"Debanking" In Focus: Trump's Planned Executive Order And Its Potential Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Debanking in Focus: Trump's Planned Executive Order and Its Potential Impact

The political landscape is abuzz with discussions surrounding a potential executive order from Donald Trump aimed at combating "debanking," a term gaining traction in conservative circles. But what exactly is debanking, and what are the potential implications of such an executive order? This article delves into the complexities of this issue, examining its potential impact on financial institutions, businesses, and the broader economy.

Understanding "Debanking"

The term "debanking" generally refers to the termination of banking services for a business or individual, often cited by conservatives as a form of political persecution. While banks routinely terminate relationships with clients for various reasons – including breaches of contract, suspected illegal activity, or high-risk profiles – the accusation of "debanking" often frames these actions as politically motivated, targeting specific individuals or groups deemed undesirable by certain factions. This narrative often centers around claims that financial institutions are bowing to pressure from progressive groups or government agencies.

This narrative frequently surfaces in discussions surrounding politically controversial individuals and organizations, particularly those involved in conservative activism or who hold views deemed controversial by certain segments of society. Claims of "debanking" often lack detailed evidence, leading to heated debates and accusations of censorship within the financial sector.

Trump's Planned Executive Order: A Closer Look

While details remain scarce, reports suggest that Trump's planned executive order aims to address concerns surrounding the alleged practice of "debanking," potentially investigating instances where it's believed to be politically motivated. The proposed order might involve investigations into the practices of financial institutions, potentially leading to regulatory scrutiny or even penalties for banks deemed to have engaged in discriminatory practices.

The exact mechanisms and scope of such an order remain unclear, but its potential ramifications are significant. This uncertainty fuels speculation regarding its constitutionality and its potential impact on the independence of financial institutions.

Potential Impacts and Concerns

The potential impact of Trump's executive order is multifaceted and raises several critical questions:

-

Impact on Financial Institutions: Banks could face increased regulatory burden and potential legal challenges, impacting their operational efficiency and profitability. This uncertainty could also affect lending practices and access to capital for businesses.

-

Impact on Businesses: Businesses, particularly those with politically controversial owners or affiliations, could face increased difficulty securing banking services. This could severely hamper their operations and growth.

-

Constitutional Concerns: The order's constitutionality is likely to be challenged, raising questions about the government's power to regulate private financial institutions and the potential for overreach.

-

Economic Implications: Increased uncertainty in the financial sector could negatively impact investor confidence and overall economic growth. A chilling effect on free speech and political activity could also be a consequence.

The Larger Context: Financial Inclusion and Political Polarization

The debate surrounding "debanking" highlights the complex interplay between financial inclusion, political polarization, and regulatory oversight. While legitimate concerns about financial crime and risk management exist, the accusations of politically motivated "debanking" raise important questions about fairness, transparency, and the potential for abuse of power. Finding a balance between protecting the financial system and safeguarding individual rights is a crucial challenge.

Moving Forward: Further clarification on the specifics of Trump's proposed executive order is needed to fully assess its potential consequences. A robust public discussion, involving legal experts, financial professionals, and policymakers, is essential to navigate this complex and potentially divisive issue. Only through open dialogue and careful consideration can we hope to find solutions that promote both financial stability and individual liberties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on "Debanking" In Focus: Trump's Planned Executive Order And Its Potential Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chat Gpts Revolution A New Era In Ai

Aug 09, 2025

Chat Gpts Revolution A New Era In Ai

Aug 09, 2025 -

Ecuador Gang Violence Cnns Exclusive Interview With A Top Commander

Aug 09, 2025

Ecuador Gang Violence Cnns Exclusive Interview With A Top Commander

Aug 09, 2025 -

Pga Star Tommy Fleetwood His Major Brand Endorsement Deals Revealed

Aug 09, 2025

Pga Star Tommy Fleetwood His Major Brand Endorsement Deals Revealed

Aug 09, 2025 -

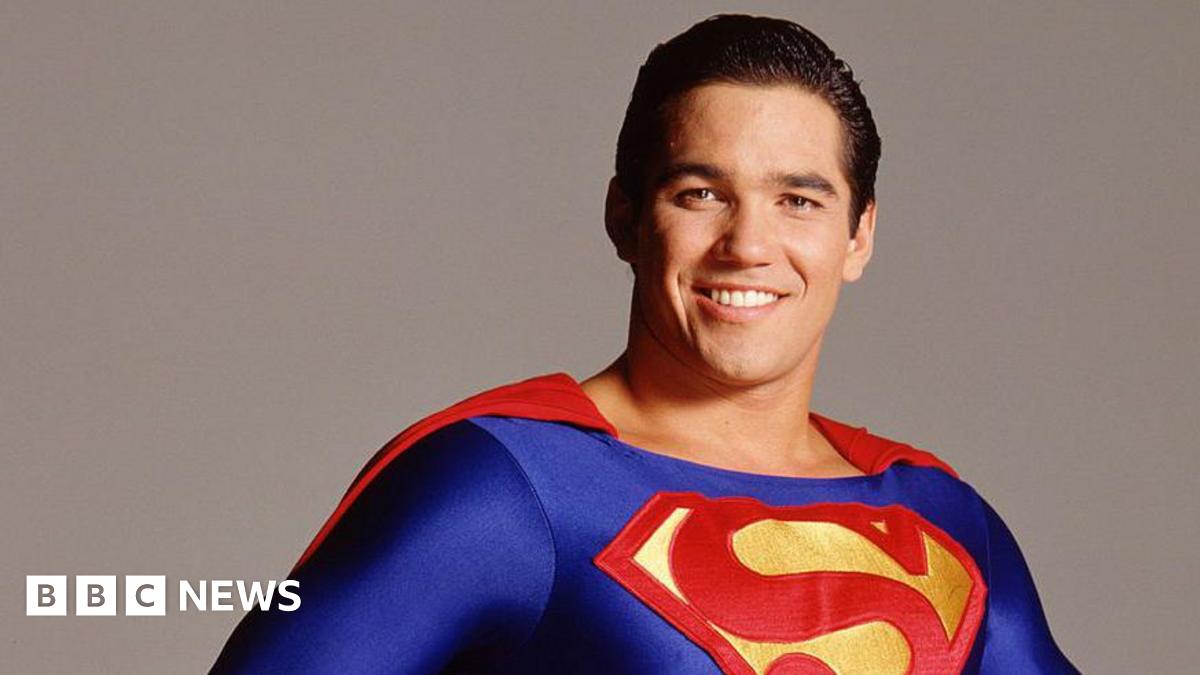

Dean Cains Unexpected Career Move Ex Superman Star Joins Ice

Aug 09, 2025

Dean Cains Unexpected Career Move Ex Superman Star Joins Ice

Aug 09, 2025 -

World Champion Nick Ball A Deep Dive Into His Cross Fit Training And Lifestyle

Aug 09, 2025

World Champion Nick Ball A Deep Dive Into His Cross Fit Training And Lifestyle

Aug 09, 2025

Latest Posts

-

Buying Tickets For Buffalo Bills Vs Baltimore Ravens A Week 1 Guide

Aug 11, 2025

Buying Tickets For Buffalo Bills Vs Baltimore Ravens A Week 1 Guide

Aug 11, 2025 -

Sunday Night Football Ravens Vs Bills Betting Preview And Expert Predictions

Aug 11, 2025

Sunday Night Football Ravens Vs Bills Betting Preview And Expert Predictions

Aug 11, 2025 -

Tottenham Hotspurs Pursuit Of Manchester City Winger Potential Transfer Analysis

Aug 11, 2025

Tottenham Hotspurs Pursuit Of Manchester City Winger Potential Transfer Analysis

Aug 11, 2025 -

Royal Rift Prince Andrews Book And The Impossibility Of A Royal Restoration

Aug 11, 2025

Royal Rift Prince Andrews Book And The Impossibility Of A Royal Restoration

Aug 11, 2025 -

Blair County Athletes Power Aaaba Teams To Championship Game

Aug 11, 2025

Blair County Athletes Power Aaaba Teams To Championship Game

Aug 11, 2025