College Savings Plan: 9 Realistic Tips For Those Starting Late

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

College Savings Plan: 9 Realistic Tips for Those Starting Late

Starting a college savings plan? Feeling behind? Don't panic! Many parents and guardians begin saving later than ideal, but it's never too late to build a solid foundation for your child's future education. This article provides nine realistic tips to help you catch up and effectively contribute to your college savings goals, even if you're starting later than you'd hoped.

H2: Understanding the Challenge: Why Starting Late Feels Daunting

The sticker shock of college tuition is enough to make anyone anxious. The average cost of a four-year public college education has skyrocketed in recent years, and private universities are even more expensive. This makes starting a college savings plan early a highly recommended financial strategy. However, life happens. Unexpected job losses, family emergencies, or simply a delayed realization of the importance of saving can leave many feeling they've missed the boat. But that's simply not true. With a dedicated approach and a realistic plan, you can still make significant progress.

H2: 9 Realistic Tips for Building Your College Savings Plan – Even if You're Behind

Here are actionable steps to help you navigate the challenge of starting late and build a robust college savings plan:

-

Assess Your Current Financial Situation: Before you begin, honestly evaluate your income, expenses, and existing debts. Create a realistic budget to identify how much you can comfortably allocate to college savings each month. Tools like budgeting apps can be incredibly helpful in this process.

-

Set Realistic Savings Goals: Instead of aiming for the full cost of college, focus on a manageable amount you can realistically save. Even smaller contributions add up over time, and you can always adjust your goals as your financial situation improves.

-

Utilize 529 Plans: 529 plans are tax-advantaged savings plans specifically designed for college expenses. Contributions grow tax-deferred, and withdrawals used for qualified education expenses are generally tax-free. Learn more about 529 plans and the various state options available on sites like [link to reputable financial website explaining 529 plans].

-

Explore Employer-Sponsored Plans: Check if your employer offers any college savings matching programs or tuition reimbursement plans. These programs can significantly boost your savings efforts.

-

Automate Your Savings: Set up automatic transfers from your checking account to your college savings account each month. This ensures consistent contributions without requiring constant manual effort.

-

Consider Part-Time Employment or Side Hustles: Supplement your income with a part-time job or freelance work to increase the amount you can allocate to college savings. Even small extra income can make a big difference over time.

-

Explore Scholarships and Grants: Begin researching scholarship opportunities early. Many scholarships are available based on merit, need, or specific talents. Websites like [link to a reputable scholarship search engine] can be invaluable resources.

-

Communicate with Your Child: Involve your child in the savings process. Discuss the importance of education and the sacrifices being made to help them achieve their goals. This fosters responsibility and appreciation.

-

Seek Professional Financial Advice: Consider consulting a financial advisor to create a personalized college savings plan tailored to your specific circumstances. They can provide valuable insights and guidance based on your individual needs and risk tolerance.

H2: Don't Delay – Start Now!

While starting late presents challenges, it’s not insurmountable. By implementing these realistic strategies and maintaining a consistent approach, you can significantly contribute to your child's college education, regardless of when you begin. Remember, even small contributions made consistently over time can create a substantial college fund. Start today and build a brighter future for your child's education!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on College Savings Plan: 9 Realistic Tips For Those Starting Late. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sicilys Mount Etna Latest Eruption Causes Disruption And Air Quality Concerns

Jun 04, 2025

Sicilys Mount Etna Latest Eruption Causes Disruption And Air Quality Concerns

Jun 04, 2025 -

Austin Tice Case Secret Files Expose Syrian Governments Role

Jun 04, 2025

Austin Tice Case Secret Files Expose Syrian Governments Role

Jun 04, 2025 -

Geert Wilders Departure Shakes Dutch Politics Coalition Faces Imminent Collapse

Jun 04, 2025

Geert Wilders Departure Shakes Dutch Politics Coalition Faces Imminent Collapse

Jun 04, 2025 -

Tiafoe And Paul Secure Quarterfinal Berths At The Us Open

Jun 04, 2025

Tiafoe And Paul Secure Quarterfinal Berths At The Us Open

Jun 04, 2025 -

Hold Rating For Northwestern Energy Nwe Implications For Investors

Jun 04, 2025

Hold Rating For Northwestern Energy Nwe Implications For Investors

Jun 04, 2025

Latest Posts

-

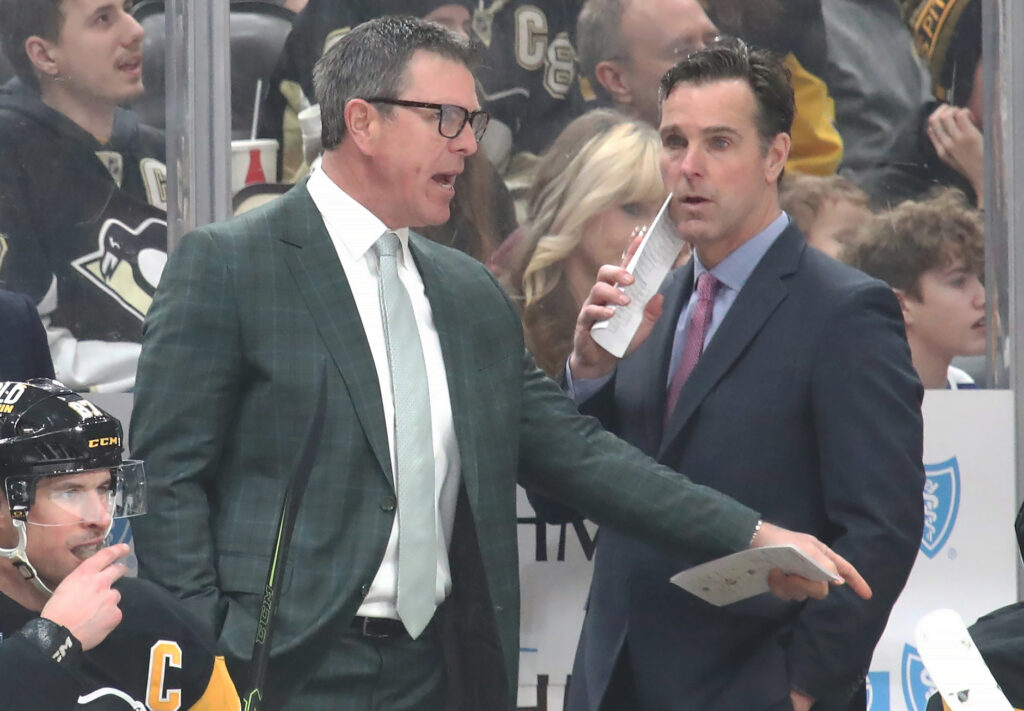

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025