Into The Heartbreak At The Core Of His Style

May 18, 2025 -

Diddys Shocking Texts To Cassie After Hotel Assault Revealed

May 18, 2025

Diddys Shocking Texts To Cassie After Hotel Assault Revealed

May 18, 2025

Latest Posts

-

50 Cent Targets Jay Z Over Diddy Friendship A Heated Hip Hop Rivalry

May 18, 2025

50 Cent Targets Jay Z Over Diddy Friendship A Heated Hip Hop Rivalry

May 18, 2025 -

Unveiling The Cast Your Guide To Netflixs Kakegurui Anime Series

May 18, 2025

Unveiling The Cast Your Guide To Netflixs Kakegurui Anime Series

May 18, 2025 -

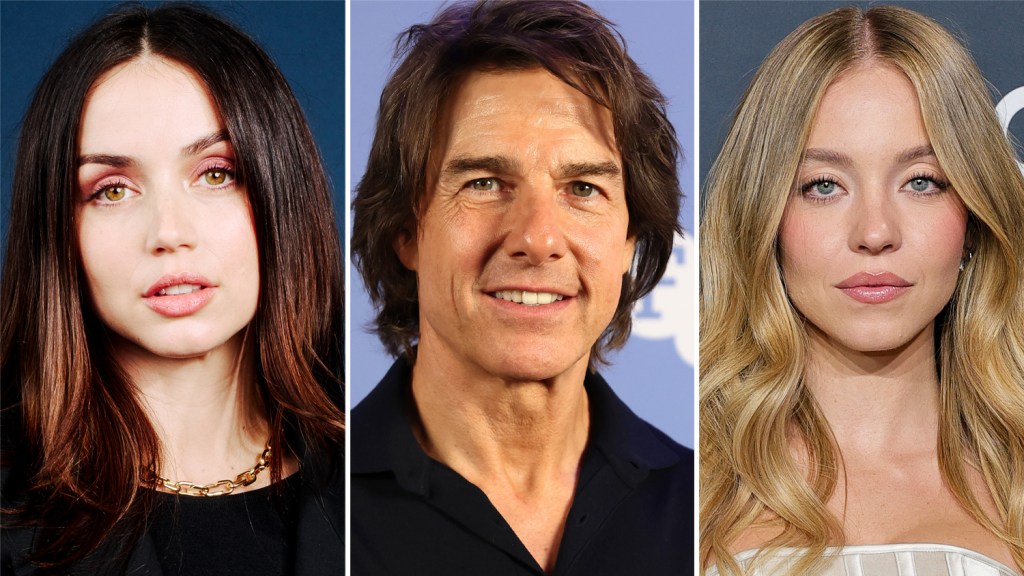

Tom Cruise And Ana De Armas Jon Chus Next Film Sydney Sweeney Also In Talks

May 18, 2025

Tom Cruise And Ana De Armas Jon Chus Next Film Sydney Sweeney Also In Talks

May 18, 2025 -

Minnesota Twins 13 Straight Wins And Counting A Shutout Streak For The Ages

May 18, 2025

Minnesota Twins 13 Straight Wins And Counting A Shutout Streak For The Ages

May 18, 2025 -

Exclusive Interview Jeffrey Dean Morgan Discusses Destination X And His Career

May 18, 2025

Exclusive Interview Jeffrey Dean Morgan Discusses Destination X And His Career

May 18, 2025