Congress Faces Deadline: Social Security Benefit Reductions Possible In 2034

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Congress Faces Deadline: Social Security Benefit Reductions Possible in 2034

Millions of Americans could face reduced Social Security benefits unless Congress acts before the looming 2034 deadline. The Social Security Administration (SSA) has repeatedly warned of a looming crisis: the Social Security trust funds are projected to be depleted by 2034, leading to potential benefit cuts of roughly 20% across the board. This isn't just a distant threat; it's a rapidly approaching reality demanding immediate attention from lawmakers.

The impending shortfall is primarily due to an aging population and a declining worker-to-beneficiary ratio. Simply put, fewer workers are contributing to the system to support a growing number of retirees. While the program continues to collect payroll taxes, these revenues will no longer be sufficient to cover promised benefits once the trust funds are exhausted.

What Does This Mean for Retirees and Future Retirees?

The potential 20% reduction in benefits would significantly impact the financial security of millions of Americans. For many, Social Security represents a substantial portion, if not the majority, of their retirement income. A 20% cut could push many seniors into poverty or severely limit their ability to afford essential expenses like healthcare, housing, and food.

- Reduced Retirement Income: The most immediate impact would be a significant decrease in monthly benefit checks. This could force many retirees to make difficult choices, potentially delaying or forgoing essential medical care or reducing their living standards.

- Increased Financial Strain: Families relying on Social Security benefits will face increased financial strain, potentially impacting their ability to save for future expenses or support their own children and grandchildren.

- Delayed Retirement: The prospect of reduced benefits could incentivize individuals to delay retirement, impacting labor market dynamics and potentially exacerbating existing workforce shortages.

Possible Solutions Under Consideration by Congress:

Congress is currently grappling with several potential solutions, but reaching a consensus remains a significant challenge. The most frequently discussed options include:

- Raising the Retirement Age: Gradually increasing the full retirement age could help extend the solvency of the system. However, this approach is controversial, potentially disproportionately impacting lower-income individuals who may not be able to work for longer periods.

- Increasing Payroll Taxes: Raising the Social Security payroll tax rate or expanding the income subject to the tax could generate additional revenue. This approach, however, could impact the disposable income of working Americans.

- Adjusting the Benefit Formula: Modifying the formula used to calculate benefits could help control costs and extend the life of the trust funds. This is a complex issue with potential impacts on different demographics.

- Investing the Trust Fund: Some propose investing a portion of the trust funds in the stock market to generate higher returns. However, this approach carries inherent risks and could face political opposition.

The Urgency of Action:

The 2034 deadline is fast approaching. Failing to address the looming shortfall will have severe consequences for millions of Americans. The longer Congress delays action, the more difficult and drastic the necessary measures will become. We urge our readers to contact their representatives and senators to express their concerns and advocate for timely action to secure the future of Social Security. Learn more about contacting your representatives . Stay informed and engaged – the future of Social Security depends on it.

Keywords: Social Security, Social Security benefits, Social Security reform, Social Security crisis, 2034 deadline, retirement benefits, Congress, retirement income, financial security, Social Security Administration, SSA, payroll taxes, retirement age.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Congress Faces Deadline: Social Security Benefit Reductions Possible In 2034. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

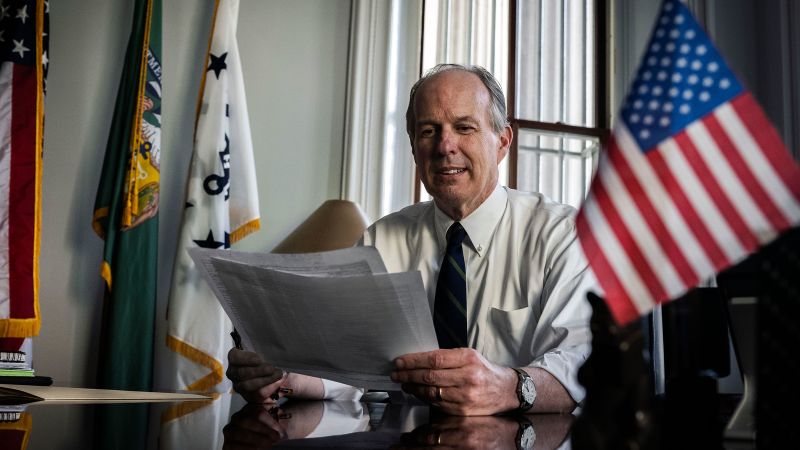

Quitting In Protest Unexpected Federal Employee Of The Year Winner

Jun 20, 2025

Quitting In Protest Unexpected Federal Employee Of The Year Winner

Jun 20, 2025 -

Detroits Skubal And Skenes Mlb Debut The Pitching Matchup That Wasnt

Jun 20, 2025

Detroits Skubal And Skenes Mlb Debut The Pitching Matchup That Wasnt

Jun 20, 2025 -

Cruz Faces Carlsons Scrutiny Over Iran A Cnn Confrontation

Jun 20, 2025

Cruz Faces Carlsons Scrutiny Over Iran A Cnn Confrontation

Jun 20, 2025 -

Tragic Loss Uk Citizen Dies From Rabies Following Moroccan Stray Dog Encounter

Jun 20, 2025

Tragic Loss Uk Citizen Dies From Rabies Following Moroccan Stray Dog Encounter

Jun 20, 2025 -

Detroit Tigers Skubal Pirates Skenes Highly Anticipated Matchup Delayed

Jun 20, 2025

Detroit Tigers Skubal Pirates Skenes Highly Anticipated Matchup Delayed

Jun 20, 2025

Latest Posts

-

Growing Democratic Discontent With Senator Fettermans Public Statements

Jun 20, 2025

Growing Democratic Discontent With Senator Fettermans Public Statements

Jun 20, 2025 -

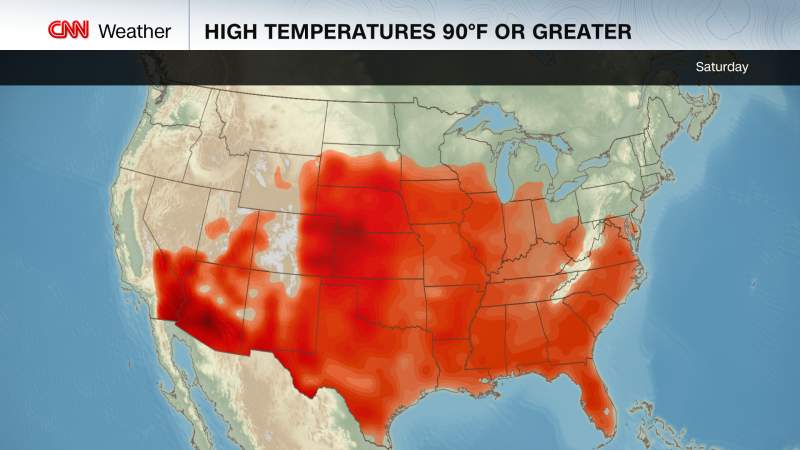

Sweltering Heat Grips The East Next Weeks Heat Dome Promises Even More Extreme Conditions

Jun 20, 2025

Sweltering Heat Grips The East Next Weeks Heat Dome Promises Even More Extreme Conditions

Jun 20, 2025 -

The Aftermath Of Kyivs Attack Ongoing Search For Victims

Jun 20, 2025

The Aftermath Of Kyivs Attack Ongoing Search For Victims

Jun 20, 2025 -

Where To Stream Watch Indiana Fever Vs Golden State Valkyries Wnba Game

Jun 20, 2025

Where To Stream Watch Indiana Fever Vs Golden State Valkyries Wnba Game

Jun 20, 2025 -

Investigation Launched Following Deadly Grimsby Car Test Drive Involving Cameron And David Walsh

Jun 20, 2025

Investigation Launched Following Deadly Grimsby Car Test Drive Involving Cameron And David Walsh

Jun 20, 2025