Deciphering Wall Street's Odd Trading Patterns: Experts Weigh In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deciphering Wall Street's Odd Trading Patterns: Experts Weigh In

Wall Street, the heart of global finance, is known for its volatility. But lately, some truly odd trading patterns have emerged, leaving experts scratching their heads and investors on edge. From unusual spikes in seemingly unrelated stocks to inexplicable drops in otherwise stable markets, the recent activity has sparked intense debate and speculation. This article delves into the mysteries behind these perplexing movements, examining potential causes and exploring expert opinions on what it all means.

Unraveling the Enigma: Recent Examples of Strange Trading Activity

The past few months have witnessed a series of peculiar events that have defied traditional market analysis. For instance, the sudden surge in the price of [insert example of a stock with unusual activity, e.g., a small-cap biotech company] raised eyebrows, with no apparent news or fundamental catalyst to justify such a dramatic increase. Similarly, the unexpected downturn in the [insert example of a sector or index experiencing unusual activity, e.g., technology sector] left many questioning the underlying forces at play. These aren't isolated incidents; analysts are reporting an increase in frequency of such anomalies.

Potential Explanations: From Algorithmic Glitches to Deliberate Manipulation

Several theories attempt to explain these erratic trading patterns. One possibility is the increasing prevalence of algorithmic trading. High-frequency trading (HFT) algorithms, designed to execute trades at lightning speed, could be contributing to unexpected market fluctuations. A glitch or unforeseen interaction between these algorithms could potentially trigger cascading effects, leading to the observed volatility.

Another theory points towards market manipulation. While difficult to prove, coordinated efforts to artificially inflate or deflate stock prices remain a possibility. This could involve sophisticated strategies designed to exploit market inefficiencies or take advantage of unsuspecting investors. Regulatory bodies are constantly working to detect and prevent such activities, but the sophistication of these schemes makes detection challenging. [Link to SEC website on market manipulation].

Furthermore, the impact of geopolitical events and macroeconomic factors cannot be ignored. Uncertainties surrounding [mention a relevant geopolitical event, e.g., the war in Ukraine] or shifts in global monetary policy can significantly impact investor sentiment, leading to unpredictable market swings.

Expert Opinions: A Divided Perspective

Experts offer varied perspectives on the situation. Some believe the recent volatility is a temporary anomaly, a byproduct of the complex interplay of factors mentioned above. Others express concerns, arguing that the frequency and intensity of these odd trading patterns suggest a deeper underlying issue within the market structure itself.

"The market is becoming increasingly complex," says Dr. [Name of a financial expert], Professor of Finance at [University Name]. "The interaction of HFT algorithms, evolving investor behavior, and global macroeconomic factors creates an environment ripe for unpredictable events."

However, others are more optimistic. "[Quote from a financial analyst with a contrasting viewpoint]," emphasizes [Name of Analyst], Chief Strategist at [Financial Institution]. They believe the market will ultimately self-correct and that these anomalies are simply part of the inherent risk in investing.

Navigating the Uncertain Waters: Advice for Investors

The current climate highlights the importance of diversification and risk management. Investors should carefully consider their risk tolerance and ensure their portfolios are well-diversified across different asset classes. Staying informed about market developments and seeking professional financial advice is also crucial during these times of uncertainty.

Conclusion: The Mystery Continues

The recent odd trading patterns on Wall Street remain a puzzle. While several explanations exist, the exact causes and consequences remain unclear. Ongoing monitoring and investigation by regulators and experts are essential to understand these anomalies and prevent future disruptions. The situation emphasizes the inherent risks and complexities of the financial markets, reinforcing the need for informed decision-making and prudent investment strategies. Stay tuned for further updates as the investigation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deciphering Wall Street's Odd Trading Patterns: Experts Weigh In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Air India Crash Possible Causes Of The Catastrophic 30 Second Failure

Jun 14, 2025

Air India Crash Possible Causes Of The Catastrophic 30 Second Failure

Jun 14, 2025 -

Are These Wall Street Trades Rational Examining Recent Market Behavior

Jun 14, 2025

Are These Wall Street Trades Rational Examining Recent Market Behavior

Jun 14, 2025 -

Marner Matthews Tensions Have The Maple Leafs Reached A Breaking Point

Jun 14, 2025

Marner Matthews Tensions Have The Maple Leafs Reached A Breaking Point

Jun 14, 2025 -

Oakmonts Challenge Spaun Leads Us Open 2025 Mc Ilroy And Scheffler Struggle

Jun 14, 2025

Oakmonts Challenge Spaun Leads Us Open 2025 Mc Ilroy And Scheffler Struggle

Jun 14, 2025 -

Offshore Boat Fire Five Rescued After Tournament Tragedy

Jun 14, 2025

Offshore Boat Fire Five Rescued After Tournament Tragedy

Jun 14, 2025

Latest Posts

-

New Immigration Policy Migrants From Cuba Haiti Nicaragua And Venezuela Face Deportation

Jun 14, 2025

New Immigration Policy Migrants From Cuba Haiti Nicaragua And Venezuela Face Deportation

Jun 14, 2025 -

Boeing 737 Max Grounded Air India Crash Fallout

Jun 14, 2025

Boeing 737 Max Grounded Air India Crash Fallout

Jun 14, 2025 -

Big Rock Fishing Tournament Fire Five Sailors Saved

Jun 14, 2025

Big Rock Fishing Tournament Fire Five Sailors Saved

Jun 14, 2025 -

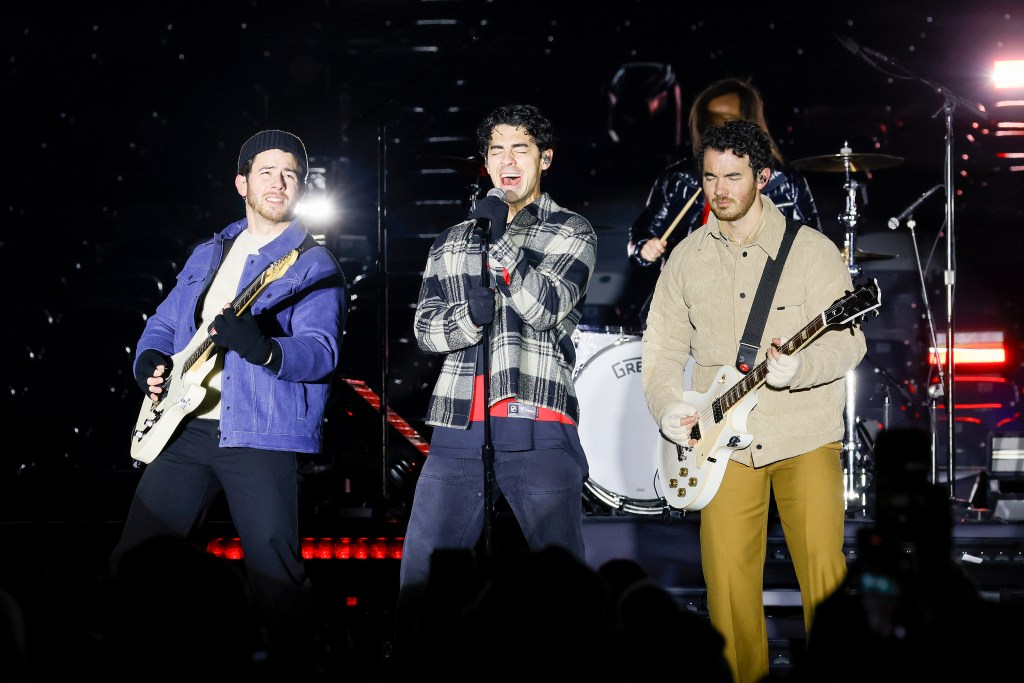

Jonas Brothers Tour Interrupted Wrigley Field And Other Shows Affected

Jun 14, 2025

Jonas Brothers Tour Interrupted Wrigley Field And Other Shows Affected

Jun 14, 2025 -

Sr 87 South Of Payson Closed Adot Reports Brush Fire Affecting Travel

Jun 14, 2025

Sr 87 South Of Payson Closed Adot Reports Brush Fire Affecting Travel

Jun 14, 2025