Could A Recession Be Near? Jamie Dimon's Economic Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could a Recession Be Near? Jamie Dimon's Economic Concerns Spark Debate

The American economy is facing a whirlwind of uncertainty, and the concerns are reaching the highest levels of finance. JPMorgan Chase CEO Jamie Dimon, a respected voice in the industry, recently voiced significant apprehension about the possibility of a looming recession. His warnings, delivered during the bank's recent earnings call, have sent ripples through the financial markets and sparked intense debate among economists and investors. This article will delve into Dimon's concerns, explore the potential triggers for a recession, and examine the differing perspectives on the likelihood of an economic downturn.

Dimon's Dire Predictions: More Than Just Market Volatility

Dimon's concerns aren't based on fleeting market fluctuations. He points to a confluence of factors, painting a picture far more complex than a simple market correction. He highlighted the impact of the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation, the ongoing war in Ukraine, and the lingering effects of the COVID-19 pandemic as major contributing elements. These factors, he argues, create a volatile and unpredictable economic landscape, increasing the risk of a significant downturn.

Key Factors Contributing to Recessionary Fears:

-

Inflationary Pressures: Persistently high inflation continues to erode consumer purchasing power and is forcing the Federal Reserve to maintain a tight monetary policy. This aggressive approach, while aimed at cooling inflation, carries the risk of triggering a recession by slowing economic growth too drastically. [Link to article about current inflation rates]

-

Geopolitical Instability: The ongoing war in Ukraine has significantly disrupted global supply chains and energy markets, contributing to inflationary pressures and overall economic uncertainty. This instability creates a fragile global economic environment, making it more susceptible to shocks. [Link to article on the impact of the Ukraine war on the global economy]

-

Consumer Sentiment: Consumer confidence, a key indicator of economic health, has been wavering. As prices rise and the threat of job losses looms, consumers are becoming more cautious with their spending, potentially leading to a slowdown in economic activity. [Link to article on consumer confidence index]

Differing Opinions: Is a Recession Inevitable?

While Dimon's warnings are significant, not all economists share his pessimism. Some argue that the strength of the current labor market and continued consumer spending could cushion the blow of potential economic headwinds. They point to positive indicators such as low unemployment rates and robust corporate earnings as reasons for optimism. However, these counterarguments often overlook the inherent uncertainties associated with the factors mentioned above.

Navigating Uncertainty: Preparing for Potential Economic Downturn

Regardless of whether a recession is imminent or not, Dimon's concerns highlight the importance of preparedness. Individuals, businesses, and governments should all be considering strategies to mitigate the potential impact of an economic downturn. This might include:

- Diversifying Investments: Spreading investments across different asset classes can help reduce risk and protect against market volatility.

- Managing Debt: Reducing debt levels can strengthen financial resilience during tough economic times.

- Building Emergency Funds: Having a sufficient emergency fund can provide a safety net during unexpected economic hardship.

Conclusion: A Time for Vigilance, Not Panic

Jamie Dimon's warning about a potential recession should be taken seriously. While a downturn isn't guaranteed, the confluence of economic and geopolitical factors creates a significant risk. Instead of panic, a proactive and cautious approach is warranted. Staying informed, diversifying assets, and strengthening financial resilience are crucial steps in navigating these uncertain times. The coming months will be critical in determining the ultimate trajectory of the American economy. Keep your eyes peeled for further updates and analysis as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could A Recession Be Near? Jamie Dimon's Economic Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Air India Crash And Boeing Long Term Effects On The Aviation Giant

Jun 13, 2025

The Air India Crash And Boeing Long Term Effects On The Aviation Giant

Jun 13, 2025 -

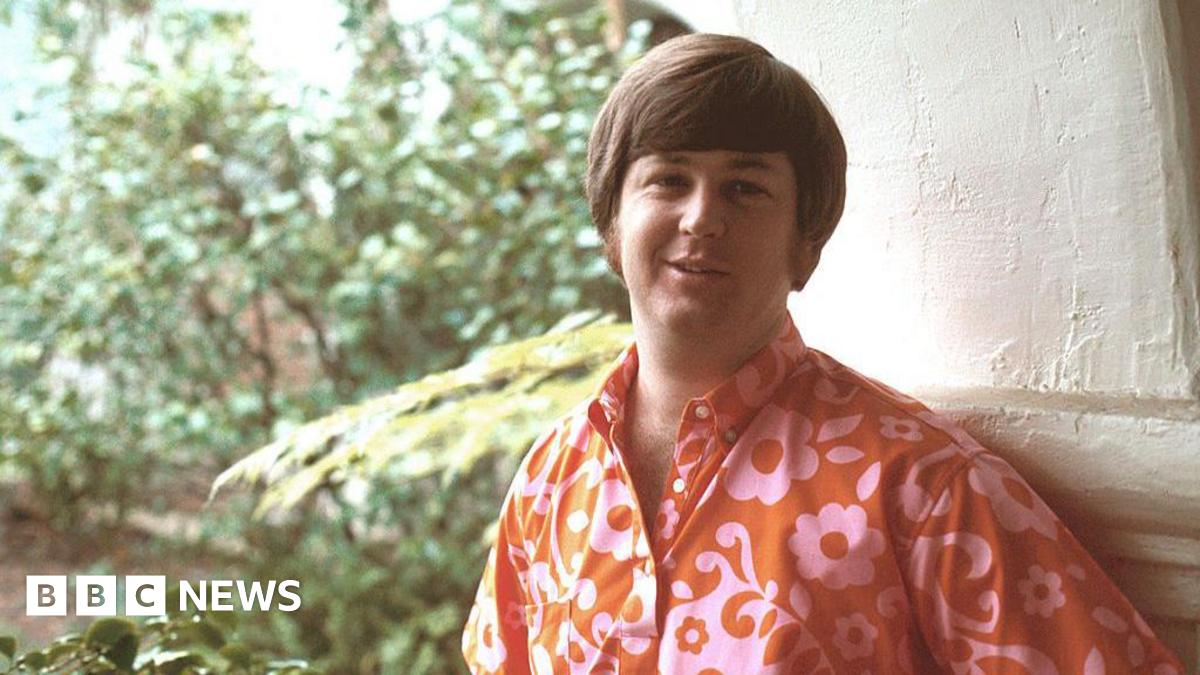

Brian Wilson Beach Boys Co Founder Dead At 82

Jun 13, 2025

Brian Wilson Beach Boys Co Founder Dead At 82

Jun 13, 2025 -

Analyzing Adobe Stocks Trajectory Following Recent Earnings

Jun 13, 2025

Analyzing Adobe Stocks Trajectory Following Recent Earnings

Jun 13, 2025 -

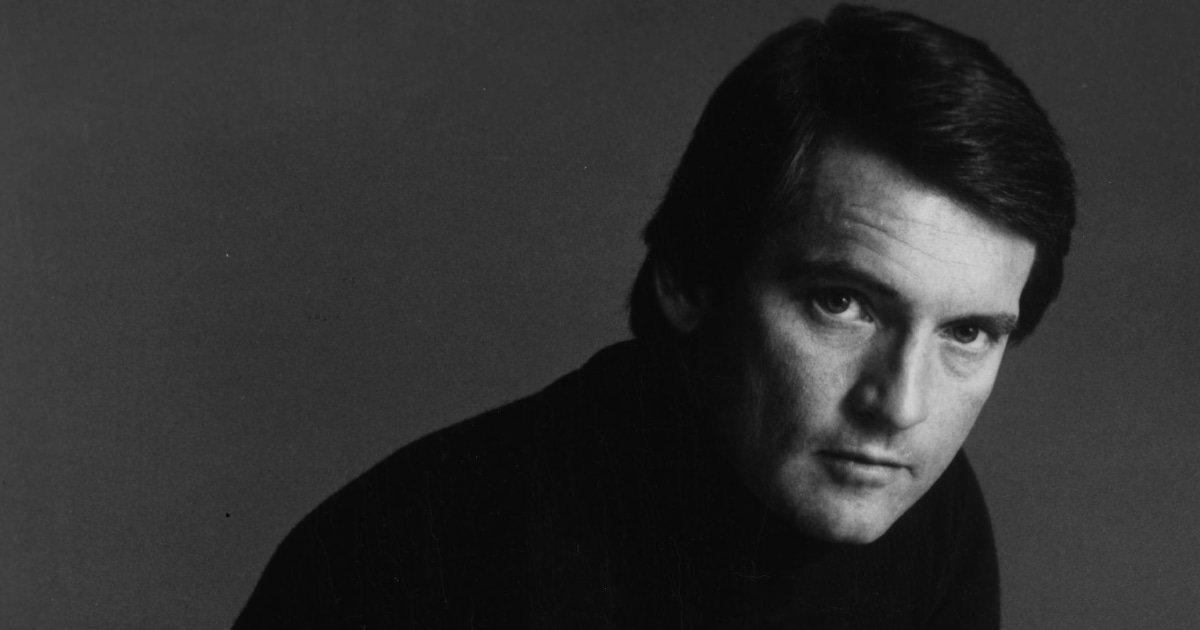

Remembering Chris Robinson A Celebrated Career On General Hospital Ends At 86

Jun 13, 2025

Remembering Chris Robinson A Celebrated Career On General Hospital Ends At 86

Jun 13, 2025 -

Brian Rolapp In Focus Latest Updates On The Pga Tour Ceo Search

Jun 13, 2025

Brian Rolapp In Focus Latest Updates On The Pga Tour Ceo Search

Jun 13, 2025

Latest Posts

-

Beeline Highway Brush Fire Evacuations And Road Closures

Jun 14, 2025

Beeline Highway Brush Fire Evacuations And Road Closures

Jun 14, 2025 -

From The Fairway To The Future The Careers Of Jackson Buchanan And Sam Haynes

Jun 14, 2025

From The Fairway To The Future The Careers Of Jackson Buchanan And Sam Haynes

Jun 14, 2025 -

Deadly San Antonio Floods Search Continues For Two Missing After Torrential Downpour

Jun 14, 2025

Deadly San Antonio Floods Search Continues For Two Missing After Torrential Downpour

Jun 14, 2025 -

Legal Victory Son Successfully Challenges Parents African Relocation Scheme

Jun 14, 2025

Legal Victory Son Successfully Challenges Parents African Relocation Scheme

Jun 14, 2025 -

More 7 Eleven Stores Than Anywhere Else Japans Snack Making Revealed

Jun 14, 2025

More 7 Eleven Stores Than Anywhere Else Japans Snack Making Revealed

Jun 14, 2025