Could Trump Eliminate Capital Gains Tax On Home Sales? Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could Trump Eliminate Capital Gains Tax on Home Sales? Analysis and Implications

A potential policy shift with far-reaching consequences for the housing market and the national economy.

The possibility of eliminating capital gains taxes on home sales has resurfaced in political discussions, particularly with regard to potential future policy under a Trump administration. While not explicitly part of his current platform, the idea has been floated by various commentators and holds significant implications for the real estate market, taxpayers, and the broader economy. This article delves into the feasibility, potential benefits, drawbacks, and overall impact of such a policy change.

Understanding Capital Gains Tax on Home Sales

Currently, homeowners in the United States can exclude up to $250,000 ($500,000 for married couples filing jointly) in capital gains from the sale of their primary residence. This exclusion applies if they have owned and lived in the home for at least two of the five years preceding the sale. Any profit exceeding this amount is subject to capital gains taxes, the rate of which depends on the taxpayer's income bracket. Eliminating this tax altogether would mean that homeowners could sell their homes for any profit without paying federal taxes on the gain.

Arguments for Elimination:

Proponents argue that eliminating capital gains taxes on home sales would:

- Boost the housing market: Increased affordability and easier transitions for sellers could lead to a more dynamic housing market, potentially stimulating construction and increasing homeownership rates.

- Stimulate the economy: Increased home sales could generate economic activity through related industries like real estate, construction, and home improvement.

- Benefit retirees: Many retirees rely on the sale of their homes to fund their retirement. Eliminating capital gains tax could significantly improve their financial security.

- Reduce complexity: The current system with its exclusions and limitations can be confusing for taxpayers. Simplification could reduce administrative burdens.

Arguments Against Elimination:

Opponents raise concerns that eliminating the tax would:

- Increase inequality: The primary beneficiaries would likely be higher-income homeowners, exacerbating existing wealth disparities.

- Reduce government revenue: The loss of tax revenue could necessitate cuts to other government programs or an increase in other taxes.

- Inflate home prices: Increased demand fueled by tax savings could lead to higher home prices, making homeownership even less affordable for many.

- Potentially harm the rental market: Increased incentives to sell rather than rent could reduce the availability of rental properties.

Feasibility and Political Landscape:

The feasibility of eliminating capital gains taxes on home sales depends on several factors, including:

- Political will: Gaining sufficient political support for such a significant tax change would be a major hurdle.

- Economic conditions: The economic impact of such a policy change would need careful consideration, especially in terms of its effect on the national debt.

- Alternative proposals: Lawmakers might consider alternative approaches, such as increasing the existing capital gains exclusion instead of eliminating the tax entirely.

Conclusion:

The potential elimination of capital gains taxes on home sales under a future Trump administration or other political scenarios presents a complex policy debate with significant economic and social implications. While the prospect of boosting the housing market and benefiting homeowners is enticing, the potential for increased inequality and revenue loss necessitates careful analysis and consideration of alternative solutions. Further research and public discourse are crucial to fully understand the potential consequences of this far-reaching policy change. The debate is likely to continue, particularly as housing market trends and economic conditions evolve.

Further Reading:

Disclaimer: This article provides general information and should not be considered financial or legal advice. Consult with a qualified professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could Trump Eliminate Capital Gains Tax On Home Sales? Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chinas Tailless Drone Program Challenges And Implications For Starlink

Jul 25, 2025

Chinas Tailless Drone Program Challenges And Implications For Starlink

Jul 25, 2025 -

Matt Shakman Hands Over Doomsday To The Russo Brothers A Directorial Transition

Jul 25, 2025

Matt Shakman Hands Over Doomsday To The Russo Brothers A Directorial Transition

Jul 25, 2025 -

Medical Fraud Allegations Truro Surgeons Leg Amputation Practices Investigated

Jul 25, 2025

Medical Fraud Allegations Truro Surgeons Leg Amputation Practices Investigated

Jul 25, 2025 -

Storms To Bring Temporary Relief After Illinois Heat Wave Severe Weather Outlook

Jul 25, 2025

Storms To Bring Temporary Relief After Illinois Heat Wave Severe Weather Outlook

Jul 25, 2025 -

Ben Sheltons Dominant Performance Opens Dc Open Campaign

Jul 25, 2025

Ben Sheltons Dominant Performance Opens Dc Open Campaign

Jul 25, 2025

Latest Posts

-

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025 -

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

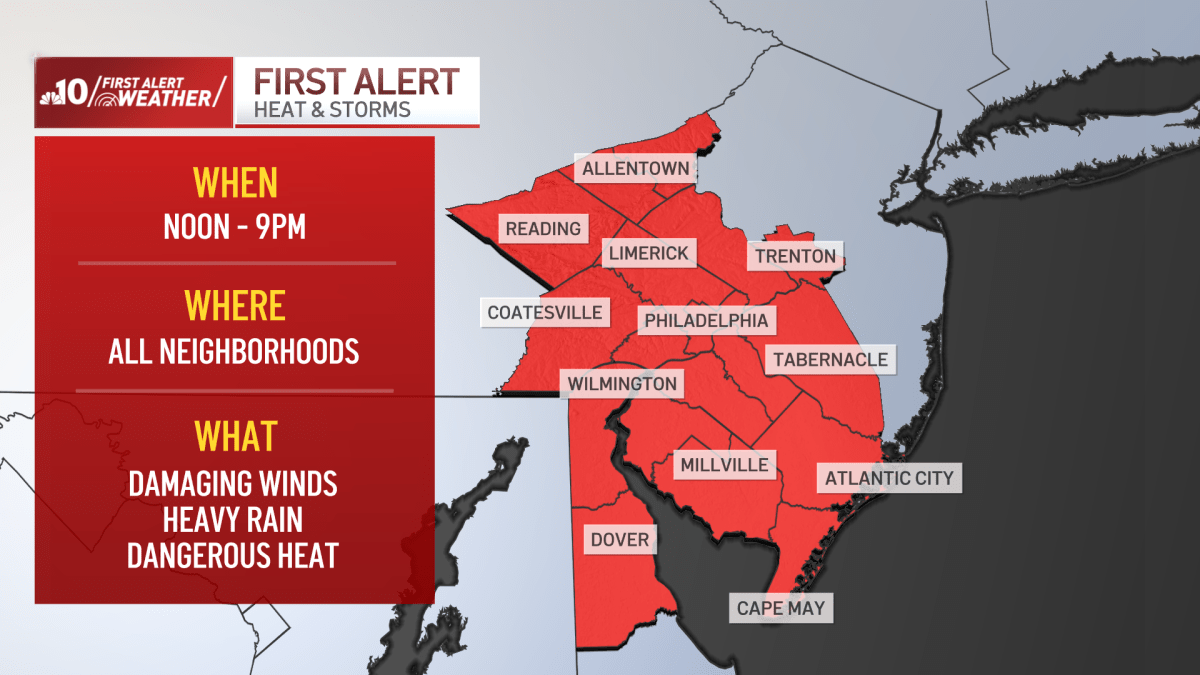

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025