Coca-Cola (KO) Stock Performance And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coca-Cola (KO) Stock Performance and Future Outlook: Is the Fizz Still There?

Coca-Cola (KO), a global beverage giant, has long been a staple in many investment portfolios. But with shifting consumer preferences and economic uncertainties, investors are naturally questioning the future outlook for this iconic brand. This article dives into Coca-Cola's recent stock performance, analyzing key factors influencing its trajectory and offering insights into potential future growth.

Recent Stock Performance: A Mixed Bag

Coca-Cola's stock performance has been relatively stable in recent years, although not without its ups and downs. While the company has consistently delivered profits, growth has been moderate, reflecting broader challenges within the beverage industry. Factors influencing this include:

- Increased competition: The rise of healthier beverage options and the growing popularity of craft sodas are putting pressure on Coca-Cola's market share.

- Inflationary pressures: Rising costs of raw materials and logistics have impacted profitability, forcing Coca-Cola to adjust pricing strategies.

- Supply chain disruptions: Global supply chain challenges have also affected the company's ability to meet consumer demand efficiently.

Analyzing Key Financial Metrics:

Analyzing key financial metrics provides a clearer picture of Coca-Cola's financial health. Investors should focus on:

- Revenue growth: Examining year-over-year revenue growth helps gauge the company's ability to expand its market reach and sales volume. Consider analyzing revenue streams from different regions and product categories.

- Profit margins: Understanding profit margins sheds light on the company's pricing power and cost management efficiency. Declining margins can signal increased pressure on profitability.

- Debt levels: Assessing the company's debt-to-equity ratio is vital to understanding its financial stability and ability to weather economic downturns. High debt levels can be a cause for concern.

- Dividend payouts: Coca-Cola is known for its consistent dividend payouts, making it attractive to income-focused investors. Analyzing the dividend yield and its sustainability is crucial.

Future Outlook: Navigating Challenges and Opportunities

Despite challenges, Coca-Cola is not standing still. The company is actively pursuing strategies to adapt to the changing market landscape:

- Diversification into healthier options: Coca-Cola is expanding its portfolio to include more water, juice, and sports drink options, catering to health-conscious consumers. This diversification strategy aims to mitigate reliance on traditional sugary drinks.

- Focus on emerging markets: Growth in developing economies presents significant opportunities for Coca-Cola. Expanding market penetration in these regions is a key component of the company's future growth strategy.

- Sustainable packaging initiatives: Addressing environmental concerns is crucial for long-term success. Coca-Cola's investments in sustainable packaging solutions reflect a commitment to environmental responsibility.

- Digital marketing and innovation: Investing in digital marketing and product innovation is essential to stay competitive in a rapidly evolving market. The company is actively leveraging data analytics to enhance its marketing effectiveness.

Is Coca-Cola Stock a Buy?

Whether Coca-Cola stock is a buy depends on individual investment goals and risk tolerance. While the company faces challenges, its strong brand recognition, global reach, and consistent dividend payouts make it an attractive investment for some. However, potential investors should carefully consider the aforementioned factors before making any investment decisions. Conducting thorough due diligence and consulting with a financial advisor are strongly recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coca-Cola (KO) Stock Performance And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Witness Testifies Again In Sean Combs Case

Jun 06, 2025

Key Witness Testifies Again In Sean Combs Case

Jun 06, 2025 -

Investigation Concludes Two Chinese Researchers Charged With Smuggling Biological Agents To University Of Michigan Lab

Jun 06, 2025

Investigation Concludes Two Chinese Researchers Charged With Smuggling Biological Agents To University Of Michigan Lab

Jun 06, 2025 -

Tragic Update Missing Stag Partygoer Found Dead In Portugal

Jun 06, 2025

Tragic Update Missing Stag Partygoer Found Dead In Portugal

Jun 06, 2025 -

Is Joe Sacco Headed To Team Name Bruins Assistant Coachs Next Move

Jun 06, 2025

Is Joe Sacco Headed To Team Name Bruins Assistant Coachs Next Move

Jun 06, 2025 -

The Unexpected Reality Maintaining Two Separate Homes

Jun 06, 2025

The Unexpected Reality Maintaining Two Separate Homes

Jun 06, 2025

Latest Posts

-

Camila Cabellos Former Boyfriend Matthew Hussey To Become A Father

Jun 06, 2025

Camila Cabellos Former Boyfriend Matthew Hussey To Become A Father

Jun 06, 2025 -

Lifetimes Latest Thriller Steve Guttenberg Plays A Serial Killer

Jun 06, 2025

Lifetimes Latest Thriller Steve Guttenberg Plays A Serial Killer

Jun 06, 2025 -

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025 -

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025 -

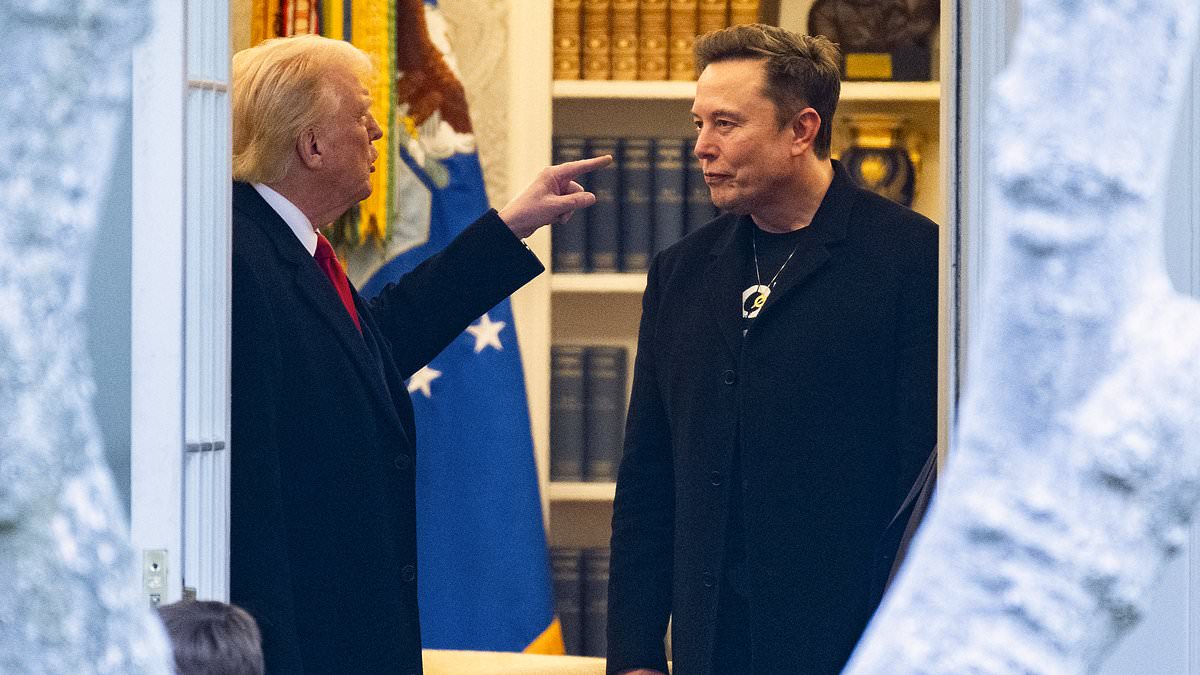

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025