Capital Gains Tax On Home Sales: Trump's Consideration And Its Market Effects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Capital Gains Tax on Home Sales: Trump's Consideration and its Market Effects

The potential alteration of capital gains taxes on home sales, a topic frequently discussed during Donald Trump's presidency and beyond, continues to spark debate and uncertainty within the real estate market. Understanding the implications of such changes is crucial for both homeowners and investors. This article delves into the complexities of this issue, exploring Trump's proposed changes and their potential impact on the housing market.

Trump's Stance on Capital Gains Tax and Housing:

During his time in office, Donald Trump expressed interest in reforming the capital gains tax system. While he didn't propose a specific plan solely targeting the primary residence exclusion, his broader tax proposals indirectly impacted homeowners. His focus was often on reducing tax rates across the board, which could have potentially lowered the tax burden for those selling homes for a significant profit. However, no sweeping changes directly impacting the $250,000 (single filer) / $500,000 (married couple filing jointly) exclusion for capital gains on the sale of a primary residence were enacted.

Understanding Capital Gains Tax on Home Sales:

Capital gains tax applies to the profit realized from selling an asset, including a home, for more than its purchase price. The current law allows homeowners to exclude a substantial portion of their profit from taxation, providing a significant tax advantage. This exclusion is meant to encourage homeownership and mobility. However, exceeding this exclusion threshold results in taxation of the profit at the applicable capital gains tax rate.

Potential Market Effects of Changes:

Any significant alteration to the capital gains tax exclusion for home sales could have far-reaching consequences:

- Increased Housing Prices: If the exclusion were reduced or eliminated, many homeowners might be less willing to sell, potentially leading to a decrease in housing inventory and, consequently, higher prices. This is particularly relevant in already competitive markets.

- Reduced Housing Mobility: Higher capital gains taxes could discourage individuals from relocating for job opportunities or other life changes. The financial burden of selling a home and paying substantial taxes could significantly limit mobility.

- Impact on Investment Properties: Changes could also affect the investment property market, influencing investor decisions regarding buying, selling, and holding properties. Increased tax burdens might reduce investment activity.

- Shift in Market Dynamics: The changes could disproportionately impact certain demographics, such as older homeowners with significant home equity. This could lead to a shift in the typical homeowner profile.

Current Landscape and Future Outlook:

While Trump's administration didn't enact major changes to the capital gains tax on home sales, the debate continues. Policy discussions about affordable housing, tax reform, and economic stimulus regularly revisit the implications of adjusting this key element of the tax code. Future legislative actions could potentially alter the current landscape, making it essential for homeowners and investors to stay informed.

What Homeowners Should Do:

Staying informed about potential tax law changes is crucial. Consult with a qualified tax advisor to understand your specific circumstances and plan accordingly. Understanding the implications of capital gains tax on your personal financial situation is key to making informed decisions regarding buying, selling, or refinancing your home.

Further Research:

For more in-depth information, consult resources like the IRS website [link to IRS website] and publications from reputable financial planning organizations.

Disclaimer: This article provides general information and does not constitute financial or legal advice. Consult with a qualified professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Capital Gains Tax On Home Sales: Trump's Consideration And Its Market Effects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Guardians Manager Stephen Vogt On 50 50 Season Stretch Exclusive Video Interview

Jul 25, 2025

Guardians Manager Stephen Vogt On 50 50 Season Stretch Exclusive Video Interview

Jul 25, 2025 -

Luckin Coffee The Chinese Coffee Chain Now Brewing In America

Jul 25, 2025

Luckin Coffee The Chinese Coffee Chain Now Brewing In America

Jul 25, 2025 -

Space X Launches Another 24 Starlink Satellites Into Polar Orbit

Jul 25, 2025

Space X Launches Another 24 Starlink Satellites Into Polar Orbit

Jul 25, 2025 -

Gaza Crisis Deepens Famine Fears Rise Aid Official Says

Jul 25, 2025

Gaza Crisis Deepens Famine Fears Rise Aid Official Says

Jul 25, 2025 -

Mcus Fantastic Four Post Credits Scene Leak Sparks Online Buzz

Jul 25, 2025

Mcus Fantastic Four Post Credits Scene Leak Sparks Online Buzz

Jul 25, 2025

Latest Posts

-

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025 -

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

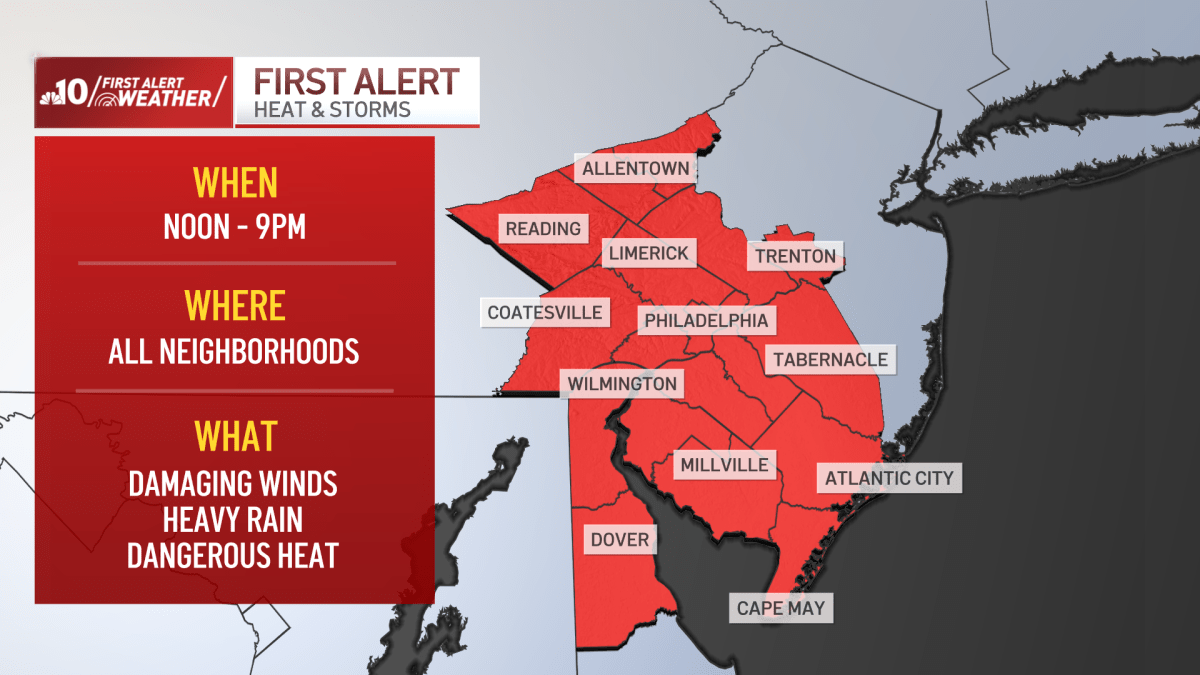

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025