Could Trump Eliminate Capital Gains Taxes On Home Sales? Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could Trump Eliminate Capital Gains Taxes on Home Sales? Analysis and Implications

The prospect of eliminating capital gains taxes on home sales has resurfaced in political discussions, sparking considerable debate among homeowners, real estate investors, and tax experts alike. While former President Trump championed such a measure during his campaigns, its feasibility and potential consequences remain complex and multifaceted. This article delves into the potential impact of such a policy change, exploring its economic implications and examining its likelihood of implementation.

Understanding Capital Gains Taxes on Home Sales

Before analyzing the potential elimination, it's crucial to understand the current system. Capital gains taxes apply to the profit realized from selling an asset, including a home, exceeding a certain threshold. The IRS allows homeowners to exclude up to $250,000 ($500,000 for married couples filing jointly) in capital gains from the sale of their primary residence, provided they meet certain ownership and use requirements. This exclusion significantly reduces the tax burden for many homeowners.

However, profits exceeding this limit are subject to capital gains taxes, the rate of which depends on the taxpayer's income bracket and the length of time the property was owned. Eliminating these taxes entirely would represent a significant change to the existing tax code.

Potential Economic Impacts of Eliminating Capital Gains Taxes on Home Sales

The potential economic consequences of eliminating capital gains taxes on home sales are far-reaching and subject to differing interpretations.

Arguments for Elimination:

- Increased Home Sales: Proponents argue that eliminating capital gains taxes would stimulate the housing market by encouraging more people to sell their homes. This could increase housing inventory, potentially lowering prices and making homes more affordable for first-time buyers.

- Economic Growth: Increased housing market activity could inject more capital into the economy, boosting overall economic growth. Construction jobs and related industries would likely see a surge.

- Enhanced Retirement Planning: Homeowners could use the tax-free proceeds from their home sales to supplement their retirement income, potentially reducing reliance on social security or other retirement savings.

Arguments Against Elimination:

- Increased Inequality: Critics argue that such a policy would disproportionately benefit high-income homeowners, exacerbating income inequality. The tax break would primarily assist those who have already accumulated significant wealth through homeownership.

- Reduced Government Revenue: Eliminating these taxes would significantly reduce government revenue, potentially impacting funding for crucial social programs and infrastructure projects. Finding alternative revenue streams could prove politically challenging.

- Potential for Market Distortion: A sudden influx of homes onto the market could potentially lead to a price correction, negatively impacting homeowners who might be looking to sell at a higher price.

Likelihood of Implementation and Political Considerations

While the idea of eliminating capital gains taxes on home sales holds appeal for many, its political feasibility remains uncertain. Such a significant tax change would require substantial political capital and would likely face significant opposition from those concerned about its potential economic consequences and its impact on government revenue.

The current political climate and the priorities of the administration in power would play a significant role in determining the likelihood of such a policy being enacted. Considering the budgetary implications, bipartisan support would be essential for such a sweeping change to the tax code.

Conclusion: A Complex Issue with Far-Reaching Implications

The potential elimination of capital gains taxes on home sales presents a complex economic and political puzzle. While it might stimulate the housing market and provide benefits to some homeowners, it also carries significant risks, particularly regarding income inequality and the impact on government finances. A thorough cost-benefit analysis, coupled with a careful consideration of alternative policy options, is crucial before any significant changes are made to the existing tax system. Further research and public discourse are needed to fully understand the potential consequences of such a radical shift. This issue will undoubtedly continue to be debated in political and economic circles for the foreseeable future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could Trump Eliminate Capital Gains Taxes On Home Sales? Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fantastic Four Post Credits Scene Explained

Jul 25, 2025

Fantastic Four Post Credits Scene Explained

Jul 25, 2025 -

Orioles Vs Guardians Join The Live Game Discussion Thread Thursday 1 10 Pm Et

Jul 25, 2025

Orioles Vs Guardians Join The Live Game Discussion Thread Thursday 1 10 Pm Et

Jul 25, 2025 -

Two Americans Normandy Dream A Story Of Perseverance

Jul 25, 2025

Two Americans Normandy Dream A Story Of Perseverance

Jul 25, 2025 -

Gaza Faces Mass Starvation Over 100 Humanitarian Groups Raise Alarm

Jul 25, 2025

Gaza Faces Mass Starvation Over 100 Humanitarian Groups Raise Alarm

Jul 25, 2025 -

Roadblocks Emerge For Chinas Plan To Deploy 15 000 Satellites

Jul 25, 2025

Roadblocks Emerge For Chinas Plan To Deploy 15 000 Satellites

Jul 25, 2025

Latest Posts

-

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025

Thousands Without Phone Service Major Ee And Bt Network Failure

Jul 26, 2025 -

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025

Anthony Ruggiero Selected For Fcbl All Star Game

Jul 26, 2025 -

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025

Wwes La Knight Problem Creative Mismanagement Or Strategic Choice

Jul 26, 2025 -

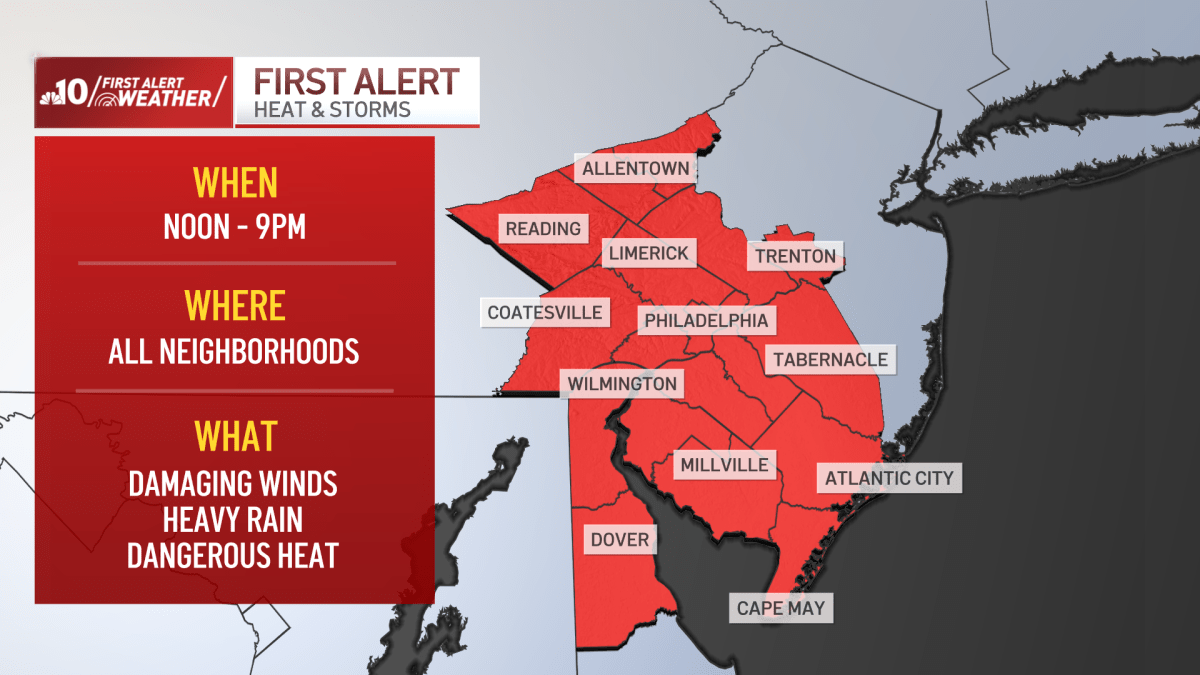

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025

Philadelphia Region Under Severe Weather Watch Heat Storms And Live Updates

Jul 26, 2025 -

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025

Eastern Massachusetts Hit By Severe Thunderstorms Trees Down Wires Downed

Jul 26, 2025