Car Loan Interest Deduction 2024: Qualification Requirements Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Car Loan Interest Deduction 2024: Qualification Requirements Explained

Are you considering buying a new car in 2024 and wondering if you can deduct the interest you pay on your car loan? The answer isn't a simple yes or no. While the ability to deduct car loan interest was significantly curtailed years ago, understanding the nuances of the current tax laws is crucial to maximizing your tax benefits. This comprehensive guide breaks down the qualification requirements for a car loan interest deduction in 2024.

The Reality Check: No Direct Car Loan Interest Deduction

First, let's address the elephant in the room: There's no longer a direct deduction for interest paid on car loans for personal use vehicles. The ability to deduct interest on car loans largely disappeared with the Tax Cuts and Jobs Act of 2017. This means you can't simply itemize your car loan interest on your tax return and expect a reduction in your tax bill.

However, There's a Potential Loophole: Home Equity Loans and Lines of Credit

While you can't deduct interest directly from a car loan, there's a potential workaround. If you used a home equity loan or a home equity line of credit (HELOC) to finance your car purchase, a portion of the interest you pay might be deductible. This is because home equity loan interest is often deductible, but only up to the amount of equity in your home.

Qualification Requirements for Home Equity Loan Interest Deduction:

To deduct interest paid on a home equity loan or HELOC used for a car purchase, you must meet these criteria:

- The loan must be secured by your primary residence or a second home. This means the loan is backed by the value of your property.

- The loan must be used to substantially improve your home or for other qualified expenses. While purchasing a car is not considered a home improvement, some argue that using a home equity loan for a car is deductible if the car purchase is related to improving your business or job-related travel (this is a gray area and requires careful consideration of IRS guidelines). Consult a tax professional for guidance in this situation.

- You must itemize your deductions on your tax return. The standard deduction might be higher than your itemized deductions, making itemizing less beneficial.

- Your total home equity debt cannot exceed the fair market value of your home.

Important Considerations:

- Consult a Tax Professional: The rules surrounding home equity loans and tax deductions are complex. It's highly recommended to consult with a qualified tax advisor or CPA to determine your eligibility and ensure you comply with all IRS regulations. Their expertise can help navigate the intricacies and prevent costly mistakes.

- Record Keeping: Meticulous record-keeping is essential. Maintain accurate records of your loan documents, interest payments, and any expenses related to your home equity loan. This will be crucial during tax season.

- Tax Laws Change: Tax laws are subject to change. Stay informed about any updates to the IRS guidelines regarding home equity loans and interest deductions.

Alternatives to Consider:

If you cannot utilize a home equity loan for deductibility, consider exploring other financing options. Shop around for the best interest rates on your car loan to minimize your overall interest payments.

In conclusion, while a direct car loan interest deduction is no longer available, understanding the potential for deductions through home equity loans requires careful consideration of your financial situation and consultation with a qualified tax professional. Remember to always prioritize accurate record-keeping and stay updated on current tax laws. Don't hesitate to reach out to a financial advisor for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Car Loan Interest Deduction 2024: Qualification Requirements Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Justice Department Whistleblower Unveiling The Reasons Behind The Betrayal

Jul 11, 2025

Justice Department Whistleblower Unveiling The Reasons Behind The Betrayal

Jul 11, 2025 -

Bidens Physician Deflects Questions On Trumps Mental State In House Investigation

Jul 11, 2025

Bidens Physician Deflects Questions On Trumps Mental State In House Investigation

Jul 11, 2025 -

Waddell Gets The Ball Mets Game Two Starter Announced

Jul 11, 2025

Waddell Gets The Ball Mets Game Two Starter Announced

Jul 11, 2025 -

After Ice Release Mahmoud Khalil Seeks 20 Million In Damages From Trump Administration

Jul 11, 2025

After Ice Release Mahmoud Khalil Seeks 20 Million In Damages From Trump Administration

Jul 11, 2025 -

Syast Hay Nadrst Mhajrty Thdydy Bray Amnyt Mly Ayran

Jul 11, 2025

Syast Hay Nadrst Mhajrty Thdydy Bray Amnyt Mly Ayran

Jul 11, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

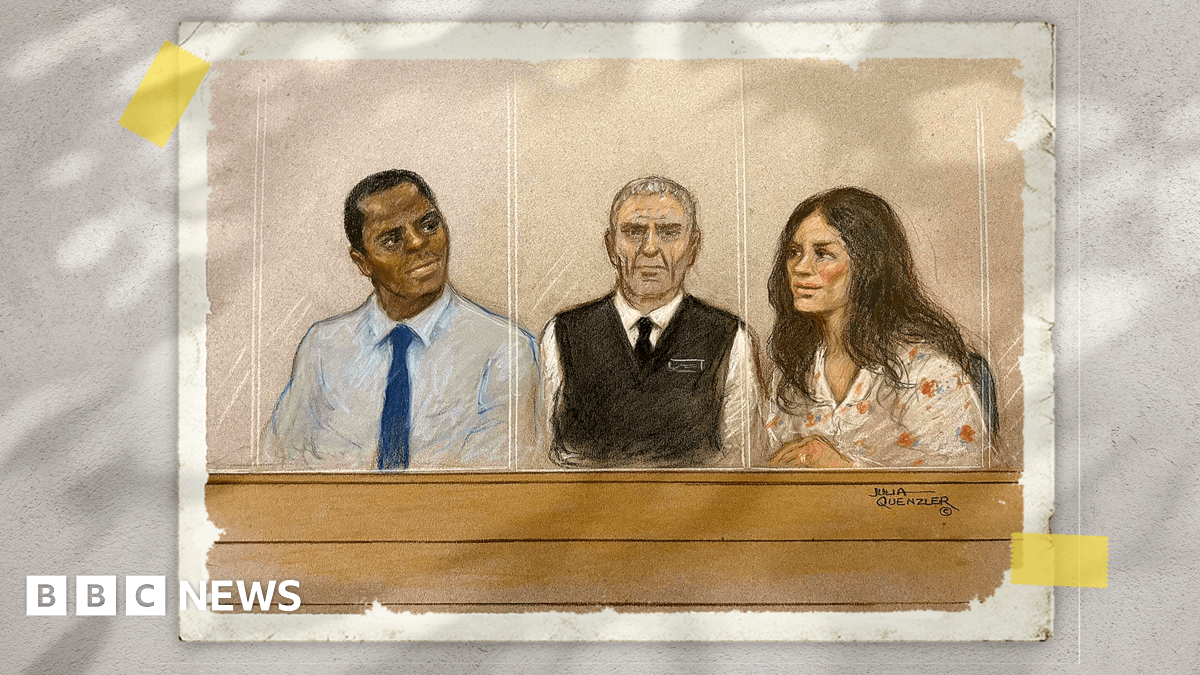

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

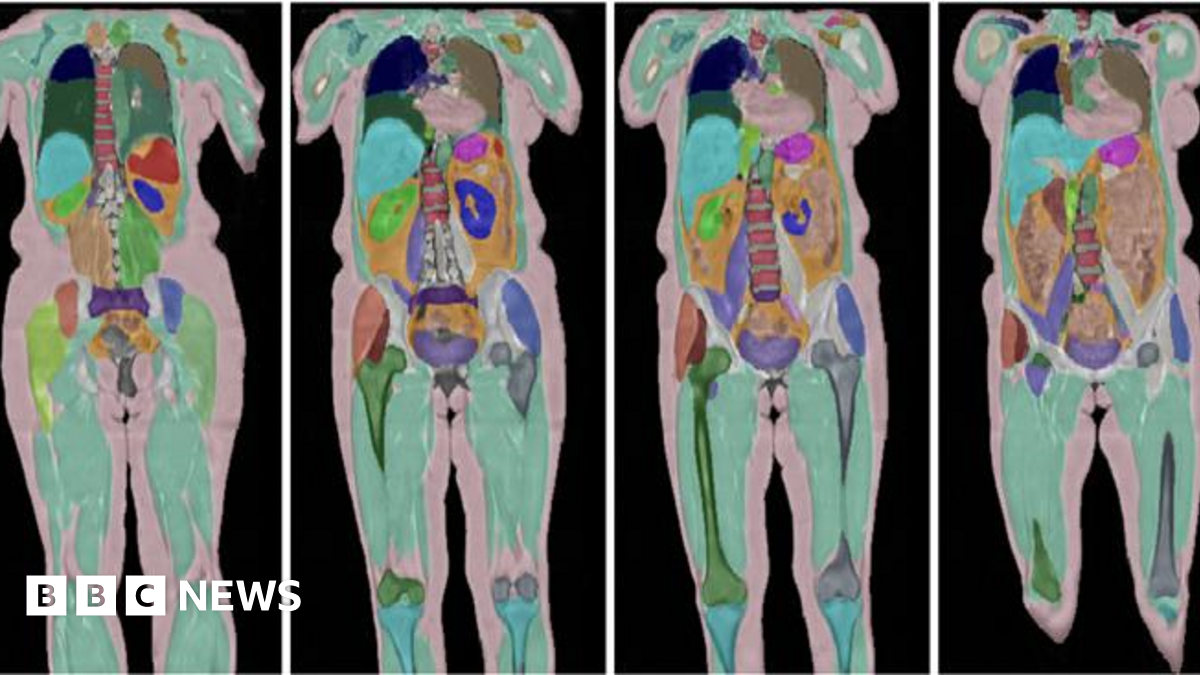

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025