Car Finance Mis-selling: Are You Eligible For Compensation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Car Finance Mis-selling: Are You Eligible for Compensation?

Are you struggling with car finance payments? Do you suspect you were mis-sold your car finance agreement? You're not alone. Thousands of people across the UK have been affected by car finance mis-selling, and you might be entitled to significant compensation.

The car finance industry is vast, offering a range of products from Hire Purchase (HP) and Personal Contract Purchase (PCP) to loans secured against your vehicle. However, aggressive sales tactics and a lack of transparency have led to widespread mis-selling, leaving consumers trapped in unfair agreements.

What constitutes car finance mis-selling?

Mis-selling can take many forms, including:

- Failure to adequately explain the terms and conditions: Were you fully aware of the interest rates, fees, and penalties associated with your agreement? Were these explained clearly and concisely, or were you pressured into signing without a thorough understanding?

- Misrepresentation of the APR (Annual Percentage Rate): Were you given a misleadingly low APR, or were crucial fees excluded from the calculation, making the true cost significantly higher?

- Incorrect affordability assessments: Did the lender adequately assess your financial situation before approving your application? Were your income and expenses properly considered, or were you approved despite obvious affordability issues?

- Pressure selling tactics: Were you pressured into signing an agreement without sufficient time to consider your options? Did the salesperson use aggressive or misleading tactics to secure your business?

- Hidden fees and charges: Were there unexpected fees or charges added to your agreement that weren't clearly explained upfront?

Signs you may have been mis-sold car finance:

- Struggling to make payments: Are your monthly payments unaffordable, leading to financial hardship?

- Unexpected fees and charges: Are you facing unexpected charges or penalties you weren't aware of?

- Feeling pressured during the sales process: Do you recall feeling pressured or rushed into making a decision?

- Lack of understanding of the agreement: Do you feel you didn't fully understand the terms and conditions of your agreement at the time of signing?

What to do if you think you've been mis-sold car finance:

- Gather your documentation: Collect your finance agreement, any correspondence with the lender, and any evidence of the sales process.

- Review your agreement carefully: Pay close attention to the terms and conditions, interest rates, fees, and penalties.

- Contact the lender: Explain your concerns to the lender and request a review of your agreement.

- Seek independent advice: Consider consulting a solicitor specialising in consumer finance law or a claims management company experienced in car finance mis-selling cases. They can assess your situation and advise you on the best course of action.

- Consider making a formal complaint: If your complaint is not resolved by the lender, you can escalate it to the Financial Ombudsman Service (FOS).

How much compensation could you receive?

The amount of compensation you can receive will depend on the specifics of your case, including the extent of the mis-selling and the financial losses you've suffered. This could include:

- Refund of excess interest and fees: You may be entitled to a refund of any excess interest or fees you've paid due to mis-selling.

- Compensation for financial distress: You may be able to claim compensation for the financial distress caused by the mis-selling, such as stress, anxiety, and missed opportunities.

Don't suffer in silence. If you suspect you've been mis-sold car finance, take action today. Your rights are important, and you deserve to be treated fairly. For further information and to find resources that can help, consider visiting the . Remember to always seek professional advice before making any legal decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Car Finance Mis-selling: Are You Eligible For Compensation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Pattinson As Batman James Gunn Clarifies Dcu Plans

Aug 03, 2025

No Pattinson As Batman James Gunn Clarifies Dcu Plans

Aug 03, 2025 -

Cambios Politicos En El Salvador Mandatos Presidenciales De 6 Anos Y Reeleccion Sin Limite

Aug 03, 2025

Cambios Politicos En El Salvador Mandatos Presidenciales De 6 Anos Y Reeleccion Sin Limite

Aug 03, 2025 -

Did You Win Check The Mega Millions Numbers For August 1st 140 M

Aug 03, 2025

Did You Win Check The Mega Millions Numbers For August 1st 140 M

Aug 03, 2025 -

Pentagon To Test Golden Dome Missile Defense System Ahead Of 2028 Election

Aug 03, 2025

Pentagon To Test Golden Dome Missile Defense System Ahead Of 2028 Election

Aug 03, 2025 -

Dexters Return Analyzing Performance Anxiety In Resurrection

Aug 03, 2025

Dexters Return Analyzing Performance Anxiety In Resurrection

Aug 03, 2025

Latest Posts

-

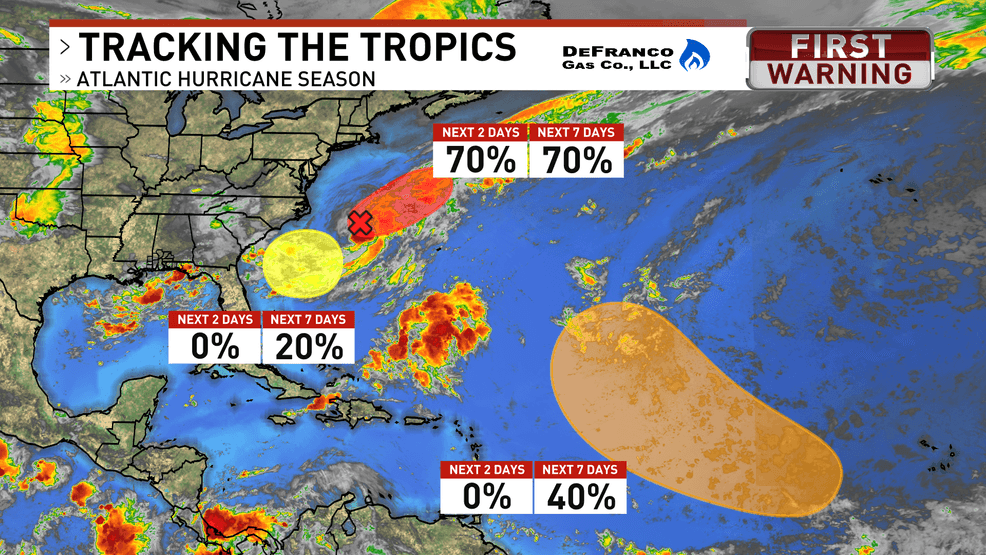

Tropics Awaken A Late Start To The 2025 Hurricane Season

Aug 05, 2025

Tropics Awaken A Late Start To The 2025 Hurricane Season

Aug 05, 2025 -

Competition Ends Tyler Loop Wins Kicker Position In Camp

Aug 05, 2025

Competition Ends Tyler Loop Wins Kicker Position In Camp

Aug 05, 2025 -

Uncover The Beauty Of Town Name A Scenic Upstate New York Destination

Aug 05, 2025

Uncover The Beauty Of Town Name A Scenic Upstate New York Destination

Aug 05, 2025 -

August 4th Nyt Connections Puzzle 785 Complete Solutions

Aug 05, 2025

August 4th Nyt Connections Puzzle 785 Complete Solutions

Aug 05, 2025 -

The Crucial Choice 35 Runs Or 4 Wickets In Cricket Strategy

Aug 05, 2025

The Crucial Choice 35 Runs Or 4 Wickets In Cricket Strategy

Aug 05, 2025