Coca-Cola (KO): Key Factors Driving Investor Attention In 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coca-Cola (KO): Key Factors Driving Investor Attention in 2024

Coca-Cola (KO), a global beverage giant, continues to captivate investor attention in 2024. While facing persistent economic headwinds and evolving consumer preferences, the company demonstrates resilience and strategic adaptability, making it a compelling stock for analysis. Several key factors are driving this ongoing investor interest, prompting both bullish and bearish predictions.

H2: Navigating Inflation and Shifting Consumer Spending

One of the most significant factors impacting Coca-Cola's performance, and indeed the entire consumer staples sector, is inflation. Rising prices for raw materials, packaging, and transportation have squeezed profit margins. Investors are keenly watching how effectively Coca-Cola manages these inflationary pressures while maintaining its pricing power. The company's ability to pass on increased costs to consumers without significantly impacting demand will be crucial for future growth. This requires a delicate balancing act, and its success in this area will be a key indicator for investors throughout 2024.

H2: The Power of Brand Portfolio Diversification

Coca-Cola's impressive portfolio diversification is a major strength. While its flagship Coca-Cola brand remains iconic, the company's investment in a wider range of beverages, including sparkling waters (like Topo Chico), juices, teas (like Gold Peak), and sports drinks (like Powerade), provides a crucial hedge against fluctuating demand for any single product. This diversification strategy mitigates risk and positions the company for growth in various market segments. Investors are increasingly looking beyond the core cola products and evaluating the performance and potential of this broader portfolio.

H3: Growth in Emerging Markets

Emerging markets represent a significant growth opportunity for Coca-Cola. These regions offer expanding consumer bases with rising disposable incomes, presenting substantial potential for increased sales. However, navigating the complexities of these diverse markets, including regulatory hurdles and logistical challenges, is critical. Investors are closely monitoring Coca-Cola's progress in penetrating and capitalizing on these key markets. Success in this area could significantly boost the company's long-term growth trajectory.

H2: Sustainability Initiatives and ESG Concerns

Environmental, Social, and Governance (ESG) factors are increasingly important for investors. Coca-Cola's commitment to sustainability, including reducing its environmental footprint and promoting responsible sourcing, is under scrutiny. Investors are evaluating the company's progress towards its sustainability goals and its overall ESG performance. A strong commitment to ESG principles can attract socially conscious investors and enhance the company's long-term value.

H2: Competition and Innovation

The beverage industry is fiercely competitive. Coca-Cola faces challenges from both established rivals and emerging players. The company's ability to innovate and develop new products that meet evolving consumer preferences, such as healthier options and functional beverages, will be key to maintaining its market share. Investors are assessing Coca-Cola's innovation pipeline and its ability to effectively compete in a dynamic market landscape.

H2: Looking Ahead: What Investors Should Consider

In summary, several key factors are influencing investor sentiment towards Coca-Cola in 2024. Analyzing the company's ability to manage inflation, leverage its diversified portfolio, expand into emerging markets, address ESG concerns, and maintain its competitive edge is crucial for assessing its future performance. While the stock's performance remains subject to market volatility and unforeseen events, understanding these driving forces provides a valuable framework for investors making decisions about Coca-Cola (KO). Further research into quarterly earnings reports and industry analyses is recommended for a comprehensive understanding.

Disclaimer: This article provides general information and should not be considered as financial advice. Consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coca-Cola (KO): Key Factors Driving Investor Attention In 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Goodbye Hamptons Paige De Sorbos Summer House Departure Confirmed

Jun 06, 2025

Goodbye Hamptons Paige De Sorbos Summer House Departure Confirmed

Jun 06, 2025 -

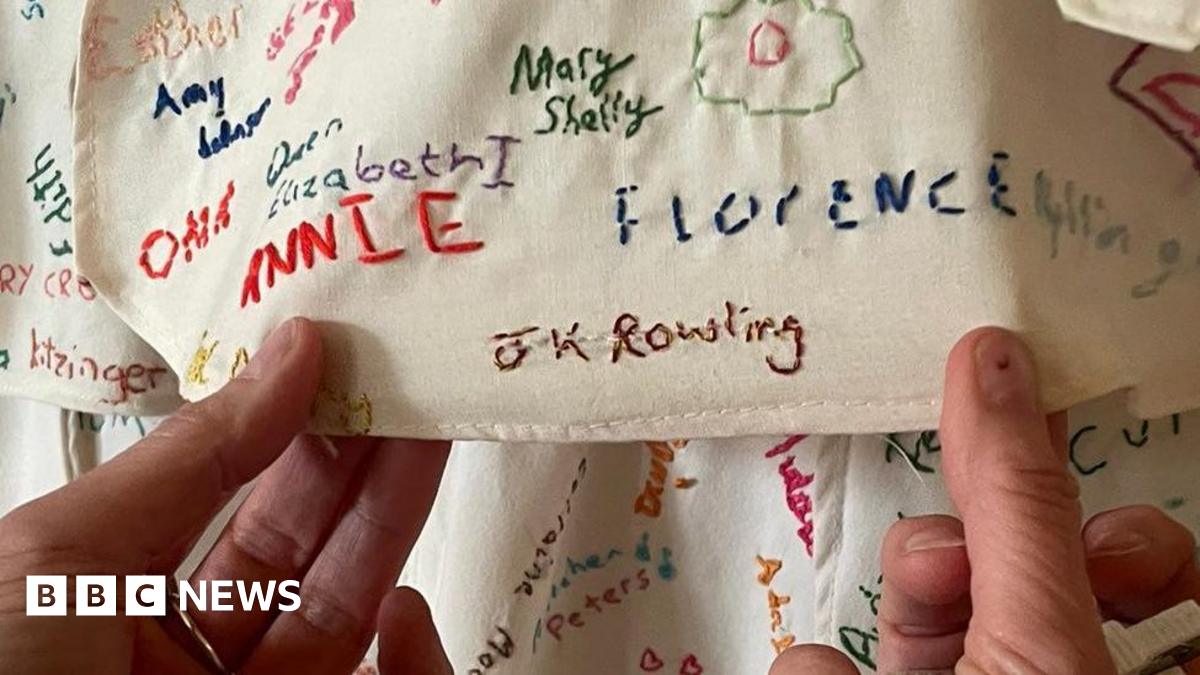

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025 -

Robinhood Hood Stock Market Performance 6 46 Uptick On June 3rd Detailed

Jun 06, 2025

Robinhood Hood Stock Market Performance 6 46 Uptick On June 3rd Detailed

Jun 06, 2025 -

Understanding Ghost Hurricanes A Key To Better Hurricane Prediction

Jun 06, 2025

Understanding Ghost Hurricanes A Key To Better Hurricane Prediction

Jun 06, 2025 -

Lilibet Mountbatten Windsor Turns Four See The Heartwarming Photos From Meghan

Jun 06, 2025

Lilibet Mountbatten Windsor Turns Four See The Heartwarming Photos From Meghan

Jun 06, 2025

Latest Posts

-

Assessing The Significance Have Recent Ukrainian Airfield Attacks Changed The Conflict

Jun 06, 2025

Assessing The Significance Have Recent Ukrainian Airfield Attacks Changed The Conflict

Jun 06, 2025 -

Walton Goggins And Aimee Lou Wood Dispelling The White Lotus Feud Rumors

Jun 06, 2025

Walton Goggins And Aimee Lou Wood Dispelling The White Lotus Feud Rumors

Jun 06, 2025 -

Sade Robinson Murder Maxwell Andersons June 6th Court Appearance

Jun 06, 2025

Sade Robinson Murder Maxwell Andersons June 6th Court Appearance

Jun 06, 2025 -

15 Hour Wait In Pouring Rain The Hype Around The New Ni

Jun 06, 2025

15 Hour Wait In Pouring Rain The Hype Around The New Ni

Jun 06, 2025 -

Disqualification As Director Rob Cross Former World Darts Champion Penalized For Tax Non Compliance

Jun 06, 2025

Disqualification As Director Rob Cross Former World Darts Champion Penalized For Tax Non Compliance

Jun 06, 2025