California's Emergency Rate Hike: How It Impacts State Farm Policyholders

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California's Emergency Rate Hike: How it Impacts State Farm Policyholders

California homeowners are facing a significant shock: State Farm, one of the state's largest insurers, has announced an emergency rate hike impacting hundreds of thousands of policyholders. This dramatic increase, approved by the California Department of Insurance (CDI), raises crucial questions about the future of home insurance affordability and accessibility in the Golden State. This article delves into the specifics of the rate hike, its causes, and what it means for State Farm customers.

Why the Emergency Rate Hike?

The CDI's approval of State Farm's emergency rate increase cites escalating wildfire risks and increased costs associated with catastrophic events as the primary reasons. California has experienced increasingly intense and frequent wildfires in recent years, leading to billions of dollars in insured losses. These rising claims costs, coupled with reinsurance market volatility (the insurance that insurers buy to protect themselves against catastrophic losses), have forced insurers like State Farm to seek significant rate adjustments to remain financially solvent. The rising cost of construction materials and labor further exacerbates the issue, making rebuilding after a disaster significantly more expensive.

How Much Will State Farm Premiums Increase?

The exact percentage increase varies depending on location and specific policy details. However, reports indicate that some policyholders could see increases ranging from 10% to 20% or more. This means significant added financial strain for many Californians already struggling with the rising cost of living. State Farm has emphasized that this is an emergency measure, necessary to ensure the company's ability to continue providing coverage in the state. They've also stated that they're working to mitigate the impact on their policyholders through various initiatives, though details remain limited.

What Can State Farm Policyholders Do?

Facing a sudden and potentially substantial premium increase can be alarming. Here are some steps State Farm policyholders can consider:

- Review your policy: Carefully examine your policy details to understand the precise amount of your increase and the reasons behind it. Contact State Farm directly if you have questions or believe there's an error.

- Shop around: While finding comparable coverage might be challenging in the current market, it's worthwhile to obtain quotes from other insurers to see if more affordable options are available. Remember to compare coverage details meticulously, as cheaper policies might offer less comprehensive protection.

- Consider mitigation measures: Homeowners can take steps to reduce their wildfire risk, which might lead to potential premium discounts in the future. These measures could include clearing brush around your property, installing fire-resistant roofing, and ensuring proper home maintenance. Check with your local fire department or insurance provider for specific recommendations.

- Explore financial assistance programs: Depending on your circumstances, you may qualify for financial assistance programs that can help offset the cost of your insurance premiums. Contact your local government agencies or community organizations for more information.

The Broader Implications for California

State Farm's emergency rate hike is not an isolated incident. Other major insurers are also facing similar challenges in California, leading to concerns about the availability and affordability of home insurance across the state. This situation highlights the urgent need for comprehensive strategies to address wildfire risk and create a more sustainable insurance market in California. The state government is actively exploring solutions, including investing in wildfire prevention and mitigation efforts and potentially creating a state-backed insurance program as a last resort for those unable to find affordable private coverage.

Looking Ahead

The future of home insurance in California remains uncertain. The State Farm rate hike serves as a stark reminder of the increasing challenges posed by climate change and the need for proactive measures to address these issues. Staying informed, understanding your options, and advocating for policy changes are crucial for California homeowners in navigating this complex landscape. For further information on insurance options in California, consider visiting the California Department of Insurance website: [link to CDI website].

Keywords: California, State Farm, insurance, rate hike, emergency rate increase, homeowners insurance, wildfire, CDI, California Department of Insurance, home insurance cost, insurance premiums, wildfire risk, insurance affordability, California wildfires, reinsurance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California's Emergency Rate Hike: How It Impacts State Farm Policyholders. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Launched Into State Officials Rome Trip Funded By Regulated Companies

May 17, 2025

Investigation Launched Into State Officials Rome Trip Funded By Regulated Companies

May 17, 2025 -

Italy Through Food Stanley Tuccis Nat Geo Culinary Series

May 17, 2025

Italy Through Food Stanley Tuccis Nat Geo Culinary Series

May 17, 2025 -

Alleged Nightclub Assault Chris Brown Charged In London

May 17, 2025

Alleged Nightclub Assault Chris Brown Charged In London

May 17, 2025 -

Victoria Cross Recipient Ben Roberts Smiths Defamation Case Appeal Denied

May 17, 2025

Victoria Cross Recipient Ben Roberts Smiths Defamation Case Appeal Denied

May 17, 2025 -

Revolutionizing Olympic Transport La 28s Air Taxi System At Uber Prices

May 17, 2025

Revolutionizing Olympic Transport La 28s Air Taxi System At Uber Prices

May 17, 2025

Latest Posts

-

The Scheme Behind Benicio Del Toros Incredible Gift

May 18, 2025

The Scheme Behind Benicio Del Toros Incredible Gift

May 18, 2025 -

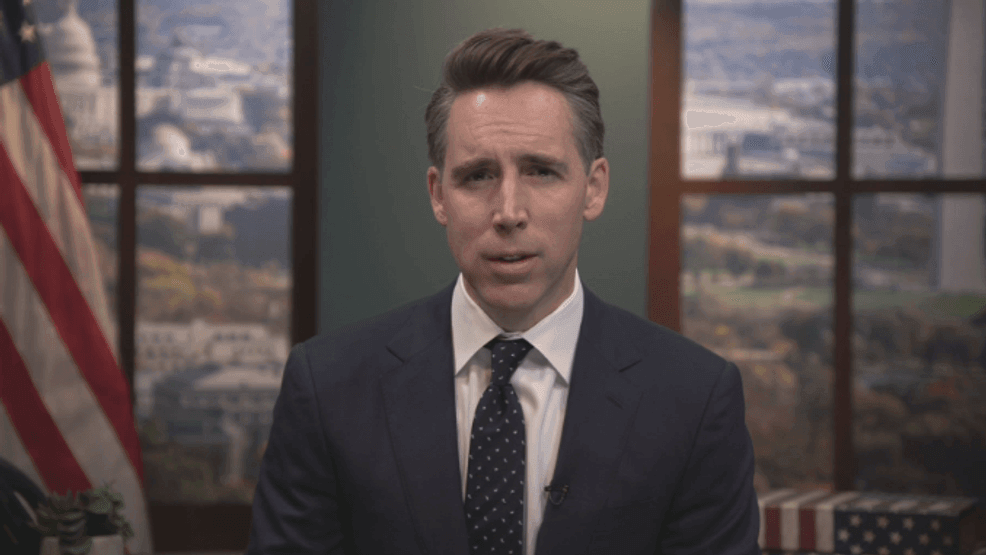

State Farm Allstate Under Scrutiny Senator Hawley Chairs Key Insurance Hearing

May 18, 2025

State Farm Allstate Under Scrutiny Senator Hawley Chairs Key Insurance Hearing

May 18, 2025 -

Ben Roberts Smith Loses War Crimes Defamation Appeal Key Developments Explained

May 18, 2025

Ben Roberts Smith Loses War Crimes Defamation Appeal Key Developments Explained

May 18, 2025 -

La Dodgers Victory Over Oakland Ohtanis Two Homers Rushings Promising Start

May 18, 2025

La Dodgers Victory Over Oakland Ohtanis Two Homers Rushings Promising Start

May 18, 2025 -

Aoc Calls Out Trumps Border Czar The Full Story And Response

May 18, 2025

Aoc Calls Out Trumps Border Czar The Full Story And Response

May 18, 2025