Coca-Cola (KO): Analyzing The Investment Opportunity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coca-Cola (KO): Is the Soda Giant Still a Sweet Investment?

Coca-Cola (KO) – the name conjures images of refreshing fizzy drinks and a global brand synonymous with happiness. But for investors, the question is less about the nostalgic feeling and more about the financial reality: is Coca-Cola still a worthwhile investment in today's market? This in-depth analysis explores the opportunities and challenges facing the beverage giant, helping you determine if KO deserves a place in your portfolio.

H2: A Look at the Fundamentals: More Than Just Soda

While Coca-Cola's iconic sodas remain a significant revenue driver, the company has strategically diversified its portfolio. This diversification is key to understanding its long-term prospects. They've successfully expanded into:

- Still beverages: Water, juices, and teas now represent a significant portion of their sales, catering to the growing health-conscious consumer base. Brands like Dasani and Minute Maid are key players in this segment.

- Global reach: Coca-Cola's extensive global distribution network provides a significant competitive advantage, allowing them to reach billions of consumers worldwide. This broad reach mitigates risk associated with regional economic downturns.

- Focus on efficiency: The company has demonstrated a commitment to streamlining operations and improving efficiency, resulting in cost savings and increased profitability.

H2: Challenges Facing the King of Beverages

Despite its strengths, Coca-Cola faces several challenges:

- Shifting consumer preferences: The growing awareness of sugar consumption and its health implications has led to a decline in soda consumption in many markets. This necessitates continued innovation and diversification into healthier alternatives.

- Competition: The beverage industry is fiercely competitive, with both established players and new entrants vying for market share. This necessitates aggressive marketing and product innovation.

- Geopolitical risks: Operating globally exposes Coca-Cola to various geopolitical risks, including currency fluctuations, political instability, and regulatory changes in different countries.

H3: Analyzing Coca-Cola's Financial Performance

Investors should scrutinize Coca-Cola's financial statements, including:

- Revenue growth: Consistent revenue growth indicates a healthy business model, while declining revenue may signal underlying problems.

- Profit margins: Strong profit margins demonstrate efficiency and pricing power.

- Debt levels: High debt levels can increase financial risk and limit the company's flexibility.

- Dividend payouts: Coca-Cola has a long history of paying dividends, making it attractive to income-oriented investors. However, investors should always evaluate the sustainability of these payouts.

H2: The Investment Outlook: Sweet or Sour?

Coca-Cola's future success hinges on its ability to adapt to evolving consumer preferences and maintain its global leadership position. Its diversification strategy, while promising, requires careful monitoring. The company's strong brand recognition, global reach, and consistent dividend payments make it an appealing investment for some, but the challenges posed by shifting consumer trends and intense competition should not be overlooked.

H3: Before Investing:

Before making any investment decisions, conduct thorough due diligence. Consider consulting a financial advisor to assess your risk tolerance and determine if Coca-Cola aligns with your investment goals. Always diversify your portfolio to mitigate risk. Analyzing recent financial reports and industry trends will provide a more complete picture before investing in Coca-Cola (KO).

H2: Disclaimer: This article provides general information and should not be construed as financial advice. Investing involves risk, and the value of investments can fluctuate.

This article offers a comprehensive overview, utilizing keywords such as "Coca-Cola," "KO," "investment," "stock," "dividend," "beverages," "financial performance," and related terms to improve search engine optimization. Remember to conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coca-Cola (KO): Analyzing The Investment Opportunity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2026 Patriot League Football Lineup Includes Villanova

Jun 06, 2025

2026 Patriot League Football Lineup Includes Villanova

Jun 06, 2025 -

Ryan Gosling For White Black Panther Analyzing The Mcus Casting Possibilities

Jun 06, 2025

Ryan Gosling For White Black Panther Analyzing The Mcus Casting Possibilities

Jun 06, 2025 -

Broadcom Stock Forecast Where Traders See Avgo Going Post Earnings

Jun 06, 2025

Broadcom Stock Forecast Where Traders See Avgo Going Post Earnings

Jun 06, 2025 -

Robinhood Hood Stock Performance 6 46 Increase On June 3rd Causes And Implications

Jun 06, 2025

Robinhood Hood Stock Performance 6 46 Increase On June 3rd Causes And Implications

Jun 06, 2025 -

Robinhood Hood Share Price Jump Understanding The 6 46 June 3rd Surge

Jun 06, 2025

Robinhood Hood Share Price Jump Understanding The 6 46 June 3rd Surge

Jun 06, 2025

Latest Posts

-

Matthew Hussey Expecting First Child With Spouse

Jun 06, 2025

Matthew Hussey Expecting First Child With Spouse

Jun 06, 2025 -

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025 -

Jd Sports 110 Release People Camp Out For Highly Anticipated Sneakers

Jun 06, 2025

Jd Sports 110 Release People Camp Out For Highly Anticipated Sneakers

Jun 06, 2025 -

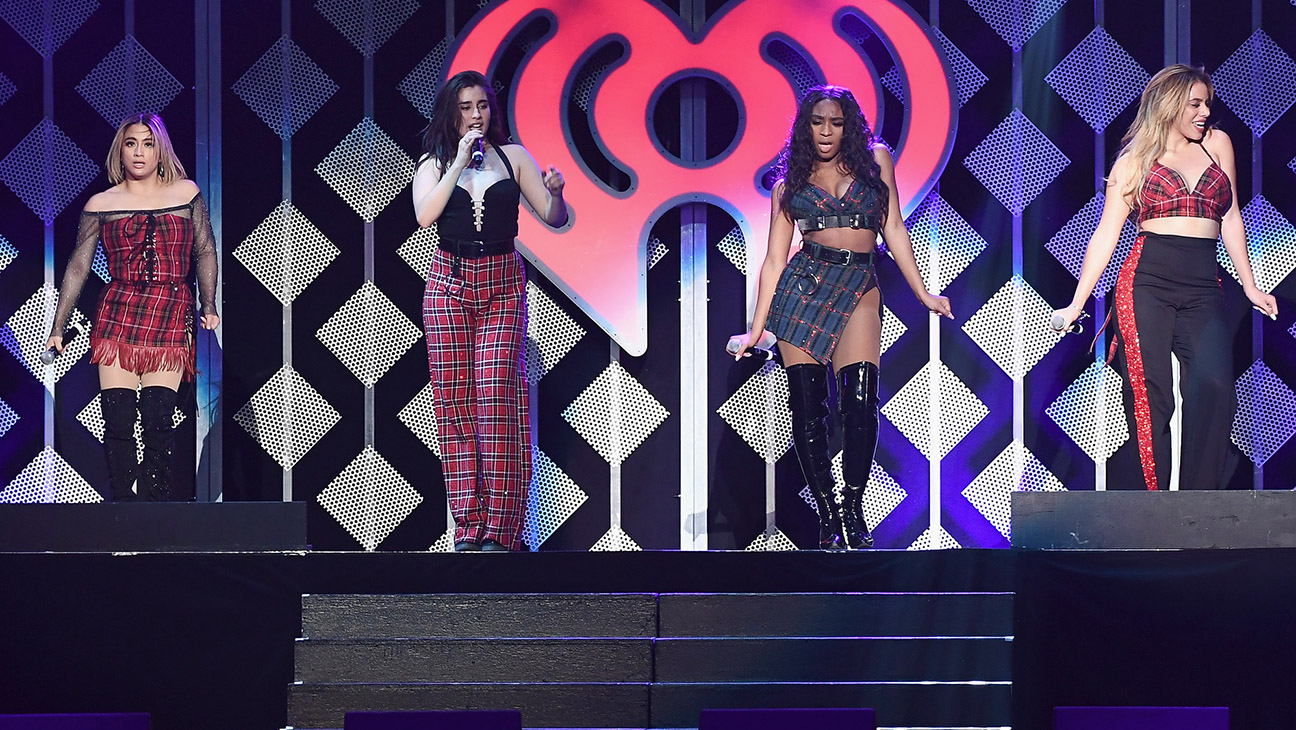

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025

Exclusive Fifth Harmony Minus Camila Discuss Potential Reunion

Jun 06, 2025 -

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025

The Reason Behind Walton Goggins Tearful Instagram Unfollow Of Aimee Lou Wood

Jun 06, 2025