Car Loan Interest Deduction 2024: Eligibility Requirements Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Car Loan Interest Deduction 2024: Eligibility Requirements Explained

Are you considering buying a new car in 2024 and wondering about potential tax savings? Understanding the intricacies of the car loan interest deduction can significantly impact your financial planning. While there isn't a specific "car loan interest deduction" in the same way there might be for mortgage interest, the rules surrounding interest deductions can still apply to car loans under certain circumstances. This article will clarify the eligibility requirements and help you determine if you qualify for any tax benefits.

The Truth About Car Loan Interest Deductibility

It's crucial to understand upfront: The interest you pay on a car loan is generally not directly deductible. Unlike mortgage interest, which often falls under itemized deductions for homeowners, car loan interest doesn't have a dedicated tax break. However, there's a crucial exception: if the loan is used for business purposes.

Business Use: The Key to Deductibility

The IRS allows deductions for interest paid on loans used for business activities. This means if you're using your car primarily for your business (e.g., a salesperson using their car for client visits, a contractor using their truck for job sites), a portion of your car loan interest might be deductible. The amount you can deduct is directly proportional to the business use percentage of your vehicle.

Determining Business Use Percentage:

Accurately tracking your business use is vital. Keep meticulous records of your mileage. You can use a mileage log to track both business and personal miles driven. The business use percentage is calculated as:

(Business Miles / Total Miles) x 100%

This percentage then applies to the total interest paid on your car loan for the tax year.

H2: Eligibility Requirements for Business-Related Car Loan Interest Deduction

To claim the deduction, you must meet several conditions:

- Business Use: As stated above, your vehicle must be used predominantly for business purposes. The IRS scrutinizes this aspect, so maintaining accurate records is paramount.

- Self-Employment or Business Ownership: You must be self-employed or own a business that utilizes the vehicle. Employees using their personal vehicles for work generally cannot deduct car loan interest.

- Proper Documentation: Keep all loan documents, including the loan agreement, interest payment statements, and your detailed mileage log. This documentation is crucial for an IRS audit.

- Itemized Deductions: You must itemize your deductions on your tax return rather than using the standard deduction. This is because interest expense is an itemized deduction.

H2: What if I use my car for both business and personal use?

If your vehicle serves both business and personal purposes, you can only deduct the portion of the interest expense attributable to business use. This is calculated using the business use percentage determined by your mileage log.

H2: Seeking Professional Tax Advice

The rules surrounding business expenses and tax deductions can be complex. For a comprehensive understanding of your specific situation and to ensure you maximize your tax benefits, consider consulting with a qualified tax professional or accountant. They can provide personalized guidance based on your individual circumstances and help you navigate the complexities of the tax code.

H2: Key Takeaways

- Car loan interest is generally not deductible unless used for business purposes.

- Accurate record-keeping of business mileage is crucial.

- Consult a tax professional for personalized advice.

This information is for general guidance only and should not be considered tax advice. Consult with a qualified tax advisor for specific guidance regarding your tax situation. Remember to always keep meticulous records to support your deductions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Car Loan Interest Deduction 2024: Eligibility Requirements Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Houthis Attack Second Red Sea Cargo Ship Sunk In A Week

Jul 11, 2025

Houthis Attack Second Red Sea Cargo Ship Sunk In A Week

Jul 11, 2025 -

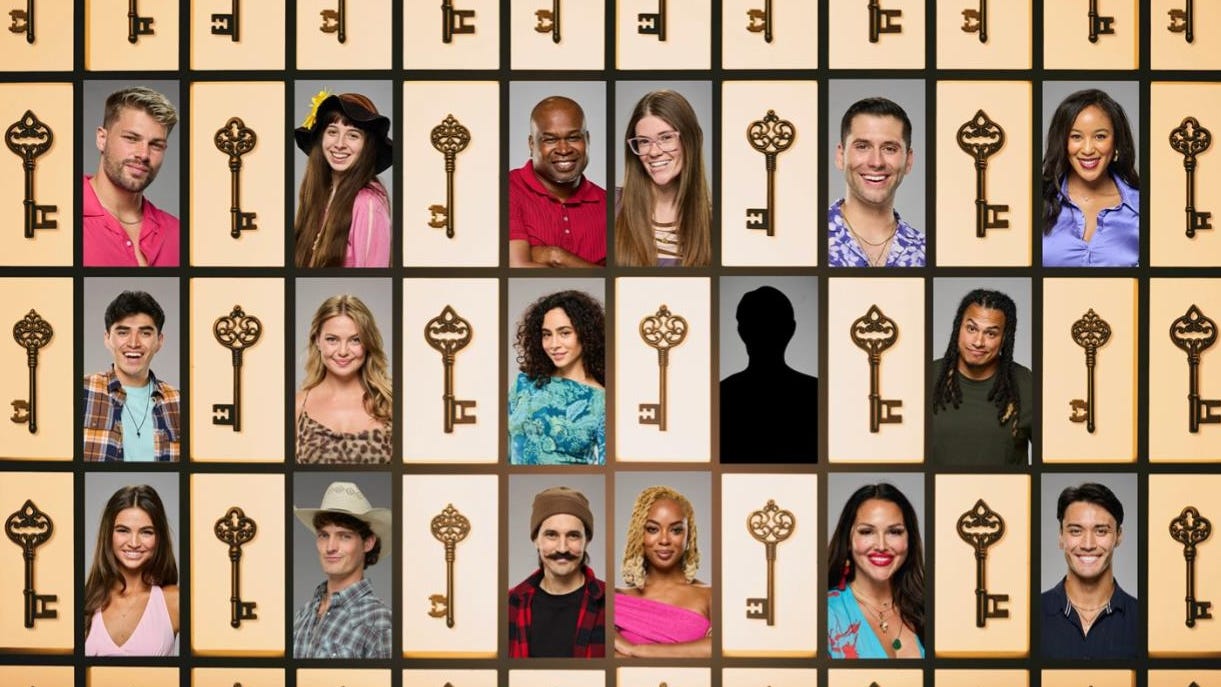

Big Brother 27 Cast Revealed Meet The Players

Jul 11, 2025

Big Brother 27 Cast Revealed Meet The Players

Jul 11, 2025 -

Southport Incident Public Inquiry Underway Families Demand Transparency

Jul 11, 2025

Southport Incident Public Inquiry Underway Families Demand Transparency

Jul 11, 2025 -

Good Samaritans Kindness Puts Him In Killer Drivers Path The Chris Marriott Story

Jul 11, 2025

Good Samaritans Kindness Puts Him In Killer Drivers Path The Chris Marriott Story

Jul 11, 2025 -

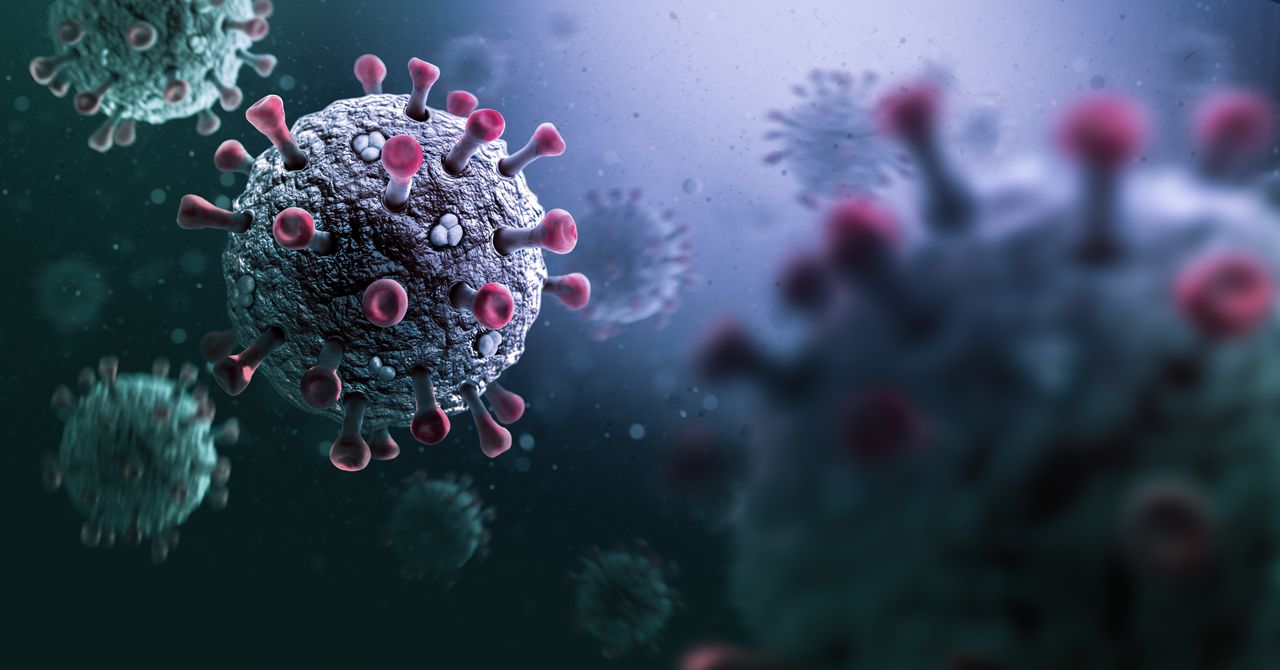

Stratus Covid Variant Symptoms Transmission And Prevention

Jul 11, 2025

Stratus Covid Variant Symptoms Transmission And Prevention

Jul 11, 2025

Latest Posts

-

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025 -

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025