Could The Economy Deteriorate Soon? Jamie Dimon Weighs In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could the Economy Deteriorate Soon? Jamie Dimon Weighs In

JPMorgan Chase CEO's warning sparks debate about the looming economic storm.

The American economy is facing headwinds, and concerns are mounting about a potential downturn. Adding fuel to the fire is a recent warning from JPMorgan Chase CEO, Jamie Dimon, who cautioned about the possibility of an economic deterioration in the coming months. Dimon's stark assessment has ignited a widespread discussion among economists and financial experts, prompting many to question: are we on the brink of a recession?

Dimon, known for his frank and often prescient assessments of the economic landscape, didn't pull any punches. In recent interviews and statements, he highlighted several key factors contributing to his concerns, painting a picture of a potentially turbulent economic future. This isn't just idle speculation; Dimon's warnings carry significant weight given JPMorgan Chase's size and his long track record in the financial industry.

What are Dimon's Key Concerns?

Dimon's concerns center around several interconnected issues:

-

Inflation: Persistently high inflation continues to erode consumer purchasing power and is forcing the Federal Reserve to maintain a tight monetary policy. This aggressive approach, while aimed at curbing inflation, also risks triggering a recession by slowing economic growth too sharply. Dimon has voiced concerns that the Fed's actions might be too late or too aggressive, leading to unintended consequences.

-

Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating geopolitical tensions across the globe, contributes to economic instability. These uncertainties create ripple effects across global supply chains, impacting energy prices and contributing to inflationary pressures. Dimon emphasizes the unpredictable nature of these external factors and their potential to significantly disrupt the economy.

-

Consumer Spending: While consumer spending has remained relatively resilient so far, Dimon cautions that this could change. Increased interest rates, high inflation, and dwindling savings could eventually lead to a significant slowdown in consumer spending, a key driver of economic growth.

-

Debt Levels: High levels of both corporate and consumer debt pose a significant risk. Rising interest rates increase the cost of servicing this debt, potentially leading to defaults and further economic contraction. Dimon has stressed the importance of managing debt carefully, both at the individual and corporate levels.

What Do Other Economists Say?

While Dimon's warnings are serious, the overall consensus among economists remains divided. Some share his concerns, pointing to the same indicators he highlighted. Others remain more optimistic, arguing that the economy is more resilient than anticipated and that a soft landing is still possible. [Link to a relevant article on diverse economic opinions]. The debate is ongoing, and further data will be needed to provide a clearer picture.

What Can We Expect?

The coming months will be crucial in determining the trajectory of the economy. Closely monitoring key economic indicators like inflation rates, consumer confidence, and employment data will be essential. Dimon's warnings serve as a stark reminder that economic uncertainty persists, urging both individuals and businesses to prepare for a potentially challenging period ahead. This might include strategies such as diversifying investments, managing debt effectively, and building financial resilience.

Call to Action: Stay informed about economic developments by regularly consulting reputable financial news sources. Understanding the potential risks can help you make informed decisions and navigate the economic landscape more effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could The Economy Deteriorate Soon? Jamie Dimon Weighs In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spending Review Analysis The Effect On Public Transport And Employment

Jun 13, 2025

Spending Review Analysis The Effect On Public Transport And Employment

Jun 13, 2025 -

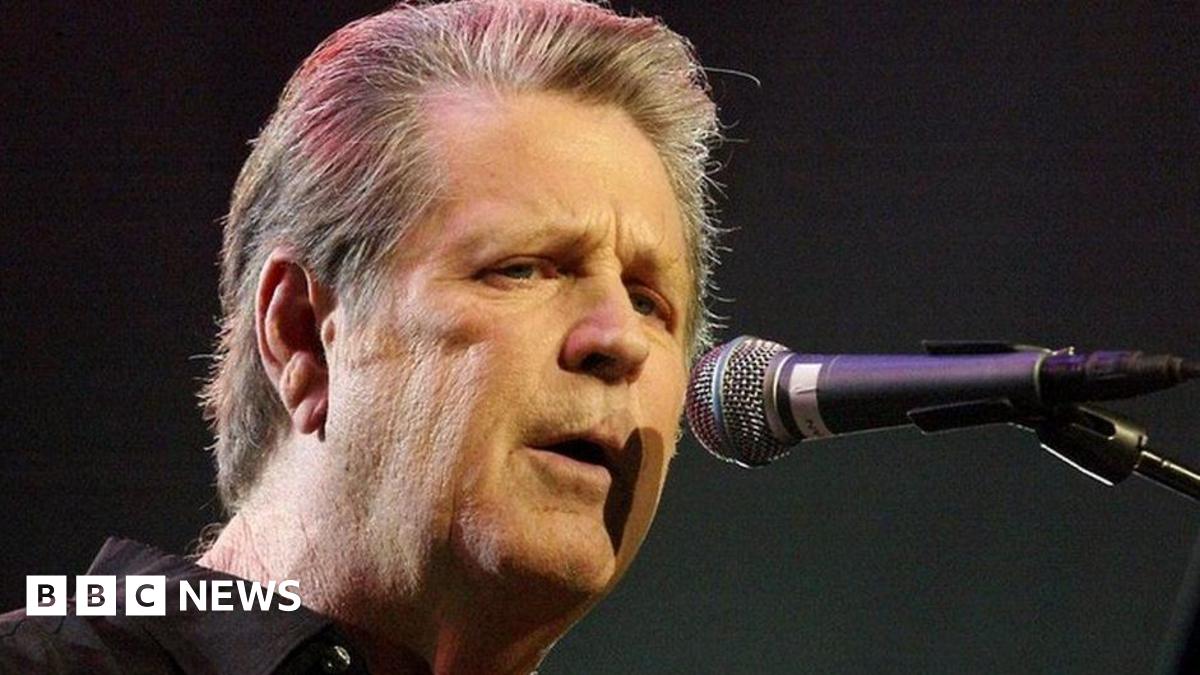

Brian Wilson A Celebration Of The Life And Music Of A Pioneer

Jun 13, 2025

Brian Wilson A Celebration Of The Life And Music Of A Pioneer

Jun 13, 2025 -

Reeves Prioritizes Nhs And Housing Amidst Budget Cuts

Jun 13, 2025

Reeves Prioritizes Nhs And Housing Amidst Budget Cuts

Jun 13, 2025 -

Heated Debate Lawler Defends Infrastructure Bill Vote In Putnam County

Jun 13, 2025

Heated Debate Lawler Defends Infrastructure Bill Vote In Putnam County

Jun 13, 2025 -

Austria Reels From Mass Shooting Police Hunt For Answers Amid National Grief

Jun 13, 2025

Austria Reels From Mass Shooting Police Hunt For Answers Amid National Grief

Jun 13, 2025

Latest Posts

-

Traffic Alert Sr 87 Closed By Adot Because Of Payson Brush Fire

Jun 14, 2025

Traffic Alert Sr 87 Closed By Adot Because Of Payson Brush Fire

Jun 14, 2025 -

Hes A U S Open Anomaly A 17 Year Olds Perspective

Jun 14, 2025

Hes A U S Open Anomaly A 17 Year Olds Perspective

Jun 14, 2025 -

No Injuries After Jet Blue Plane Incident At Logan International Airport

Jun 14, 2025

No Injuries After Jet Blue Plane Incident At Logan International Airport

Jun 14, 2025 -

Nba Finals Betting Pacers Chances To Take 3 1 Lead Over Thunder

Jun 14, 2025

Nba Finals Betting Pacers Chances To Take 3 1 Lead Over Thunder

Jun 14, 2025 -

Watch Firefighters Battle Brush Fire South Of Payson Arizona

Jun 14, 2025

Watch Firefighters Battle Brush Fire South Of Payson Arizona

Jun 14, 2025