Can Congress Save Social Security? Benefit Reductions Possible By 2034

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Can Congress Save Social Security? Benefit Reductions Loom by 2034

The future of Social Security hangs in the balance. With the Social Security Administration (SSA) projecting the depletion of its trust funds by 2034, the question on everyone's mind is: can Congress save Social Security? The answer, unfortunately, is complex and depends heavily on political will and compromise. Unless significant action is taken, beneficiaries face potential benefit reductions, a prospect causing widespread anxiety among retirees and future retirees alike.

The Looming Crisis: A Closer Look at the 2034 Deadline

The Social Security trust funds, which currently pay out benefits, are projected to be insolvent by 2034. This doesn't mean Social Security will disappear entirely. However, without Congressional intervention, the SSA will only be able to pay approximately 80% of scheduled benefits using incoming revenue. This 20% cut would drastically impact the financial security of millions of Americans relying on Social Security for their retirement income.

The impending crisis stems from a confluence of factors: the aging population, increasing life expectancy, and slower workforce growth. More retirees drawing benefits and fewer workers contributing to the system create a significant funding imbalance.

Possible Solutions: A Balancing Act of Cuts and Increases

Congress has several options to address the looming shortfall, but each presents its own challenges and political hurdles. These broadly fall into two categories: increasing revenue and reducing expenditures.

Increasing Revenue:

- Raising the Social Security tax cap: Currently, Social Security taxes only apply to earnings below a certain threshold. Raising this cap would bring more high-income earners into the system, generating additional revenue. However, this proposal often faces significant opposition from higher-income individuals and their representatives.

- Increasing the Social Security tax rate: A slight increase in the payroll tax rate could also generate substantial additional revenue. However, this option could be unpopular with workers and businesses alike.

Reducing Expenditures:

- Raising the full retirement age: Gradually increasing the age at which individuals can receive full retirement benefits could reduce long-term outlays. However, this measure could disproportionately affect lower-income workers who often have shorter lifespans and fewer savings.

- Adjusting the formula for calculating benefits: The current formula used to calculate benefits could be tweaked to slow the rate of benefit growth. However, this requires careful consideration to avoid unfairly impacting vulnerable populations.

- Reducing benefits for high-earners: This option would target benefits for higher-income recipients, potentially leaving more funds for those who rely more heavily on Social Security. However, this might face political resistance from wealthier demographics.

The Political Landscape: A Roadblock to Reform?

The biggest challenge to reforming Social Security isn't necessarily the lack of viable solutions, but rather the political gridlock in Washington. Bipartisan cooperation is crucial to finding a sustainable solution that addresses the concerns of all stakeholders. However, deeply entrenched political divisions and differing ideologies make reaching a consensus exceptionally difficult.

What You Can Do:

Staying informed about the ongoing debate and contacting your representatives to voice your concerns is crucial. Understanding the potential implications of inaction and advocating for responsible solutions can help shape the future of Social Security. The future of this vital program depends on engaged citizens demanding action from their elected officials. Learn more about Social Security reform at the official Social Security Administration website: [Insert SSA Website Link Here].

Conclusion:

The 2034 deadline for Social Security's trust fund depletion is a serious concern that requires immediate attention. While the potential for benefit reductions is a significant threat, Congress still has time to act and implement solutions to ensure the long-term viability of this critical program. The success of such efforts hinges on political compromise and a commitment to securing the financial future of millions of Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Can Congress Save Social Security? Benefit Reductions Possible By 2034. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

South Jersey Electricity Price Cuts What You Need To Know Before Summer

Jun 20, 2025

South Jersey Electricity Price Cuts What You Need To Know Before Summer

Jun 20, 2025 -

Giants Verlander Bailey Back From Injured List Ready To Pitch

Jun 20, 2025

Giants Verlander Bailey Back From Injured List Ready To Pitch

Jun 20, 2025 -

Mlb 2025 Verlanders Return Marked By Inconsistency Lack Of Wins

Jun 20, 2025

Mlb 2025 Verlanders Return Marked By Inconsistency Lack Of Wins

Jun 20, 2025 -

Bay Area Cities Experiencing Pg And E Power Outages

Jun 20, 2025

Bay Area Cities Experiencing Pg And E Power Outages

Jun 20, 2025 -

Indiana Fever Vs Golden State Valkyries Game Day Prediction Tv Schedule And Streaming Info

Jun 20, 2025

Indiana Fever Vs Golden State Valkyries Game Day Prediction Tv Schedule And Streaming Info

Jun 20, 2025

Latest Posts

-

60 Electric Bill Credit In Nj Summer Savings Program Details And Restrictions

Jun 20, 2025

60 Electric Bill Credit In Nj Summer Savings Program Details And Restrictions

Jun 20, 2025 -

Indiana Fever Vs Valkyries Coach Whites Absence Explained

Jun 20, 2025

Indiana Fever Vs Valkyries Coach Whites Absence Explained

Jun 20, 2025 -

Iran Tensions Tucker Carlson And Ted Cruz Clash In Heated Cnn Confrontation

Jun 20, 2025

Iran Tensions Tucker Carlson And Ted Cruz Clash In Heated Cnn Confrontation

Jun 20, 2025 -

Eleven Dead In Gaza As Israeli Strikes Target Aid Efforts

Jun 20, 2025

Eleven Dead In Gaza As Israeli Strikes Target Aid Efforts

Jun 20, 2025 -

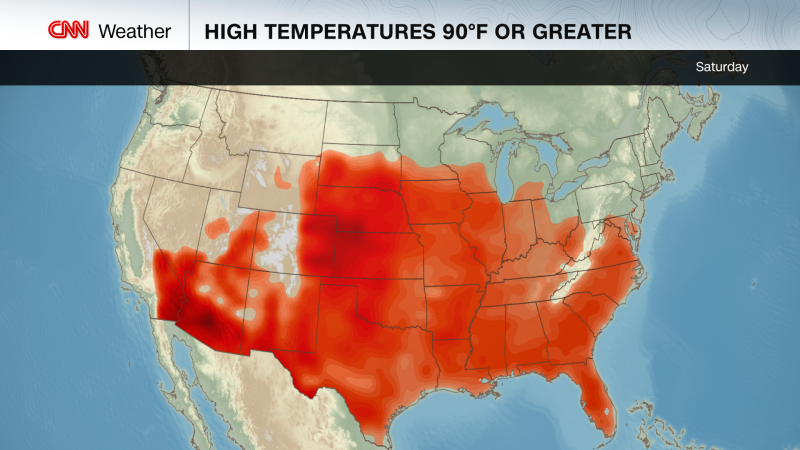

Extreme Heat Warning East Coast Faces Intensifying Heatwave Heat Dome Threat

Jun 20, 2025

Extreme Heat Warning East Coast Faces Intensifying Heatwave Heat Dome Threat

Jun 20, 2025