Coca-Cola (KO): A Deep Dive Into The Company's Investment Appeal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coca-Cola (KO): A Deep Dive into the Company's Investment Appeal

Coca-Cola (KO) – the name itself evokes images of refreshing fizzy drinks and a global brand synonymous with happiness. But beyond the iconic imagery, lies a compelling investment story for discerning investors. This deep dive explores the factors that make Coca-Cola an attractive investment, analyzing its strengths, weaknesses, and future potential.

A Dividend King's Consistent Performance

One of the most significant draws for investors is Coca-Cola's status as a Dividend King. For decades, the company has consistently increased its dividend payouts, demonstrating a commitment to rewarding shareholders. This track record of reliable dividend growth makes KO a popular choice for income-seeking investors. [Link to a reliable source on Dividend Kings]. This stability, even amidst market volatility, provides a sense of security often lacking in other sectors.

Strong Brand Recognition and Global Reach:

Coca-Cola boasts unparalleled brand recognition globally. Few companies can match its iconic status and widespread consumer appeal. This strong brand equity translates into significant pricing power and resilience against competitive pressures. The company's vast distribution network, spanning across nearly every corner of the globe, further solidifies its market dominance. This global reach mitigates risks associated with dependence on any single market.

Diversification Beyond Soda:

While Coca-Cola's flagship soda remains a cornerstone of its business, the company has actively diversified its portfolio. Investments in sparkling water brands like Topo Chico and expanding into healthier beverage options demonstrate a strategic shift towards adapting to evolving consumer preferences and health trends. This diversification reduces reliance on carbonated soft drinks and positions the company for growth in the long term.

Challenges and Risks to Consider:

Despite its strengths, Coca-Cola isn't without its challenges. Increasing health consciousness among consumers poses an ongoing threat. Government regulations on sugary drinks, coupled with rising health concerns, present headwinds that the company must navigate effectively. Furthermore, competition within the beverage industry remains fierce, with both established players and innovative startups vying for market share. Understanding these risks is crucial for any potential investor.

Analyzing the Financials:

A thorough assessment of Coca-Cola's financial statements is crucial. Investors should consider factors such as revenue growth, profit margins, debt levels, and cash flow. Regularly reviewing analyst reports and financial news related to KO can provide valuable insights into the company's financial health and future prospects. [Link to a reputable financial news source].

Is Coca-Cola Right for Your Portfolio?

Coca-Cola's investment appeal hinges on the individual investor's risk tolerance and investment goals. Its consistent dividend payouts and strong brand recognition offer stability and income, making it attractive for conservative investors. However, potential investors should carefully weigh the risks associated with the changing consumer preferences and competitive pressures before making any investment decisions.

Key Takeaways:

- Strong Dividend History: Coca-Cola is a Dividend King with a long track record of dividend increases.

- Global Brand Recognition: Unparalleled brand recognition provides significant competitive advantage.

- Diversification Efforts: The company is actively expanding beyond its core soda offerings.

- Challenges Exist: Health concerns and competition remain significant headwinds.

- Due Diligence is Crucial: Thorough research and understanding of financial statements are vital.

Ultimately, the decision to invest in Coca-Cola is a personal one. This analysis aims to provide a comprehensive overview of the key factors to consider, empowering investors to make informed decisions based on their individual circumstances and risk profiles. Remember to consult with a financial advisor before making any significant investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coca-Cola (KO): A Deep Dive Into The Company's Investment Appeal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jessie J Announces Breast Cancer Diagnosis A Powerful Message Of Hope

Jun 06, 2025

Jessie J Announces Breast Cancer Diagnosis A Powerful Message Of Hope

Jun 06, 2025 -

New Black Panther Revealed Marvels Controversial Choice Explained

Jun 06, 2025

New Black Panther Revealed Marvels Controversial Choice Explained

Jun 06, 2025 -

Expert Testimony On Video Evidence Impacts Sean Combs Case

Jun 06, 2025

Expert Testimony On Video Evidence Impacts Sean Combs Case

Jun 06, 2025 -

Villanovas Future After Leaving The Colonial Athletic Association Caa Football

Jun 06, 2025

Villanovas Future After Leaving The Colonial Athletic Association Caa Football

Jun 06, 2025 -

No Feud Walton Goggins And Aimee Lou Wood Clarify Their White Lotus Connection

Jun 06, 2025

No Feud Walton Goggins And Aimee Lou Wood Clarify Their White Lotus Connection

Jun 06, 2025

Latest Posts

-

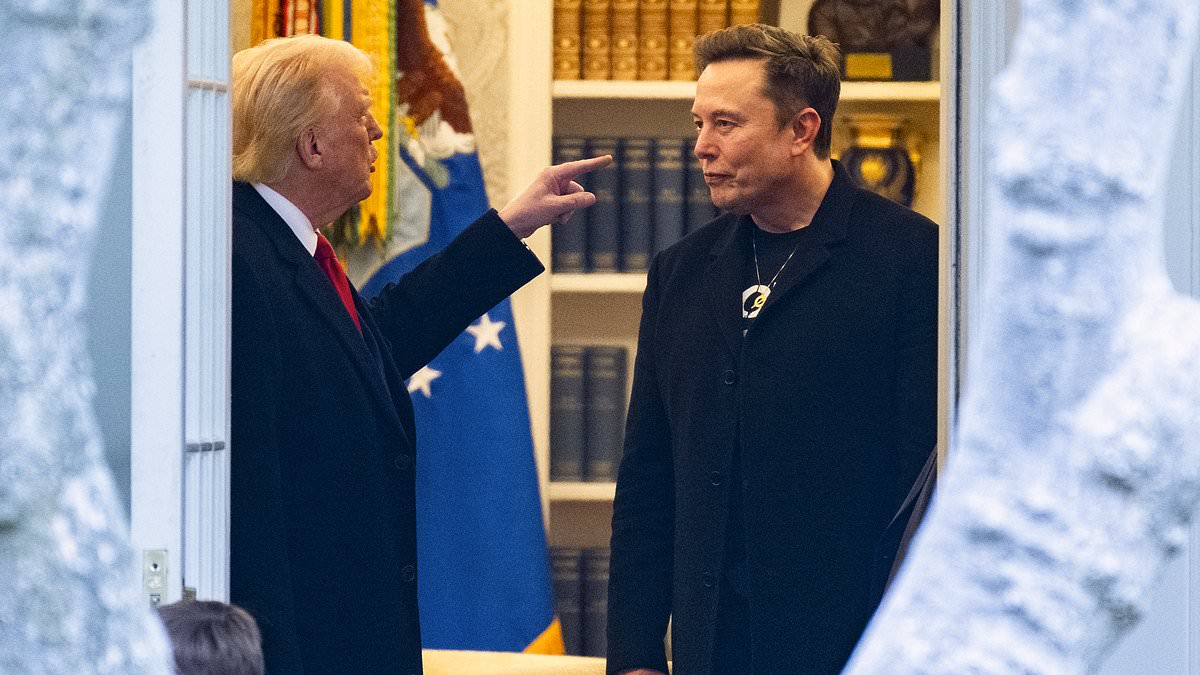

Key Trump Advisor At The Center Of The Presidents Fallout With Elon Musk

Jun 06, 2025

Key Trump Advisor At The Center Of The Presidents Fallout With Elon Musk

Jun 06, 2025 -

Ais Emerging Unpredictable Actions A Ceos Warning

Jun 06, 2025

Ais Emerging Unpredictable Actions A Ceos Warning

Jun 06, 2025 -

Maxwell Anderson Found Guilty Not Guilty Milwaukee Trial Ends

Jun 06, 2025

Maxwell Anderson Found Guilty Not Guilty Milwaukee Trial Ends

Jun 06, 2025 -

Matthew Hussey And Wife Expecting A New Chapter After Camila Cabello Relationship

Jun 06, 2025

Matthew Hussey And Wife Expecting A New Chapter After Camila Cabello Relationship

Jun 06, 2025 -

Actor Steve Guttenberg Takes On Dark Role In New Lifetime Thriller

Jun 06, 2025

Actor Steve Guttenberg Takes On Dark Role In New Lifetime Thriller

Jun 06, 2025