Coca-Cola Company (KO): Investor Interest And Stock Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coca-Cola Company (KO): Investor Interest and Stock Performance Surge Amidst Positive Earnings

The Coca-Cola Company (KO) has seen a recent surge in investor interest, driven by strong second-quarter earnings that exceeded analysts' expectations. This renewed confidence in the beverage giant is reflected in its improved stock performance, making it a compelling topic for investors and market analysts alike. Let's delve into the factors contributing to this positive trend.

Strong Q2 Earnings Fuel Investor Optimism

Coca-Cola's Q2 2024 earnings report revealed robust growth across key metrics. The company reported a significant increase in both revenue and earnings per share (EPS), surpassing Wall Street projections. This outperformance stemmed from a combination of factors, including strong pricing power, increased demand for its flagship products, and effective cost management strategies. The company's ability to navigate inflationary pressures while maintaining profitability impressed investors, signaling a resilient business model.

Global Demand Remains Robust

A key driver of Coca-Cola's success is the continued global demand for its diverse beverage portfolio. While some regions experienced minor fluctuations, overall sales volume remained strong, demonstrating the enduring appeal of its brands across different markets. This broad-based growth highlights the company's effective marketing and distribution strategies, reinforcing its position as a global leader in the beverage industry.

Strategic Investments Pay Off

Coca-Cola's strategic investments in innovation and brand building are also contributing to its positive performance. The company continues to expand its product offerings, introducing new flavors, healthier options, and innovative packaging to cater to evolving consumer preferences. These initiatives are paying off, attracting new customers and strengthening loyalty among existing ones.

Stock Performance Reflects Positive Sentiment

The positive Q2 results have translated into a significant boost in Coca-Cola's stock price. Investors are reacting favorably to the company's strong financial performance and promising outlook, driving increased demand for KO shares. This upward trend suggests a growing confidence in Coca-Cola's long-term growth potential.

Challenges Remain, But Outlook Remains Positive

While the outlook for Coca-Cola is generally positive, it's important to acknowledge the challenges the company faces. These include ongoing inflationary pressures, geopolitical uncertainties, and the ever-evolving consumer landscape. However, Coca-Cola's proven ability to adapt and innovate positions it well to navigate these hurdles.

What's Next for KO?

Analysts predict continued growth for Coca-Cola in the coming quarters, driven by consistent demand, strategic investments, and effective cost management. While short-term market fluctuations are always possible, the long-term outlook for KO remains optimistic. The company's strong brand recognition, diverse portfolio, and global reach provide a solid foundation for future success.

Investing in KO: Considerations for Investors

Before investing in Coca-Cola (KO) or any other stock, it's crucial to conduct thorough research and consider your individual risk tolerance and financial goals. Consulting with a qualified financial advisor can provide valuable insights and guidance. Remember that past performance is not indicative of future results.

Keywords: Coca-Cola, KO, stock performance, investor interest, earnings report, Q2 earnings, beverage industry, stock price, investment, financial markets, market analysis, global demand, brand recognition, inflation, consumer preferences, financial advisor, risk tolerance.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing involves risk, and you could lose money. Always conduct your own research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coca-Cola Company (KO): Investor Interest And Stock Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Inflations Unexpected Winner Dollar Generals Rise Amidst Tariff Hikes

Jun 05, 2025

Inflations Unexpected Winner Dollar Generals Rise Amidst Tariff Hikes

Jun 05, 2025 -

Geert Wilders And The Fall Of The Dutch Coalition What Happens Next

Jun 05, 2025

Geert Wilders And The Fall Of The Dutch Coalition What Happens Next

Jun 05, 2025 -

Revealed Glastonbury 2025 Full Lineup Stage Schedule And Surprise Performances

Jun 05, 2025

Revealed Glastonbury 2025 Full Lineup Stage Schedule And Surprise Performances

Jun 05, 2025 -

Dollar Generals Growth Amidst Rising Tariffs And Consumer Pressure

Jun 05, 2025

Dollar Generals Growth Amidst Rising Tariffs And Consumer Pressure

Jun 05, 2025 -

Berkshire Hathaway Sells 39 Of Bank Of America Stake Buffetts Big Move

Jun 05, 2025

Berkshire Hathaway Sells 39 Of Bank Of America Stake Buffetts Big Move

Jun 05, 2025

Latest Posts

-

China Japan Relations The Unresolved Trauma Of The Nanjing Massacre

Aug 17, 2025

China Japan Relations The Unresolved Trauma Of The Nanjing Massacre

Aug 17, 2025 -

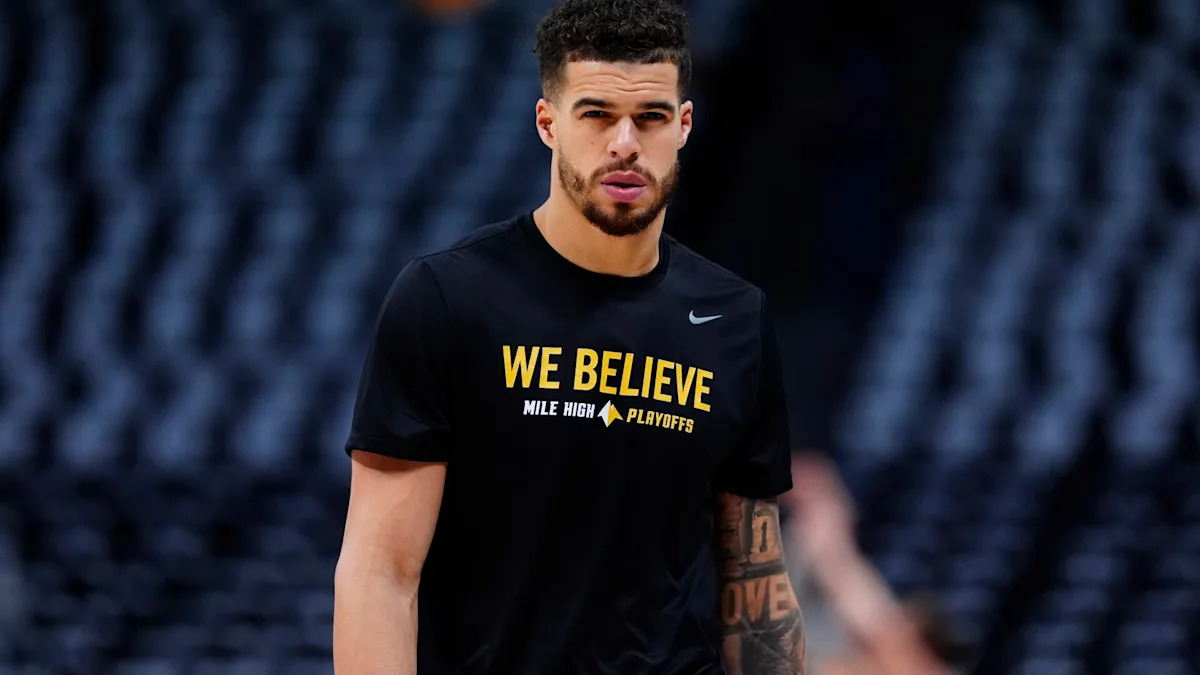

Nba Star Michael Porter Jr Sounds Alarm On Sports Bettings Influence

Aug 17, 2025

Nba Star Michael Porter Jr Sounds Alarm On Sports Bettings Influence

Aug 17, 2025 -

Intriguing New Series Claire Danes And Matthew Rhys Star In The Beast In Me

Aug 17, 2025

Intriguing New Series Claire Danes And Matthew Rhys Star In The Beast In Me

Aug 17, 2025 -

Rising Imported Measles Cases Prompt South Korea Travel Vaccination Urge

Aug 17, 2025

Rising Imported Measles Cases Prompt South Korea Travel Vaccination Urge

Aug 17, 2025 -

Halsey Revives Badlands Official Music Videos For Popular Tracks Coming Soon

Aug 17, 2025

Halsey Revives Badlands Official Music Videos For Popular Tracks Coming Soon

Aug 17, 2025